Moonspire Social Ventures

-

DATABASE (484)

-

ARTICLES (403)

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

Redpoint China Ventures focuses on early-stage TMT startups in the consumer services, transaction platforms, social networking, video entertainment, digital advertisement, big data, cloud technology, SaaS, information security and artificial intelligence sectors, among others. It has invested in more than 50 domestic consumer internet and enterprise IT companies. It has been the first institutional investor or founding investor in 80% of its investments.

Co-founder and CEO of 8villages

Sanny Gaddafi has been a technopreneur since graduating in 2004 from Universitas Bina Nusantara, Indonesia. He launched a social media platform FUPEI that offered local language options to Indonesian users. He also launched other social media ventures and eventually closed FUPEI in 2012. A chance meeting with French agronomist Mathieu Le Bras led to the development of an SMS-based information network for farmers and the creation of 8villages. Sanny became the CEO when Mathieu exited and moved to the UK.

Sanny Gaddafi has been a technopreneur since graduating in 2004 from Universitas Bina Nusantara, Indonesia. He launched a social media platform FUPEI that offered local language options to Indonesian users. He also launched other social media ventures and eventually closed FUPEI in 2012. A chance meeting with French agronomist Mathieu Le Bras led to the development of an SMS-based information network for farmers and the creation of 8villages. Sanny became the CEO when Mathieu exited and moved to the UK.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Co-founder of Wallapop

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Co-Founder of Qraved

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Co-founder and ex-CEO of 8villages

Mathieu Le Bras is an agronomist by training, with a master’s in Agriculture from ISA Lille, France. He has worked for major organizations such as the WTO, GE and Syngenta. In 2012, he established 8villages with Indonesian social media entrepreneur Sanny Gaddafi. Mathieu later left the startup and moved to the United Kingdom to pursue other ventures. He is currently the managing director of Maison du Pain, a London bakery with buyers from all over Europe.

Mathieu Le Bras is an agronomist by training, with a master’s in Agriculture from ISA Lille, France. He has worked for major organizations such as the WTO, GE and Syngenta. In 2012, he established 8villages with Indonesian social media entrepreneur Sanny Gaddafi. Mathieu later left the startup and moved to the United Kingdom to pursue other ventures. He is currently the managing director of Maison du Pain, a London bakery with buyers from all over Europe.

