Climate-Kit

-

DATABASE (32)

-

ARTICLES (108)

Revolutionizing the world of food traceability, SwissDeCode’s DNA technology allows anyone to test for contaminants and provide certifications in minutes, automatically or offline.

Revolutionizing the world of food traceability, SwissDeCode’s DNA technology allows anyone to test for contaminants and provide certifications in minutes, automatically or offline.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

CTO and co-founder of Everimpact

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

CEO of Krakakoa

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

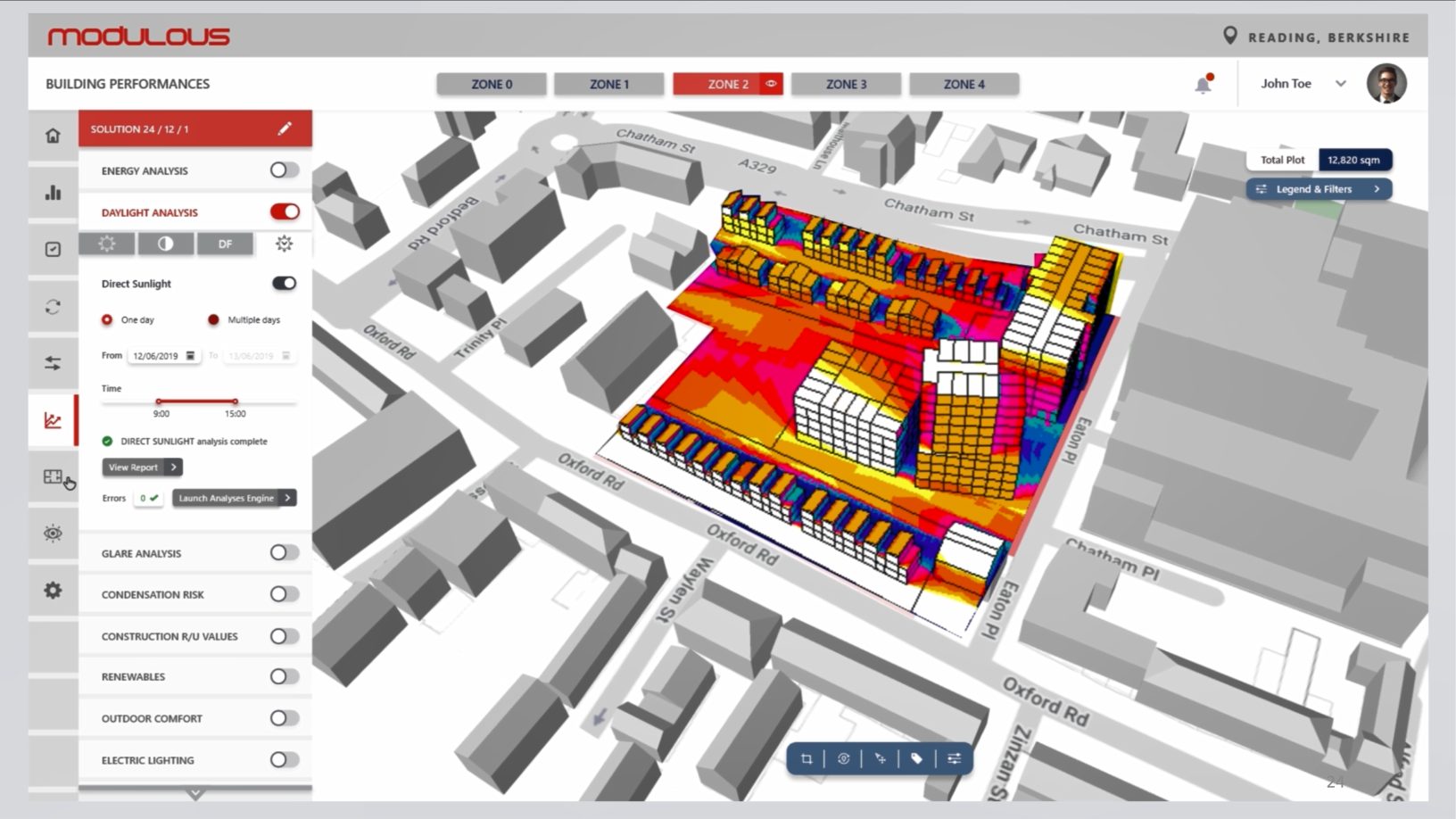

Modulous’s automated generative design technology and ready kit of parts pioneers the rapid scaling of affordable, locally built housing projects to meet sustainability goals.

