All Iron Ventures

-

DATABASE (394)

-

ARTICLES (661)

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

Co-founder and ex-CEO of 8villages

Mathieu Le Bras is an agronomist by training, with a master’s in Agriculture from ISA Lille, France. He has worked for major organizations such as the WTO, GE and Syngenta. In 2012, he established 8villages with Indonesian social media entrepreneur Sanny Gaddafi. Mathieu later left the startup and moved to the United Kingdom to pursue other ventures. He is currently the managing director of Maison du Pain, a London bakery with buyers from all over Europe.

Mathieu Le Bras is an agronomist by training, with a master’s in Agriculture from ISA Lille, France. He has worked for major organizations such as the WTO, GE and Syngenta. In 2012, he established 8villages with Indonesian social media entrepreneur Sanny Gaddafi. Mathieu later left the startup and moved to the United Kingdom to pursue other ventures. He is currently the managing director of Maison du Pain, a London bakery with buyers from all over Europe.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

Foods for Tomorrow / Heura Foods

Sold at 2,000+ outlets in four continents, the Heura brand comprises sustainably produced, nutritious, plant-based vegan products that mimic both chicken and beef.

Sold at 2,000+ outlets in four continents, the Heura brand comprises sustainably produced, nutritious, plant-based vegan products that mimic both chicken and beef.

Founder and CEO of Kufed

Founder, Andrew Buntoro, was frustrated when he was unable to find good quality international products in Indonesian e-commerce websites. As a result, he decided to start Kufed, a lifestyle and community driven platform to specialize in selling high quality foreign brands to well-heeled Indonesians. In an interview with a Kufed vendor, buyMeDesign, Andrew revealed that he wanted to be like comic heroes; Batman and Iron Man who create new ways to fight the bad guys. He wants to have a management style that can be adapted to the environment and market to create unique solutions in e-commerce. Kufed is part of the e-commerce company, PT Hood Digital Asia, which was previously known as PT KlikToday, an Indonesian version of daily deals Groupon. Andrew was COO of KlikToday.

Founder, Andrew Buntoro, was frustrated when he was unable to find good quality international products in Indonesian e-commerce websites. As a result, he decided to start Kufed, a lifestyle and community driven platform to specialize in selling high quality foreign brands to well-heeled Indonesians. In an interview with a Kufed vendor, buyMeDesign, Andrew revealed that he wanted to be like comic heroes; Batman and Iron Man who create new ways to fight the bad guys. He wants to have a management style that can be adapted to the environment and market to create unique solutions in e-commerce. Kufed is part of the e-commerce company, PT Hood Digital Asia, which was previously known as PT KlikToday, an Indonesian version of daily deals Groupon. Andrew was COO of KlikToday.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Co-founder of Huiwan Lvxing

Cross-country adventure enthusiast who has traveled across all deserts in mainland China and uninhabited zones like Lop Nur, Altyn-Tagh and Hoh Xil. Xiu Tao founded his first company in 1996.

Cross-country adventure enthusiast who has traveled across all deserts in mainland China and uninhabited zones like Lop Nur, Altyn-Tagh and Hoh Xil. Xiu Tao founded his first company in 1996.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