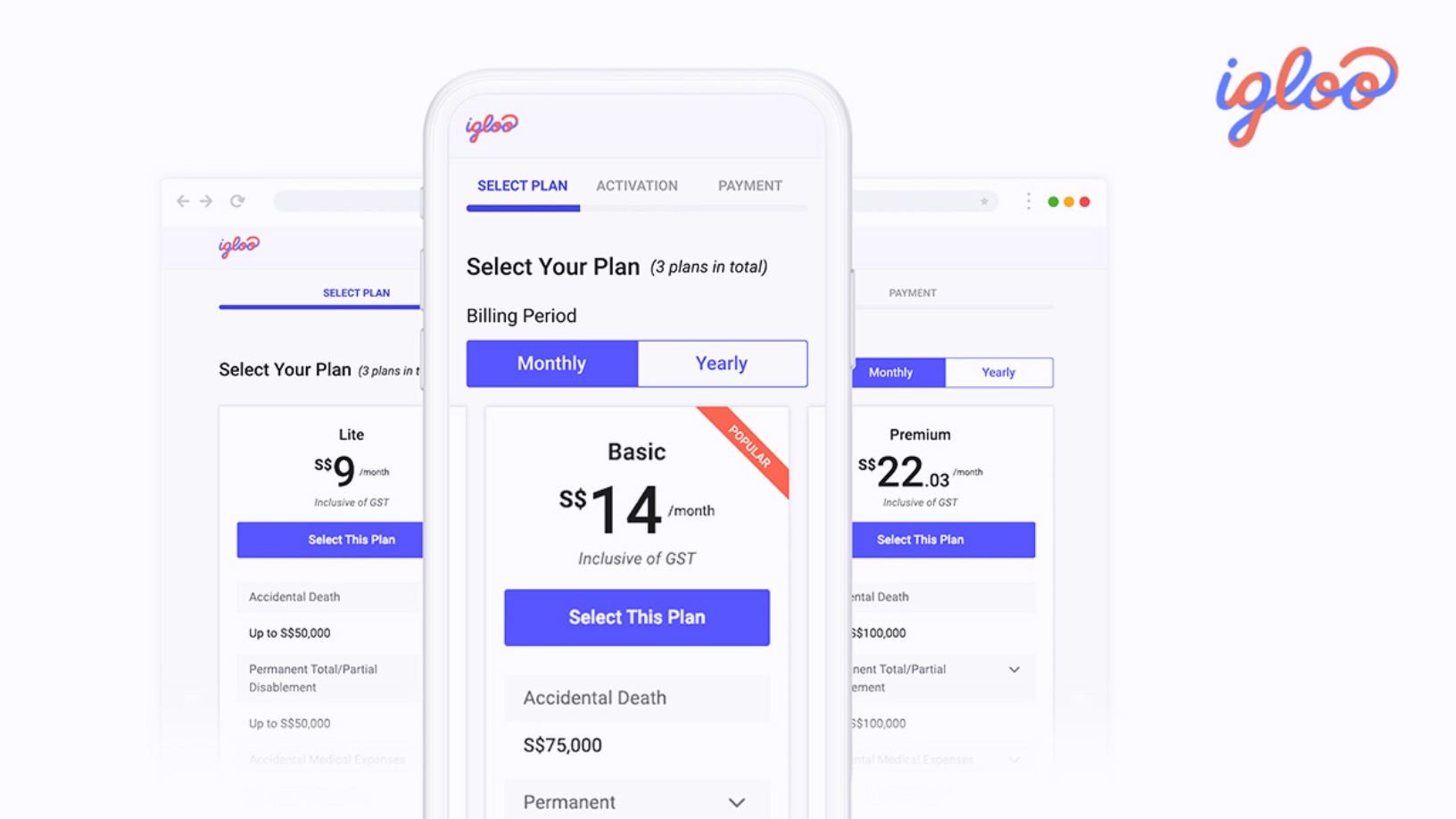

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

Tonic App: Just the tonic for overburdened doctors

CEO Daniela Seixas and COO Gonçalo Vilaça discussed Tonic App, their free solution for streamlining administrative tasks in the medical sector

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

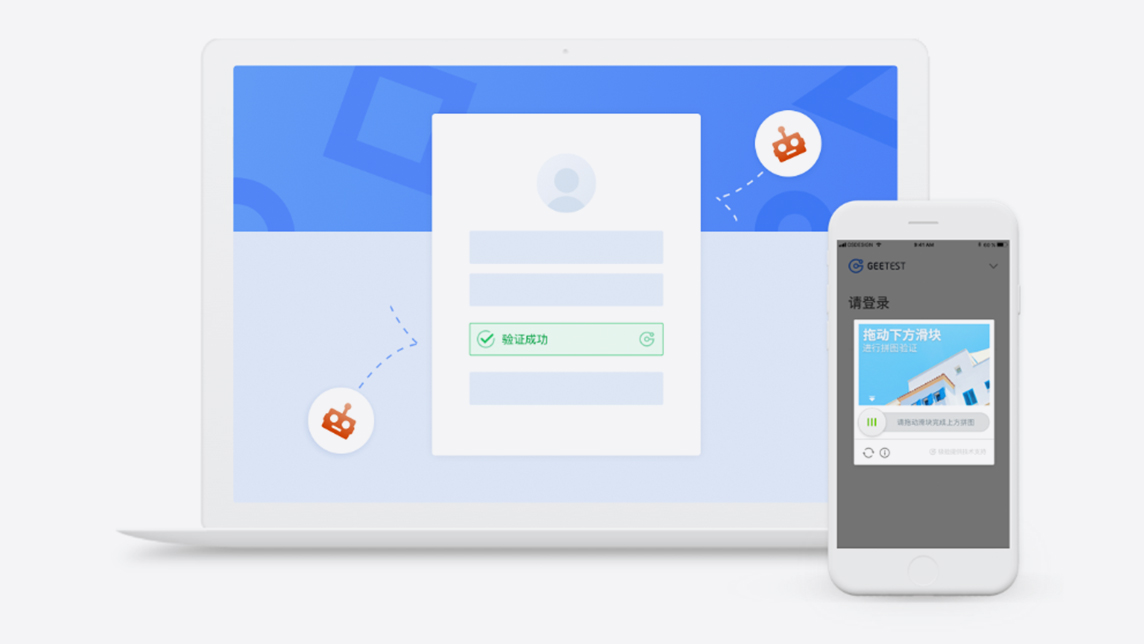

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

As AI assistant market heats up, Sherpa zooms in on smart autos, smart homes

Spanish AI assistant startup Sherpa launches Sherpa Platform, a new set of APIs for smart cars, phones and home devices

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Sorry, we couldn’t find any matches for“Moonspire Social Ventures”.