Modulous’s automated generative design technology and ready kit of parts pioneers the rapid scaling of affordable, locally built housing projects to meet sustainability goals.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

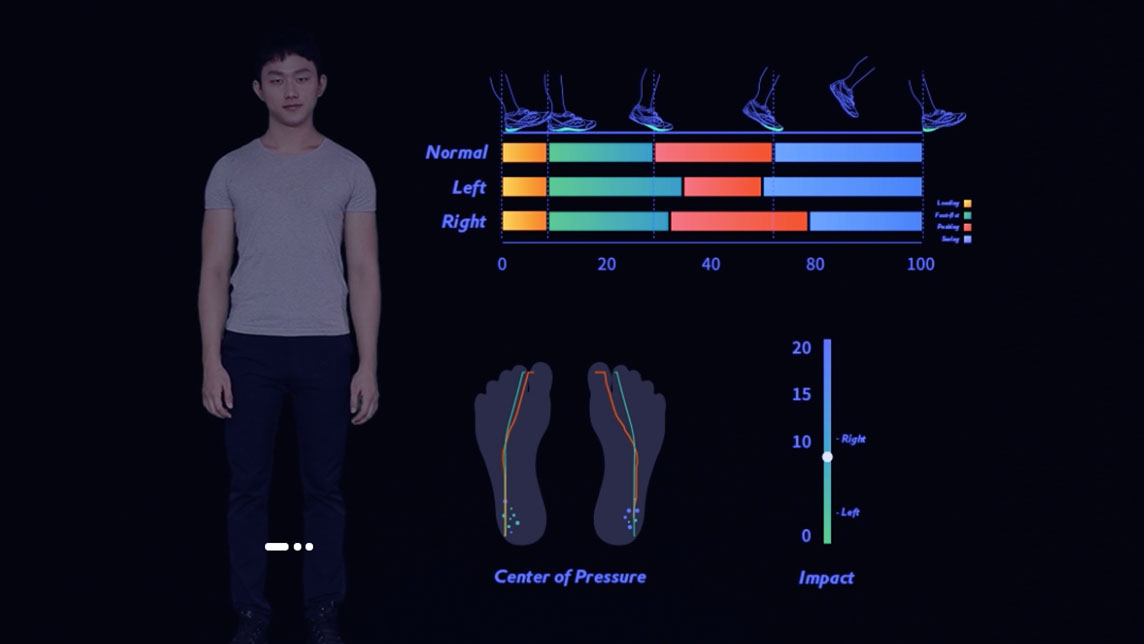

DyCare has developed and commercialized Europe's first clinically validated musculoskeletal home rehabilitation systems and looks set to disrupt a market with 100m sufferers of musculoskeletal disorders.

DyCare has developed and commercialized Europe's first clinically validated musculoskeletal home rehabilitation systems and looks set to disrupt a market with 100m sufferers of musculoskeletal disorders.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Leonardo DiCaprio is a Hollywood actor and angel investor, who runs his own charitable foundation in aid of climate action, wildlife protection, and ecosystems and communities under threat. Since 1998, the Leonardo DiCaprio Foundation has invested more than $100m in some 132 organizations worldwide, the majority of which are charities. DiCaprio has also invested in 12 for-profit companies in recent years. The most recent of these investments include his 2018 participation in the Series A round for Magnus, an app that has been called Shazam for art, as well as a 4Q17 investment in Swiss deeptech player and provider of VR and AR applications technology, MindMaze.

Leonardo DiCaprio is a Hollywood actor and angel investor, who runs his own charitable foundation in aid of climate action, wildlife protection, and ecosystems and communities under threat. Since 1998, the Leonardo DiCaprio Foundation has invested more than $100m in some 132 organizations worldwide, the majority of which are charities. DiCaprio has also invested in 12 for-profit companies in recent years. The most recent of these investments include his 2018 participation in the Series A round for Magnus, an app that has been called Shazam for art, as well as a 4Q17 investment in Swiss deeptech player and provider of VR and AR applications technology, MindMaze.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

