B2C

This function is exclusive for Premium subscribers

-

DATABASE (212)

-

ARTICLES (221)

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Enlightened Hospitality Investments (EHI)

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

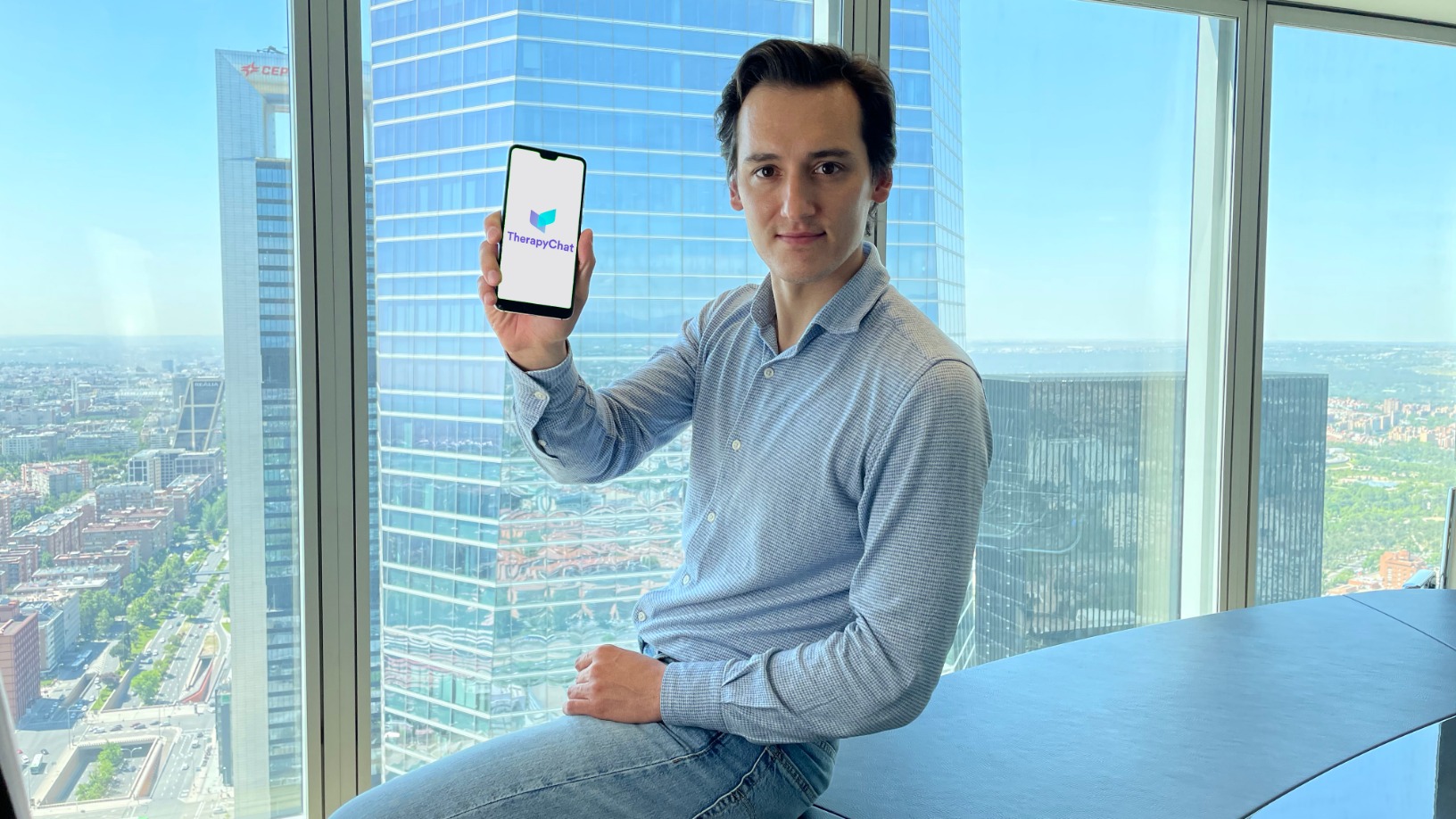

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Stockeld Dreamery: Vegan cheese created together with chefs

Backed by €16.5m in new funding, Stockeld Dreamery sets to expand into Europe and North America, and double its team to 50 a year on

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

Senior Deli: Creating easy-to-swallow, appealing food for dysphagia sufferers

Already supplying to over 200 senior homes and hospitals, the Future Food Asia 2021 co-winner uses proprietary tech to make nutritious, affordable texture-modified foods for people with swallowing difficulties