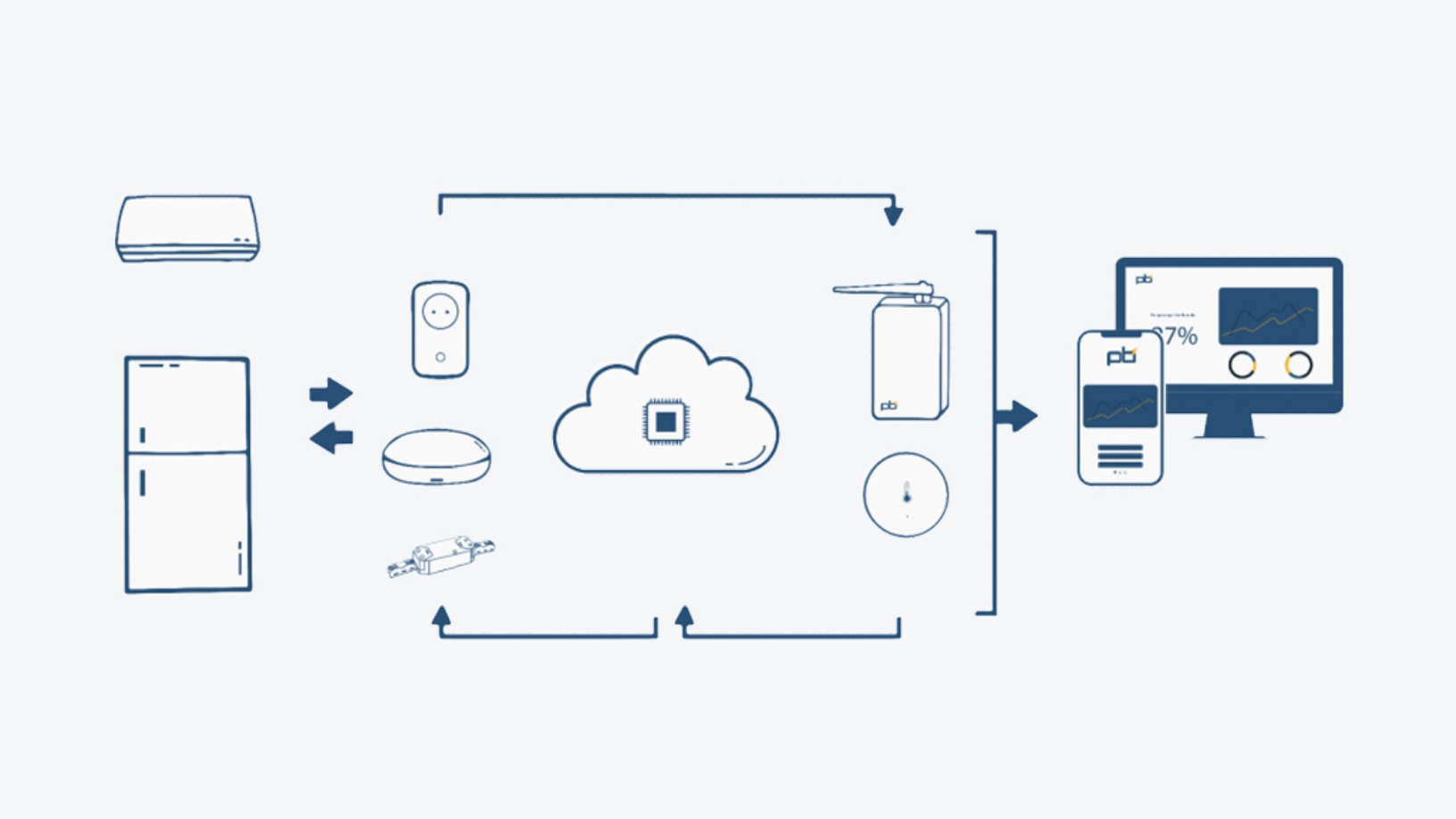

Switch Automation: On-demand, data-driven building management

The Denver-based company kicked off operations in Singapore last year, intends to use the city-state as a spring board to expand in the Asia Pacific

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Kantox: Value for corporates, headache for banks

Moving beyond its initial remit of currency exchange, Europe's fourth-fastest growing fintech Kantox has garnered awards and financial sector hostility as it differentiates itself in a crowded marketplace

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Interview with Qlue CEO, part II: Smart cities in Indonesia and beyond

Continuing from the first part of an interview, Qlue CEO Rama Raditya discusses trends, achievements and challenges in smart city development

