Agriculture & Fishery

This function is exclusive for Premium subscribers

-

DATABASE (138)

-

ARTICLES (134)

TaniHub Group's farm-to-table marketplace and agri-crowdfunding offers a two-pronged approach to help farmers to increase earnings and grow their business.

TaniHub Group's farm-to-table marketplace and agri-crowdfunding offers a two-pronged approach to help farmers to increase earnings and grow their business.

FarmCloud aims to enhance the productivity of pig and poultry producers, helping them gain visibility and control over decentralized farming facilities.

FarmCloud aims to enhance the productivity of pig and poultry producers, helping them gain visibility and control over decentralized farming facilities.

Aimed at new generation farmers, Tiantian Xuenong is the first company in China to bring the pay-for-knowledge model to the agriculture industry.

Aimed at new generation farmers, Tiantian Xuenong is the first company in China to bring the pay-for-knowledge model to the agriculture industry.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Tanijoy empowers farmers by connecting them to land, financial resources and markets, thereby improving their livelihoods while boosting local food production.

Tanijoy empowers farmers by connecting them to land, financial resources and markets, thereby improving their livelihoods while boosting local food production.

Drone Hopper’s award-winning heavy-duty (300-liter), autonomous drones can adapt to operate in different conditions including nighttime, bringing safety, flexibility and efficiency to firefighting and farming.

Drone Hopper’s award-winning heavy-duty (300-liter), autonomous drones can adapt to operate in different conditions including nighttime, bringing safety, flexibility and efficiency to firefighting and farming.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Jala’s hi-tech sensors will boost Indonesia’s seafood output by helping the fishery industry to operate more efficiently with accurate real-time data analytics.

Jala’s hi-tech sensors will boost Indonesia’s seafood output by helping the fishery industry to operate more efficiently with accurate real-time data analytics.

Automated feeder systems from eFishery will help fish and shrimp farmers to operate more profitably by providing feeding data and training to eliminate wastage.

Automated feeder systems from eFishery will help fish and shrimp farmers to operate more profitably by providing feeding data and training to eliminate wastage.

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

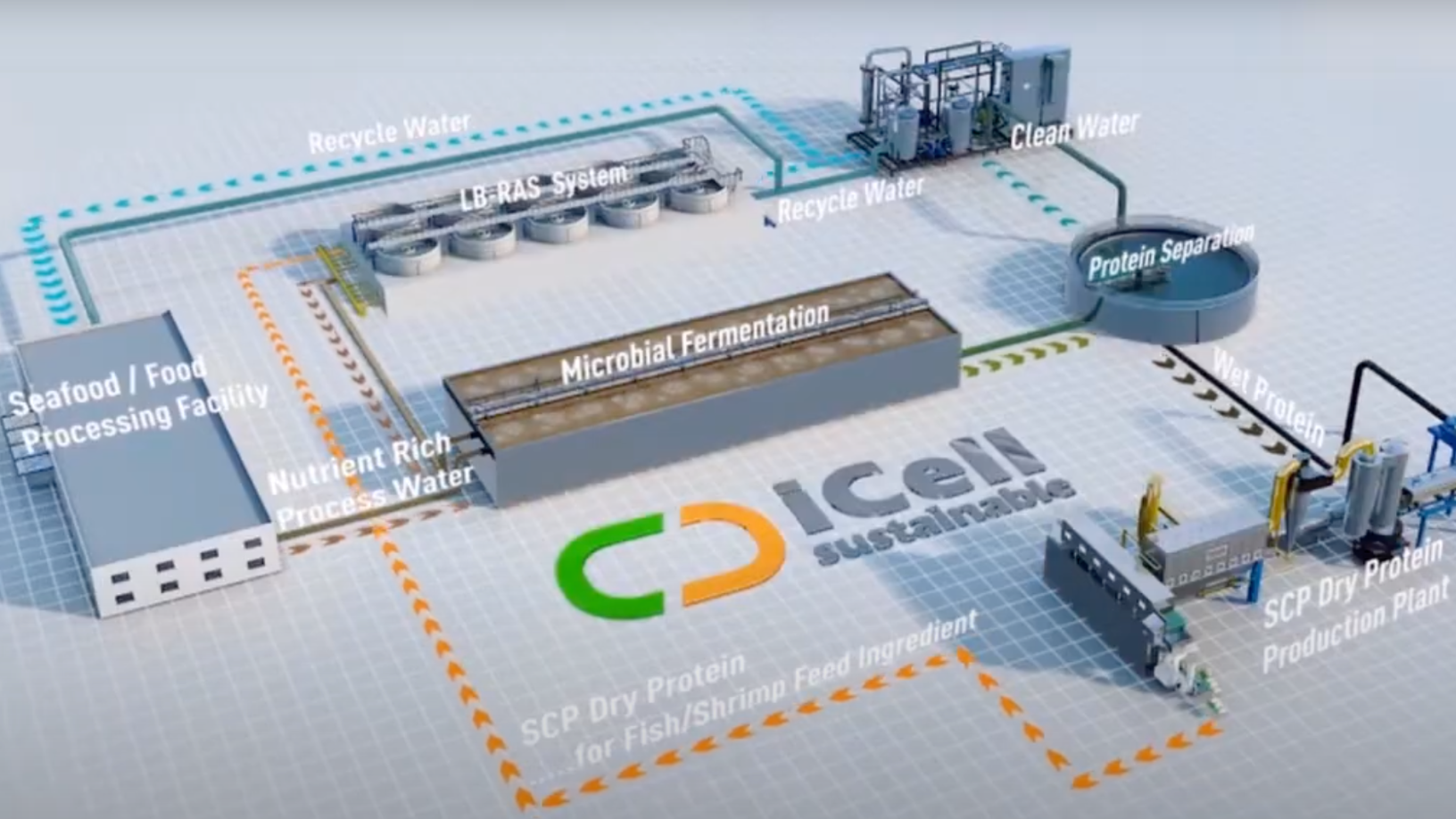

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon