Nature's Fynd

-

DATABASE (335)

-

ARTICLES (505)

Doctor Che is a We-Media influencer that provides professionally-generated content and digital tool kits to users making decisions about buying new automobiles.

Doctor Che is a We-Media influencer that provides professionally-generated content and digital tool kits to users making decisions about buying new automobiles.

A plug&play digital health SaaS that connects remotely to medical devices, patients’ smartphones and sensors, which grew HumanITcare’s client base sixfold during Covid-19.

A plug&play digital health SaaS that connects remotely to medical devices, patients’ smartphones and sensors, which grew HumanITcare’s client base sixfold during Covid-19.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

Co-founder and CEO of Seedrs

Formerly a corporate and M&A lawyer in New York and London, Jeff Lynn began his career at Sullivan & Cromwell LLP after graduating from the University of Virginia School of Law and the University of Oxford (where he majored in Civil Law). The US-born Lynn later obtained an MBA from the Saïd Business School, University of Oxford, and went on to co-found equity crowdfunding platform Seedrs.

Formerly a corporate and M&A lawyer in New York and London, Jeff Lynn began his career at Sullivan & Cromwell LLP after graduating from the University of Virginia School of Law and the University of Oxford (where he majored in Civil Law). The US-born Lynn later obtained an MBA from the Saïd Business School, University of Oxford, and went on to co-found equity crowdfunding platform Seedrs.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Graviky Labs: Sustainable ink made from air pollution

Conceptualized at MIT and named among the Best Inventions of 2019 by TIME Magazine, Graviky Labs’ carbon-negative ink is made from upcycled emissions captured with a proprietary device

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

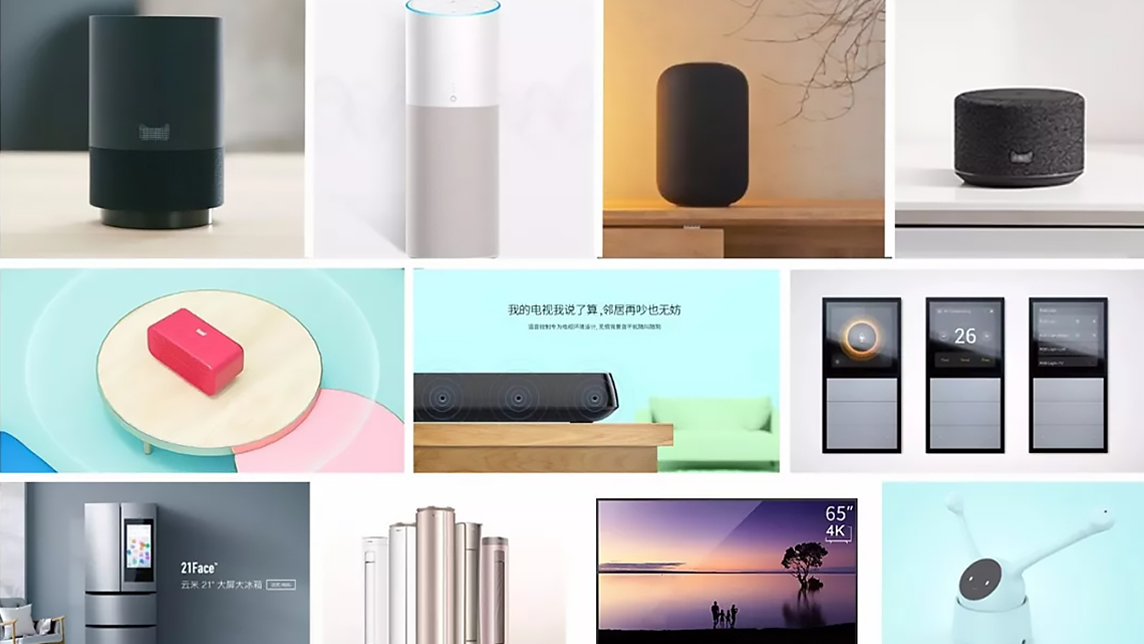

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

Sorry, we couldn’t find any matches for“Nature's Fynd”.