Big Data & Analytics

This function is exclusive for Premium subscribers

-

DATABASE (196)

-

ARTICLES (267)

Specialising in search engine optimization (SEO), marketing (SEM) and advanced analytics, Valuklik is paving the way to become the champion of digital performance marketing.

Specialising in search engine optimization (SEO), marketing (SEM) and advanced analytics, Valuklik is paving the way to become the champion of digital performance marketing.

A pioneer in the recruitment software-as-a-service (SaaS) model in Indonesia, Rekruta uses big data and highly customizable recruitment pipelines to simplify the talent search process.

A pioneer in the recruitment software-as-a-service (SaaS) model in Indonesia, Rekruta uses big data and highly customizable recruitment pipelines to simplify the talent search process.

As a one-stop adtech consultancy for B2B advertising solutions, Adskom aims to become a regional leader in ASEAN’s growing market for programmatic ad platforms.

As a one-stop adtech consultancy for B2B advertising solutions, Adskom aims to become a regional leader in ASEAN’s growing market for programmatic ad platforms.

UrbanIndo’s big data and analytics features are transforming Indonesia’s realty industry, as buyers and investors seek more detailed information to find properties in desirable locations.

UrbanIndo’s big data and analytics features are transforming Indonesia’s realty industry, as buyers and investors seek more detailed information to find properties in desirable locations.

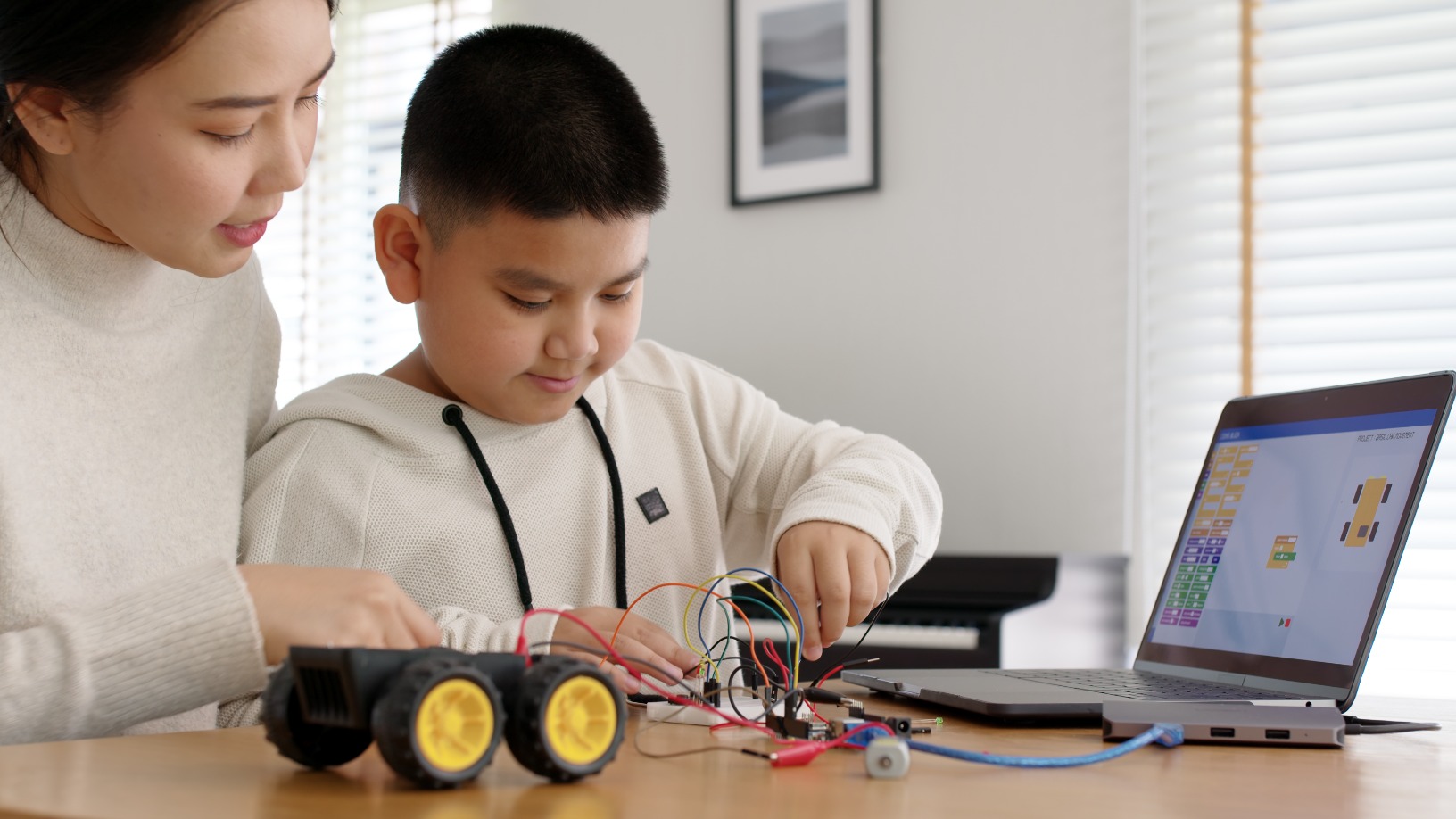

China’s largest MOOC platform for IT training is run by in-the-know professionals, and uses analytics to drive personalized learning, making vocational upgrading affordable and convenient.

