Plant-based meat

-

DATABASE (849)

-

ARTICLES (621)

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

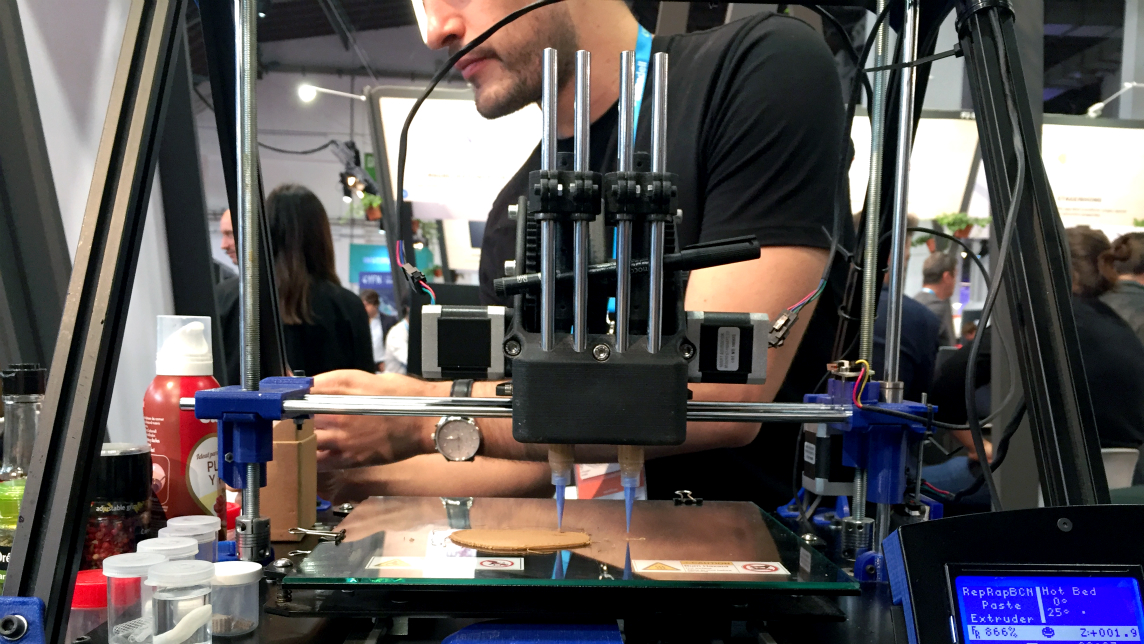

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

NotCo: Will this Bezos-backed plant-based foodtech be Chile's first unicorn?

Armed with $85m Series C funding, NotCo has expanded to the US, competing head-on with popular US alt-protein brands for a foothold in the multibillion-dollar vegan market

Sorry, we couldn’t find any matches for“Plant-based meat”.