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

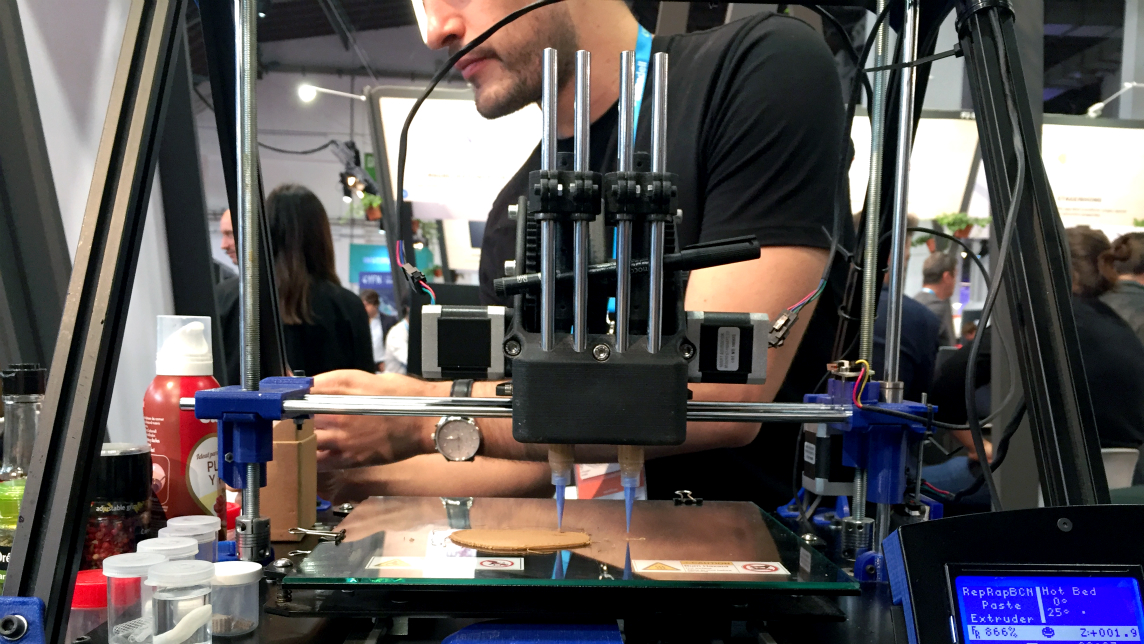

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

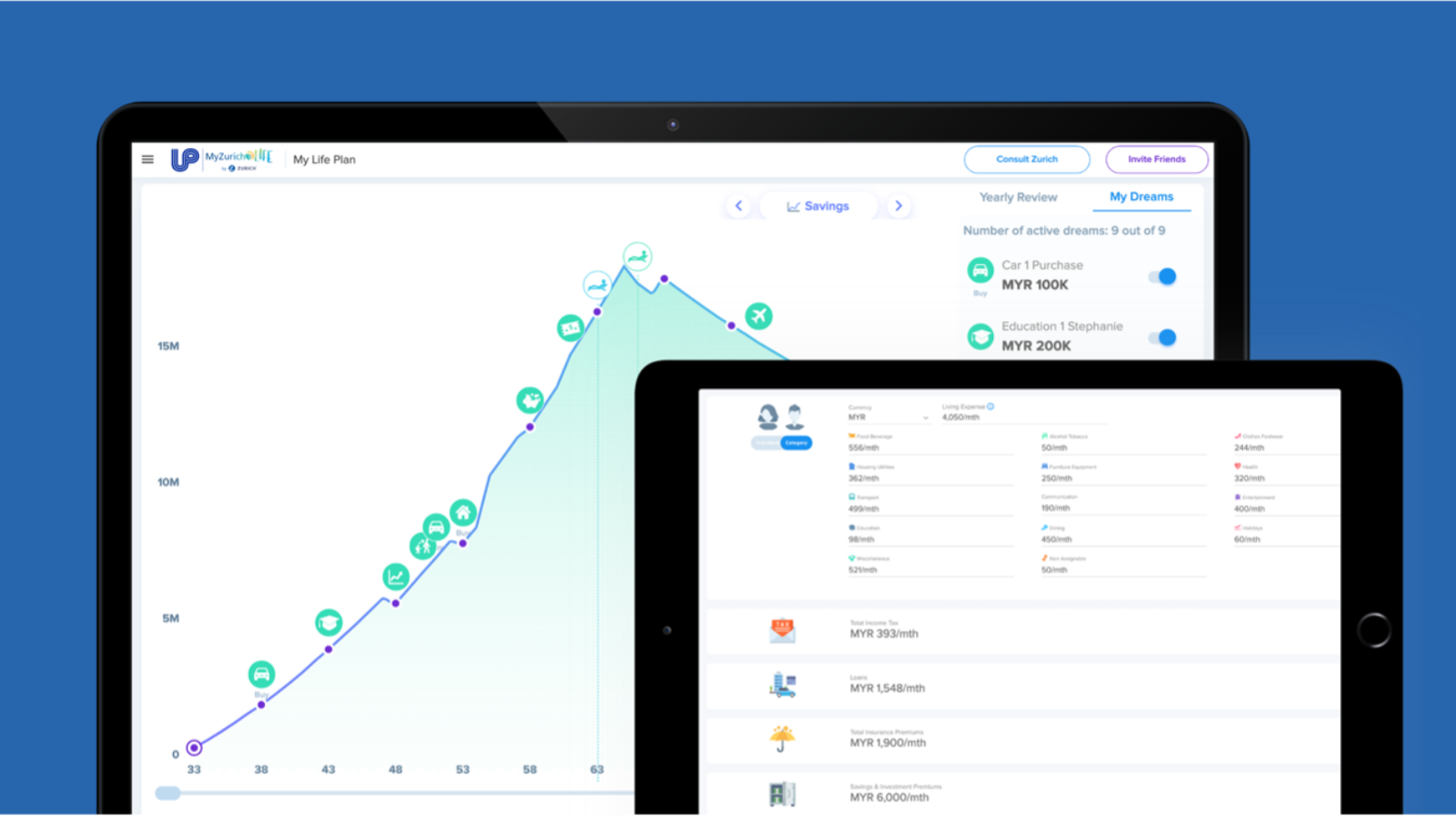

