Green Urban Data

-

DATABASE (336)

-

ARTICLES (491)

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Delivery service Koiki is a social enterprise that offers employment opportunities for vulnerable people while reducing the carbon impact of last-mile deliveries.

Delivery service Koiki is a social enterprise that offers employment opportunities for vulnerable people while reducing the carbon impact of last-mile deliveries.

DCVC (formerly Data Collective)

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

N.A.

CFO, CMO and co-founder of RecyGlo

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

PT Eigerindo Multi Produk Industri

Founded in 1979 by Indonesian businessman Ronny Lukito, PT Eigerindo Multi Produk Industri is an Indonesian apparel, accessories, bags, equipment and footwear company based in Bandung, capital of Indonesia’s West Java province. Its brands focus on tropical, outdoor adventure and urban, lifestyle gear and fashion. The company owns three brands, including Eiger, Bodypack and Exsport. Digital Happiness is the first company it funded.

Founded in 1979 by Indonesian businessman Ronny Lukito, PT Eigerindo Multi Produk Industri is an Indonesian apparel, accessories, bags, equipment and footwear company based in Bandung, capital of Indonesia’s West Java province. Its brands focus on tropical, outdoor adventure and urban, lifestyle gear and fashion. The company owns three brands, including Eiger, Bodypack and Exsport. Digital Happiness is the first company it funded.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Co-founder and CEO of Gringgo

Self-styled “professional trash talker” Olivier Pouillon moved from the USA to Bali, Indonesia in 1994, set on a mission to solve the island’s trash problem. In 2011, after years of waste consultancy and NGO work, he founded Bali Recycling, a company that produces upcycled products and promotes “trash-to-cash” programs to locals. (The company has since been renamed KONO Green Living.) In 2014, he and interior designer Febriadi Pratama started an app-based trash collection service, which later became Gringgo.

Self-styled “professional trash talker” Olivier Pouillon moved from the USA to Bali, Indonesia in 1994, set on a mission to solve the island’s trash problem. In 2011, after years of waste consultancy and NGO work, he founded Bali Recycling, a company that produces upcycled products and promotes “trash-to-cash” programs to locals. (The company has since been renamed KONO Green Living.) In 2014, he and interior designer Febriadi Pratama started an app-based trash collection service, which later became Gringgo.

SWORD Health: Reinventing the wheel for physiotherapy

AI-powered healthcare tech brings relief to overworked and understaffed physiotherapy providers

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Dao Foods unfazed by China tech crackdown, says alternative proteins aligned with state goals

Impact investor Dao Foods expects government support for alternative proteins to come, as it announces second batch of startups, diversifying into fermentation and cell-based proteins

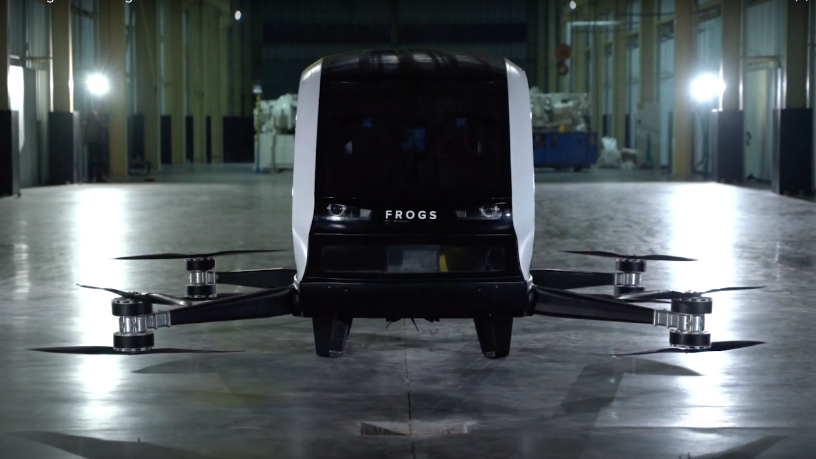

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Kopi Kenangan serves up an addictive blend of rapid expansion and profitability

Its recent $109m Series B infusion boosts the Indonesian startup's confidence for sustainability and regional expansion despite the current Covid-19 slowdown

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Plant-based eggs: The next big thing in the alternative protein market

Plant-based eggs may be the fastest growing segment in plant-based foods, but hacking the formula for a perfect egg substitute is proving a hurdle. Are alt-protein startups up for the challenge?

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Sorry, we couldn’t find any matches for“Green Urban Data”.