Brinc and Hatch

-

DATABASE (994)

-

ARTICLES (811)

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

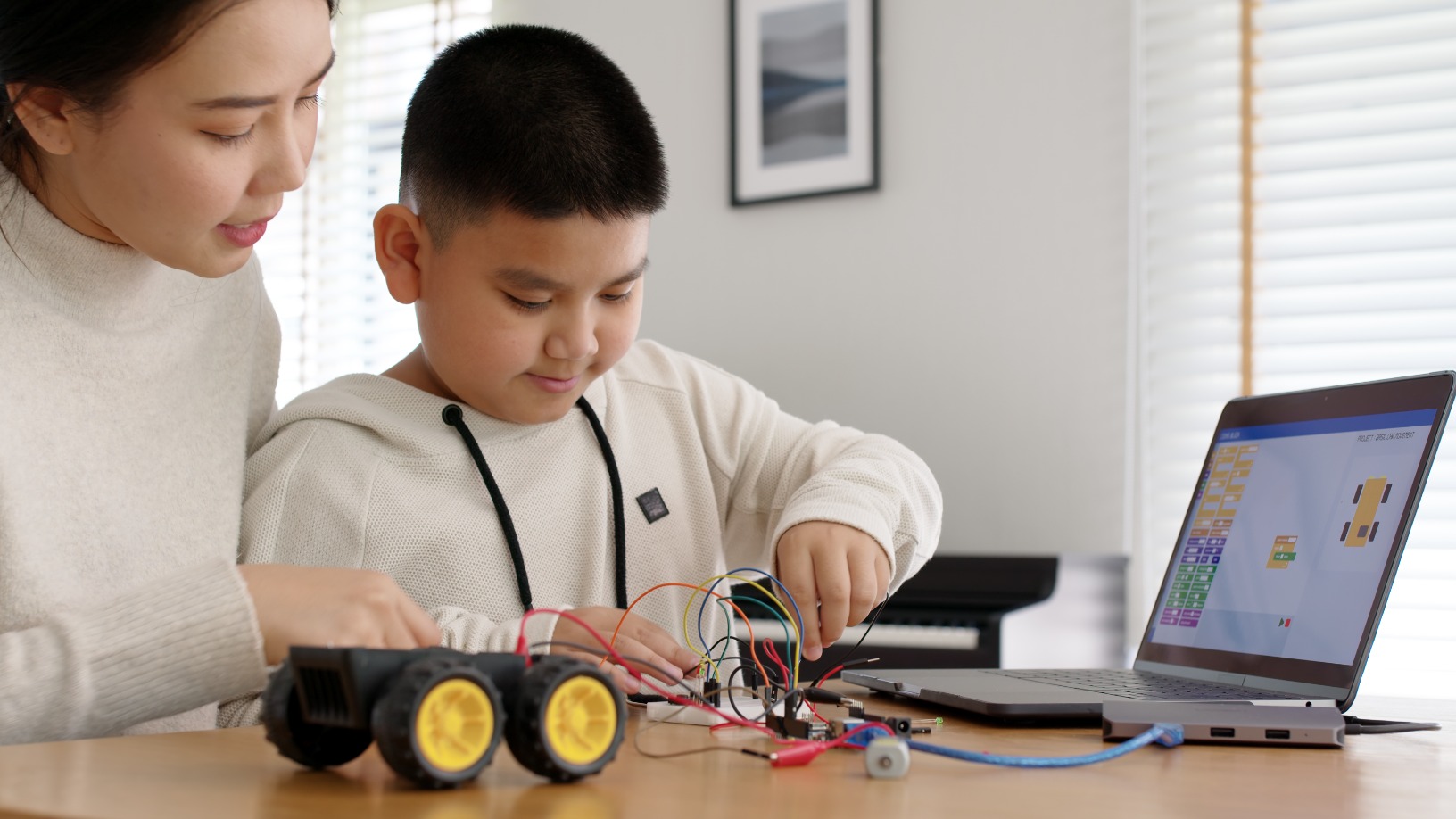

AI-powered edtech for children brings real-time interactive learning into the classroom for the price of a book.

AI-powered edtech for children brings real-time interactive learning into the classroom for the price of a book.

Southern Publishing and Media was founded in December 2008 by Guangdong Provincial Publishing Group. It was listed on the Shanghai Stock Exchange in 2016.

Southern Publishing and Media was founded in December 2008 by Guangdong Provincial Publishing Group. It was listed on the Shanghai Stock Exchange in 2016.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Bristol Myers Squibb or BMS is one of the world’s largest biopharmaceutical companies developing medicines in oncology, hematology, immunology and cardiovascular disease. It invests directly and via VC funds, including Life Sciences Partners (LSP) and BioGeneration Ventures, as LP. BMS is headquartered in New York and has 10 offices and facilities within the US and 13 in overseas locations, namely, Puerto Rico, Canada, France, Belgium, the UK, Ireland, Germany, Japan and China.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Hundsun Technologies Inc. was founded in Hangzhou in 1995. It was listed on the Shanghai Stock Exchange in 2003. A leading Chinese supplier of financial software and network services, the company focuses on wealth and asset management and offers integrated solutions and services to banks and financial institutions that work in securities, futures, funds, trusts, insurance, exchanges and private placements.

Hundsun Technologies Inc. was founded in Hangzhou in 1995. It was listed on the Shanghai Stock Exchange in 2003. A leading Chinese supplier of financial software and network services, the company focuses on wealth and asset management and offers integrated solutions and services to banks and financial institutions that work in securities, futures, funds, trusts, insurance, exchanges and private placements.

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Rainier: Decade-long dedication to VR research bears fruit in edtech market

Beijing-based Rainier is using VR technology to improve safety in lab experiments at universities and high schools, even primary schools

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Kuaipeilian wins largest seed round in China arts education sector

In the hotly contested online-to-offline piano tutoring market, will an injection of funds help Kuaipeilian trounce the competition?

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Ecojoko: Using AI, real-time data to save electricity

The French startup’s energy-saving assistant and mobile app show how much electricity is being used and how much can be saved for every household appliance

Agricool: Growing fresh strawberries in shipping containers

Paris-based Agricool grows fresh produce in urban aeroponics farms within shipping containers for sale at downtown supermarkets, aims to supply more large cities by 2030

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

Eliport: Friendly neighborhood robots for cheaper last-mile deliveries

The Spanish logistics robot maker has a solution to improve last-mile delivery, with community-based smart robots, parcel hubs and postboxes. CompassList spoke to its co-founders at the recent 4YFN conference in Barcelona

Sorry, we couldn’t find any matches for“Brinc and Hatch”.