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

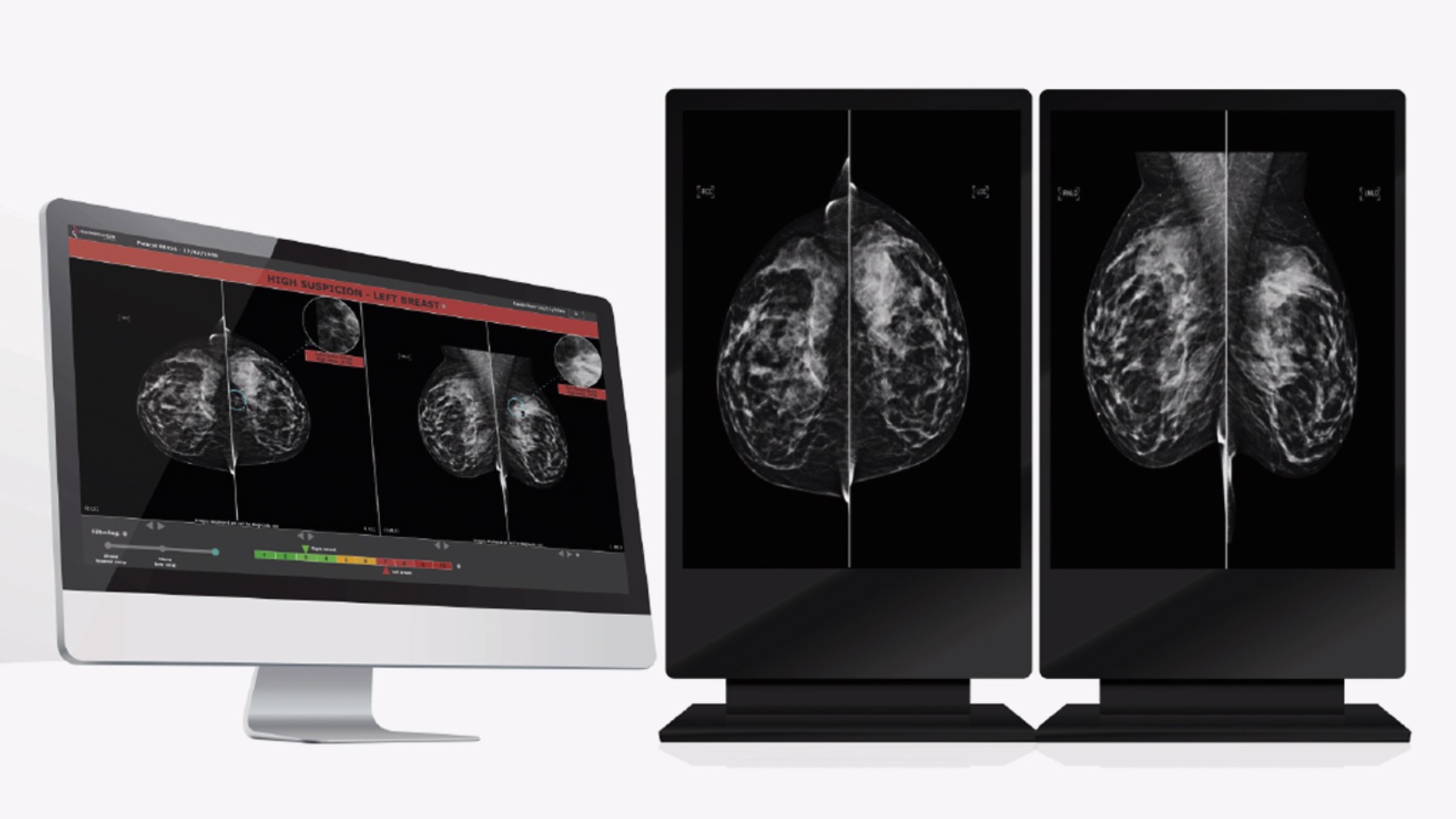

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Sorry, we couldn’t find any matches for“All Iron Ventures”.