Origin of the Buddha Head

-

DATABASE (995)

-

ARTICLES (811)

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

The merged entity of China’s two largest local services rivals, Meituan has a market cap of HKD 1.93tn in the Hong Kong Stock Exchange, where it is listed. Its total transaction volume reached RMB 682bn in 2019. In 2015, Meituan merged with Chinese rival Dianping and was known as Meituan-Dianping, but the brand has since been unified to Meituan. Now headed by Meituan founder Wang Xing, the Tencent-backed company is China’s largest on-demand, or O2O (online-to-offline), services provider, offering food delivery, restaurant booking, group buying, movie ticket booking and more.

The merged entity of China’s two largest local services rivals, Meituan has a market cap of HKD 1.93tn in the Hong Kong Stock Exchange, where it is listed. Its total transaction volume reached RMB 682bn in 2019. In 2015, Meituan merged with Chinese rival Dianping and was known as Meituan-Dianping, but the brand has since been unified to Meituan. Now headed by Meituan founder Wang Xing, the Tencent-backed company is China’s largest on-demand, or O2O (online-to-offline), services provider, offering food delivery, restaurant booking, group buying, movie ticket booking and more.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

A famous angel investor in the healthcare sector, Shao Hui founded Youxiang, the first cross-border medical tourism player in China in 2006, targeting the Chinese upper class. In 2001, he participated in the venture-stage funding of Beijing Nanshan Ski Village, now the most popular ski village in China.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

Will Hunting Capital was founded by Wang Xinguang, the former vice-president of Phoenix Media Fund, in 2014.

Will Hunting Capital was founded by Wang Xinguang, the former vice-president of Phoenix Media Fund, in 2014.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Hangzhou-based Tisiwi Ventures is an angel investor focused on Chinese internet companies. One of the earliest in China to adopt the Y Combinator model, it has backed more than 100 startups.

Hangzhou-based Tisiwi Ventures is an angel investor focused on Chinese internet companies. One of the earliest in China to adopt the Y Combinator model, it has backed more than 100 startups.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

China Literature was founded in March 2015 by merging Tencent Literature and Shanda Literature. It went public on the Stock Exchange of Hong Kong in November 2017. It owns online reading brand Qidian.com and acquired film and television production company New Classic Media in August 2018. It focuses on building a premium e-reading platform at home and abroad while seeking business opportunities in the adaptation of its copyrighted literary works into film and television productions, comics and animation and video games. As at late June 2019, there are over 11.7m pieces of literary works in its online library.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

China new retail: A blend of the best of online and offline shopping

Players big and small are contributing to China’s new retail revolution

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

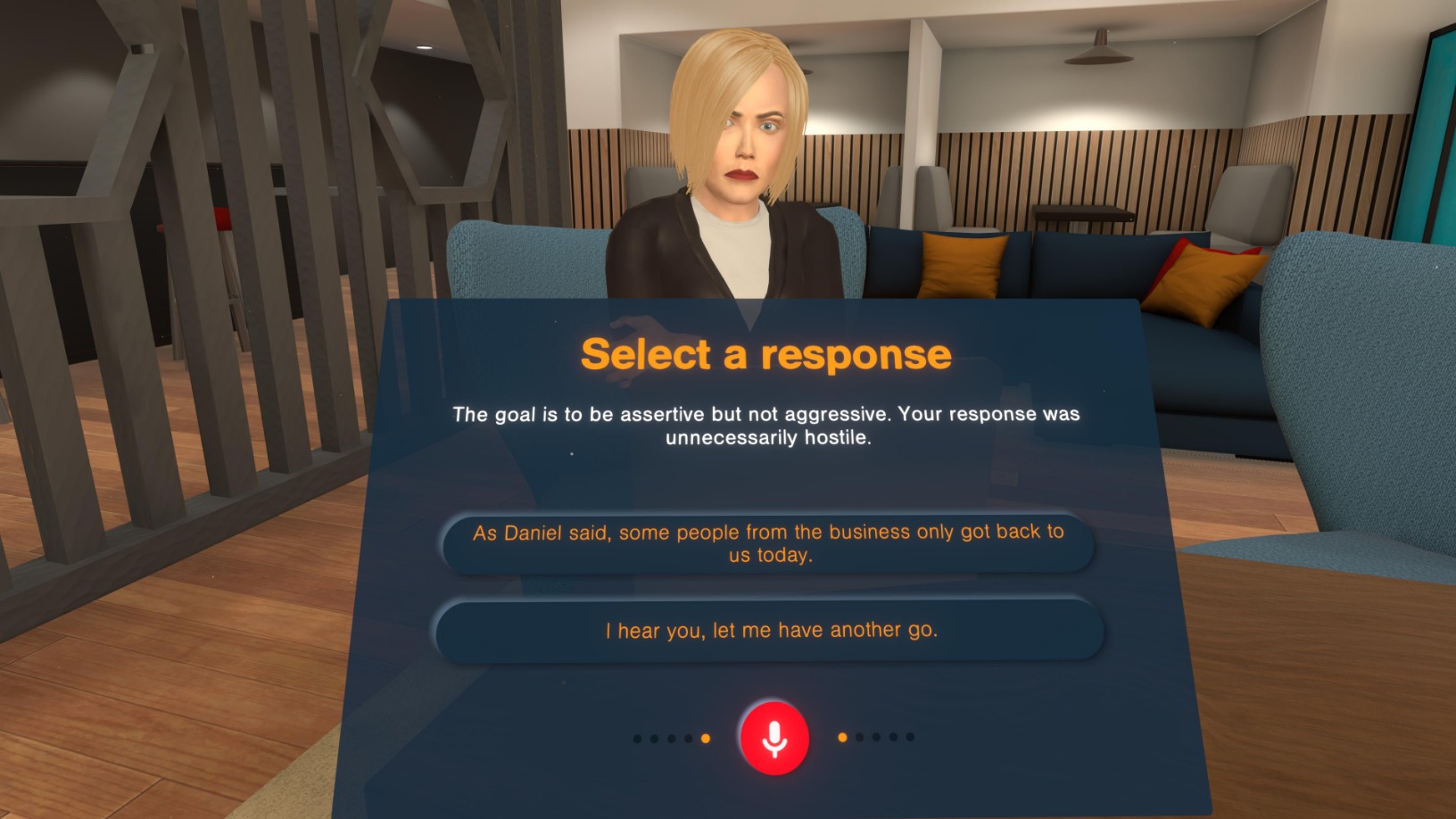

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Founder and CEO Gao Lufeng on Ninebot's acquisition of American motorized scooter maker Segway, China’s rise in technology and innovation, and the company’s plans for the US market

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Indonesian esports team RRQ dreams of being "the king of kings"

The Jakarta team is growing its brand with collaborations and its academy, expects more esports interest amid Covid-19 home confinements

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Sorry, we couldn’t find any matches for“Origin of the Buddha Head”.