CEO and Co-founder of Plastic Bank

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

SwissDeCode: Portable DNA test kits detect food contamination within minutes

DNAFoil, the startup’s rapid and accurate on-site food safety testing kit, can be deployed by non-expert staff after a few hours of training, with no need for lab equipment

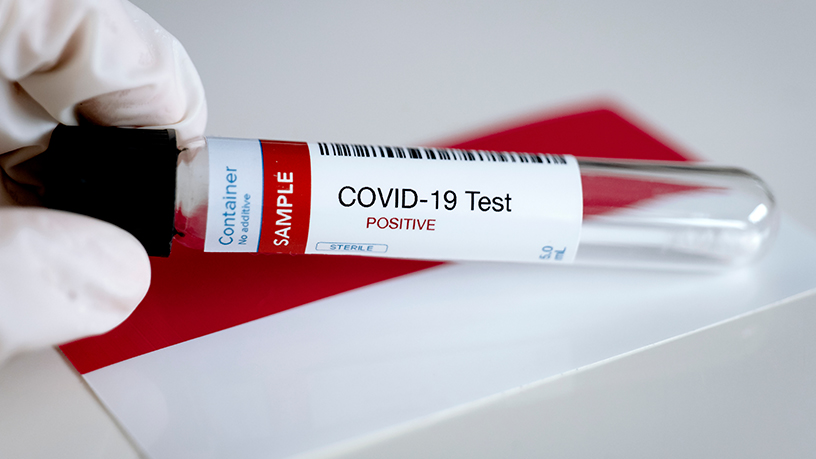

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

In Spain, DIY drones help entice students to study science and tech

Spanish startup Bonadrone aims to revolutionize the way science, math and technology are taught in schools and is disrupting the drone sector by enabling users to customize their own 3D-printed drones

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Promising market, but China’s DTC genetic testing startups have to first overcome a few hurdles

Genetic information is being used for everything from predicting health risks to personalizing exercise and dietary regimes. China represents a huge potential market for direct-to-consumer (DTC) genetic testing

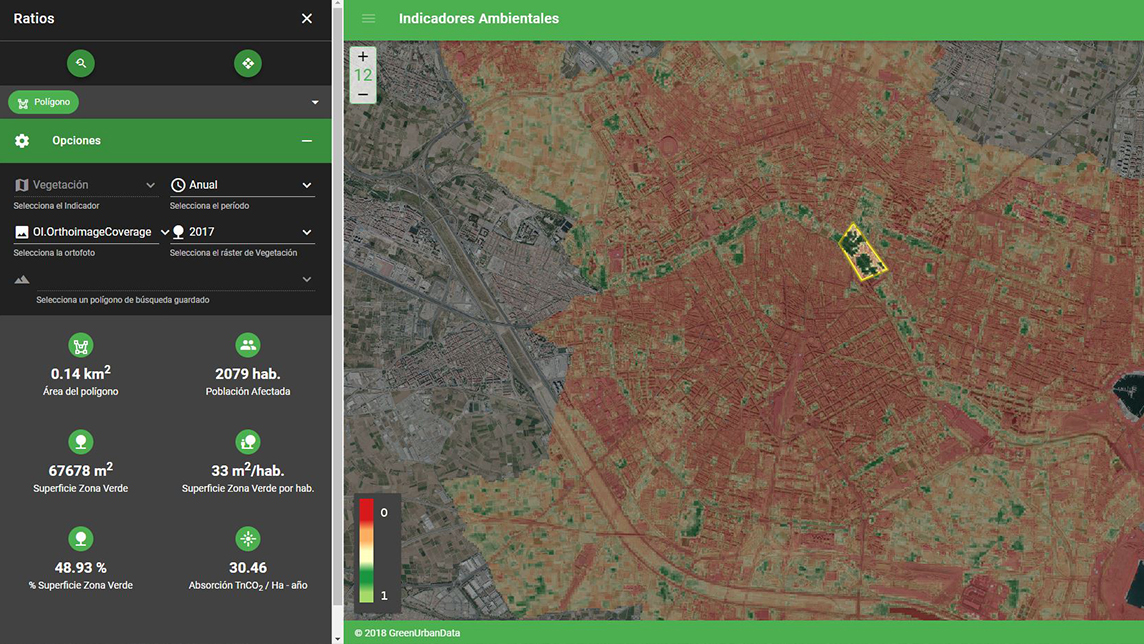

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Sorry, we couldn’t find any matches for“Climate-Kit”.