A*Star

-

DATABASE (997)

-

ARTICLES (811)

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

All-in-one billing SaaS for SMEs and freelancers offering automated invoicing, calculation and tracking; payment collection through major payment gateways; accessible anywhere, anytime via the cloud.

All-in-one billing SaaS for SMEs and freelancers offering automated invoicing, calculation and tracking; payment collection through major payment gateways; accessible anywhere, anytime via the cloud.

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

Sandeep Tandon is a serial entrepreneur and investor, with a bachelor’s and a master’s in Electrical Engineering from the University of Southern California, USA. He is currently the managing director of Tandon Technology Ventures, part of Sandeep’s Tandon Group that is based in San Jose in California. He also co-founded Freecharge that was recently sold to Paytm, an e-commerce brand owned by India’s mobile internet company One97 Communications. Sandeep is an active angel investor and mentor, with personal investments in 15 startups including a first Series A funding of US$ 4.5 million in Unacademy in January 2017.

Sandeep Tandon is a serial entrepreneur and investor, with a bachelor’s and a master’s in Electrical Engineering from the University of Southern California, USA. He is currently the managing director of Tandon Technology Ventures, part of Sandeep’s Tandon Group that is based in San Jose in California. He also co-founded Freecharge that was recently sold to Paytm, an e-commerce brand owned by India’s mobile internet company One97 Communications. Sandeep is an active angel investor and mentor, with personal investments in 15 startups including a first Series A funding of US$ 4.5 million in Unacademy in January 2017.

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Hirokazu “Hiro” Mashita is a founder and director at M&S Partners Pte Ltd, a venture capital firm based in Singapore. A prolific business angel, he is known to have invested in more than 20 Indian startups in 2015 alone, earning him the nickname “Super Angel from Japan”.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

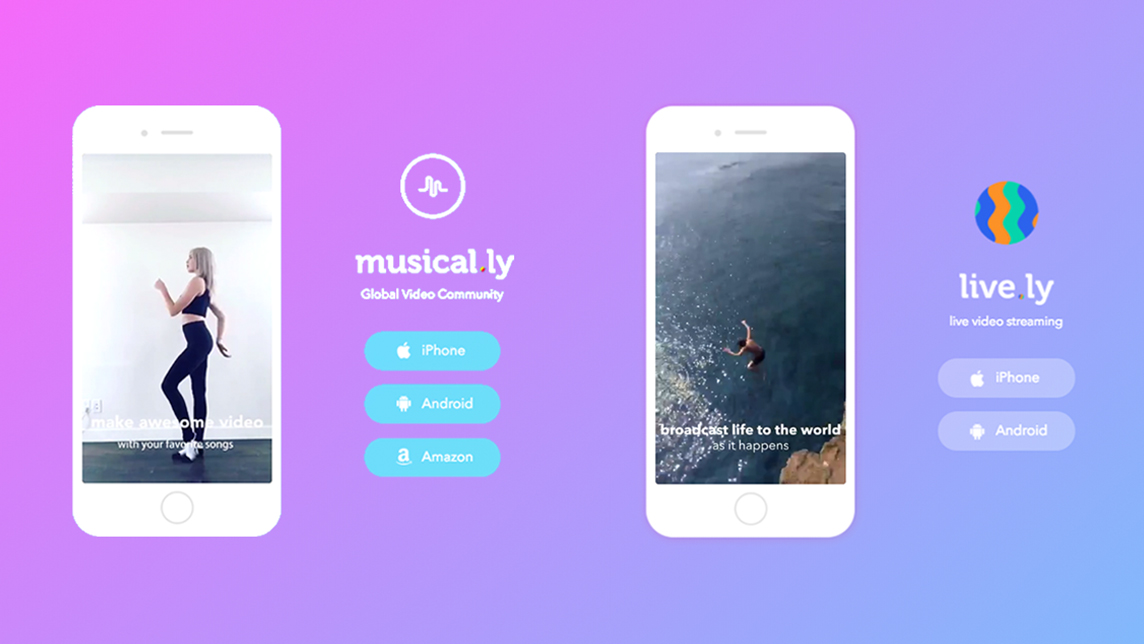

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.