China’s largest MOOC platform for IT training is run by in-the-know professionals, and uses analytics to drive personalized learning, making vocational upgrading affordable and convenient.

China’s HR 3.0 SaaS pioneer has a massive CV bank and 70,000+ corporate clients – valuable data resources for quick, accurate job matches.

China’s HR 3.0 SaaS pioneer has a massive CV bank and 70,000+ corporate clients – valuable data resources for quick, accurate job matches.

Powered by analytics, this homework app relieves teachers from setting/marking homework while analyzing individual progress, so teachers can deliver more personalized, productive teaching.

Powered by analytics, this homework app relieves teachers from setting/marking homework while analyzing individual progress, so teachers can deliver more personalized, productive teaching.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Qraved ups the ante in restaurant search/booking + social networking with professionally-curated dining guides; users’ own curated, shareable guides; and points redeemable for dining vouchers.

Qraved ups the ante in restaurant search/booking + social networking with professionally-curated dining guides; users’ own curated, shareable guides; and points redeemable for dining vouchers.

China’s most visited used car valuation and trading platform provides transparent, reliable pricing and quality in a usually opaque market.

China’s most visited used car valuation and trading platform provides transparent, reliable pricing and quality in a usually opaque market.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

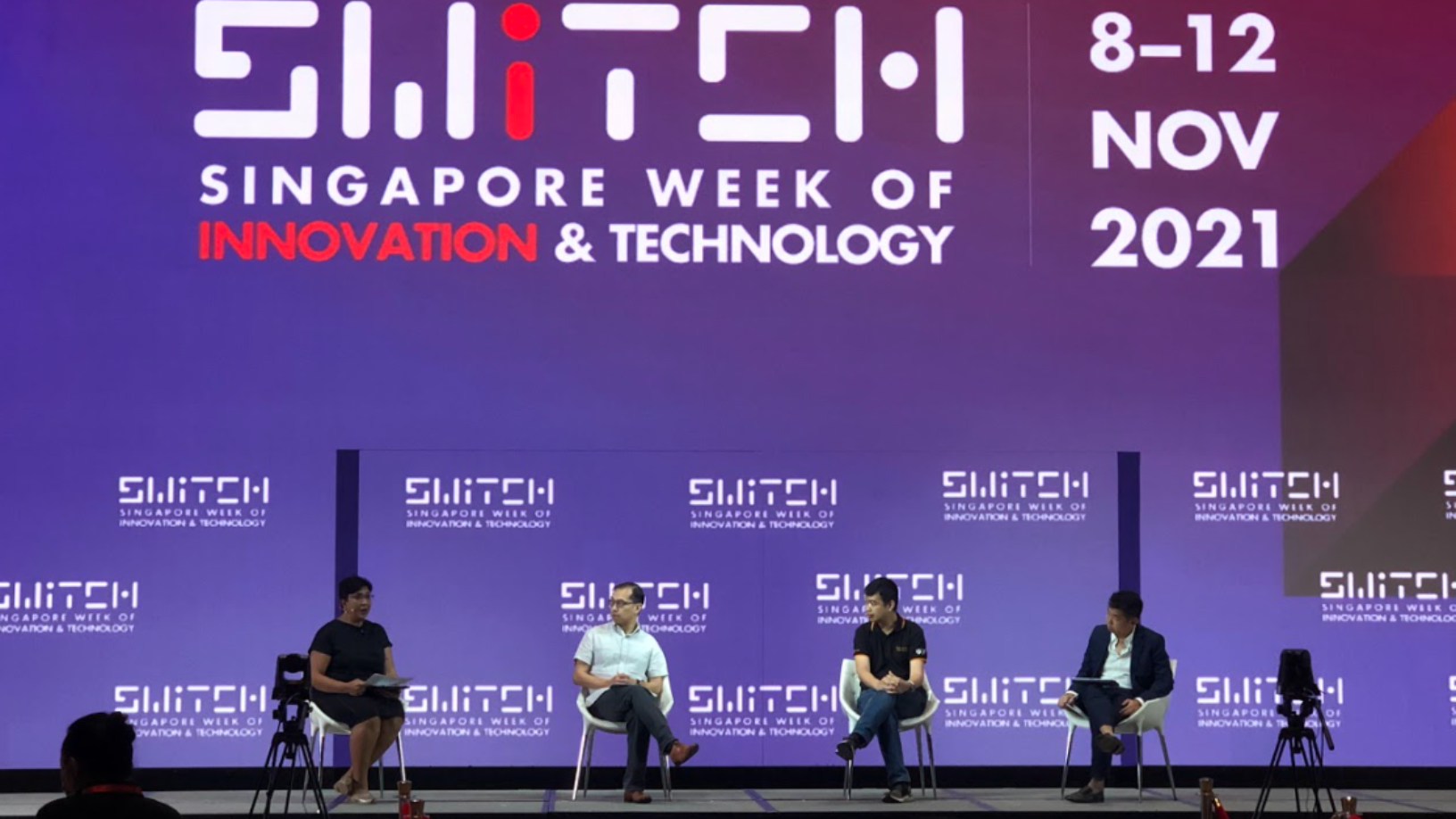

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Search instead for portugal, b2b, hospitality