Brinc and Hatch

-

DATABASE (994)

-

ARTICLES (811)

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

AI-powered edtech for children brings real-time interactive learning into the classroom for the price of a book.

AI-powered edtech for children brings real-time interactive learning into the classroom for the price of a book.

Southern Publishing and Media was founded in December 2008 by Guangdong Provincial Publishing Group. It was listed on the Shanghai Stock Exchange in 2016.

Southern Publishing and Media was founded in December 2008 by Guangdong Provincial Publishing Group. It was listed on the Shanghai Stock Exchange in 2016.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Hundsun Technologies Inc. was founded in Hangzhou in 1995. It was listed on the Shanghai Stock Exchange in 2003. A leading Chinese supplier of financial software and network services, the company focuses on wealth and asset management and offers integrated solutions and services to banks and financial institutions that work in securities, futures, funds, trusts, insurance, exchanges and private placements.

Hundsun Technologies Inc. was founded in Hangzhou in 1995. It was listed on the Shanghai Stock Exchange in 2003. A leading Chinese supplier of financial software and network services, the company focuses on wealth and asset management and offers integrated solutions and services to banks and financial institutions that work in securities, futures, funds, trusts, insurance, exchanges and private placements.

Toge Productions: Sprouting the best of Indonesian-made video games

Tracing the milestones of Indonesia's earliest gaming startup success – the indie developers behind Infectonator

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

VitiBot: Using robotics to make winemaking more sustainable

Combining a passion for robotics with his family’s history in winemaking, VitiBot CEO and co-founder Cedric Bache saw an opportunity to help winemakers meet the dual challenges of modernization and sustainable development

VEnvirotech: Organic waste converted at source into biodegradable raw bioplastic

The Spanish startup presents an innovative circular business model to stand out in the ever-growing bioplastics sector with its on-site smart-waste container and garbage-consuming bacteria

EverSafe Online: Pre-empting cyber attacks so companies avoid huge losses

Making cybersecurity affordable for SMEs, Shenzhen-based Eversafe Online launches China's first business intelligence search engine to track, pre-empt cyber attacks

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Lesielle: Award-winning personalized cosmetics that adapt to changing skincare needs

This Spanish AI-powered device combines with a mobile app to track the daily condition of your skin and tailor-make cosmetics for each customer

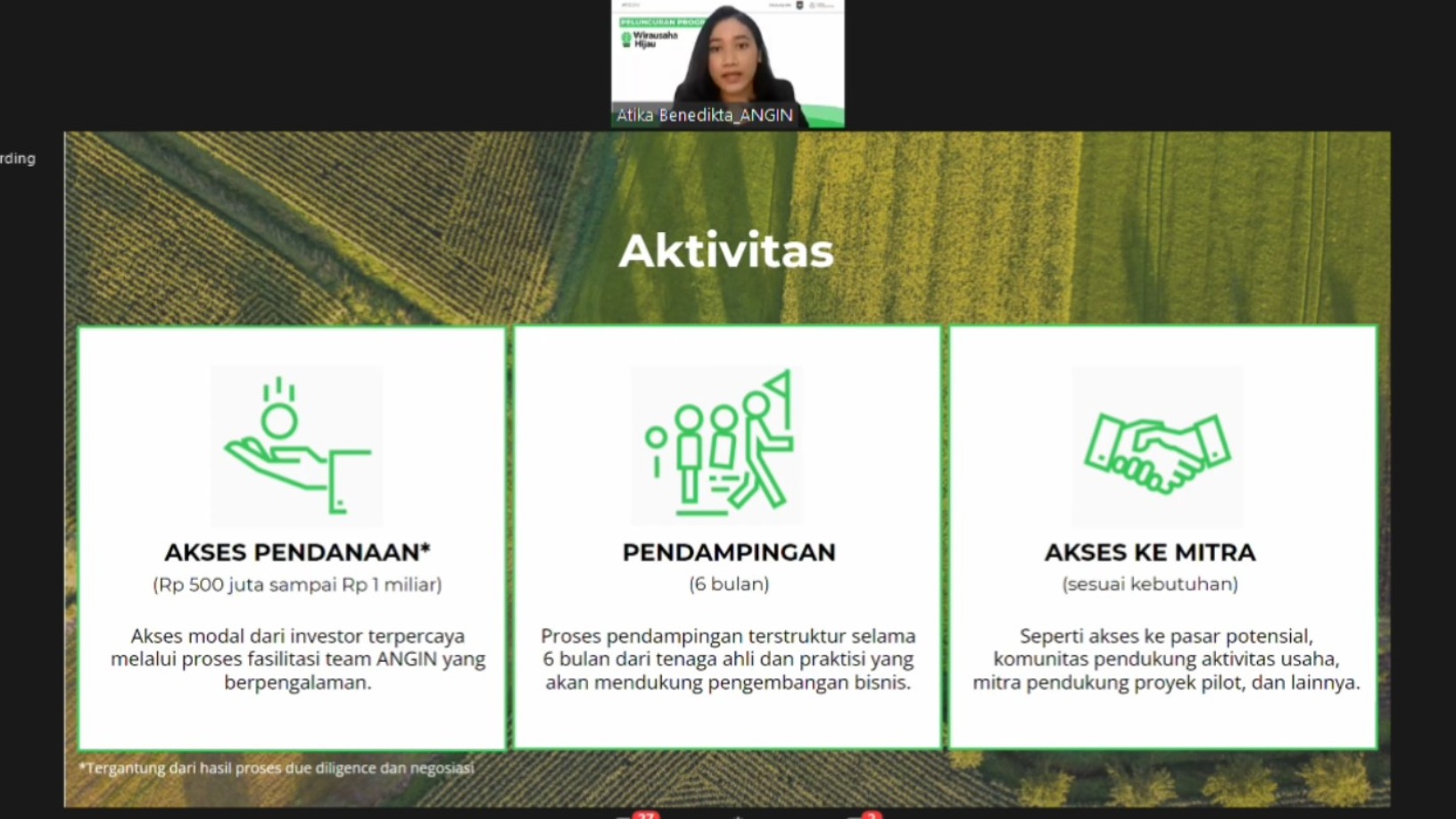

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts

Calling Factorial “the Zendesk of HR," Silicon Valley heavyweight CRV led the round, in its first-ever investment in Spain

Sorry, we couldn’t find any matches for“Brinc and Hatch”.