Agriculture & Fishery

This function is exclusive for Premium subscribers

-

DATABASE (138)

-

ARTICLES (134)

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

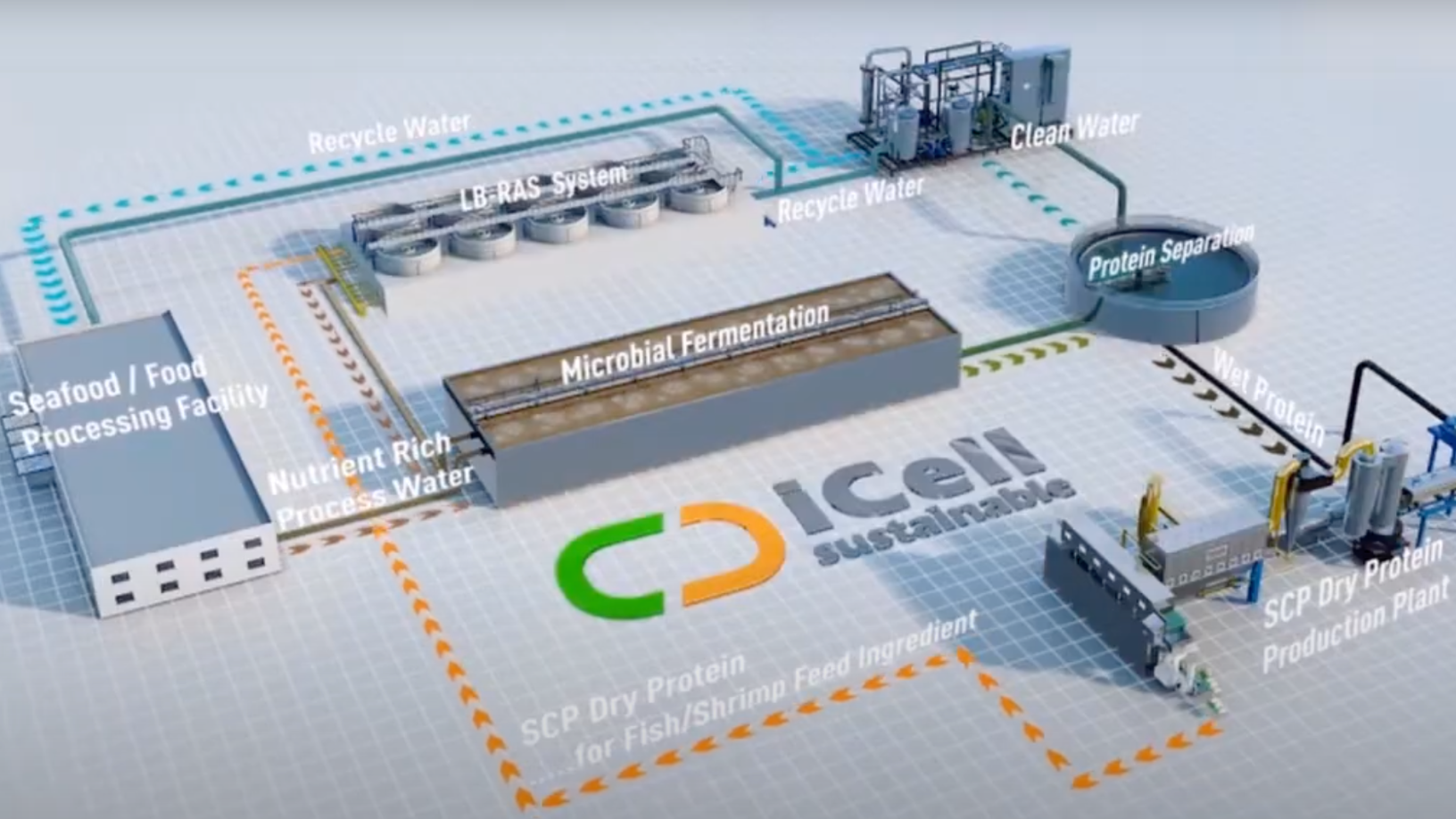

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon