A*Star

-

DATABASE (997)

-

ARTICLES (811)

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

LINE Ventures is the venture capital arm of LINE Corporation, a mobile app and internet services company based in Japan. LINE Corp is, in turn, a subsidiary of the Korean internet conglomerate NAVER.

LINE Ventures is the venture capital arm of LINE Corporation, a mobile app and internet services company based in Japan. LINE Corp is, in turn, a subsidiary of the Korean internet conglomerate NAVER.

Battle is a senior member of the Aspen Institute. He is on the boards of LinkedIn, Netflix, Expedia, OpenTable, Workday and FICO. Battle was once a global partner at Accenture.

Battle is a senior member of the Aspen Institute. He is on the boards of LinkedIn, Netflix, Expedia, OpenTable, Workday and FICO. Battle was once a global partner at Accenture.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

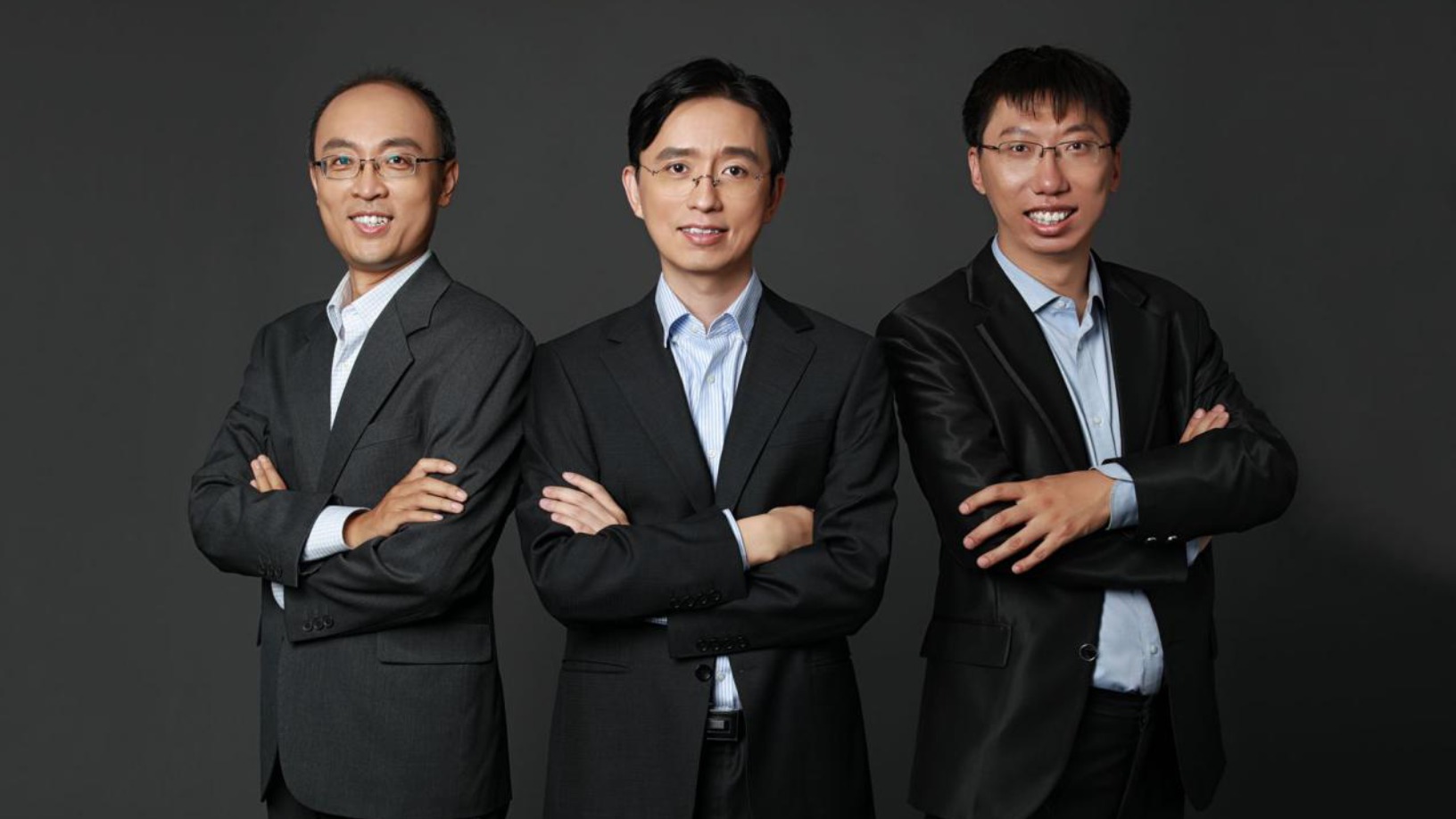

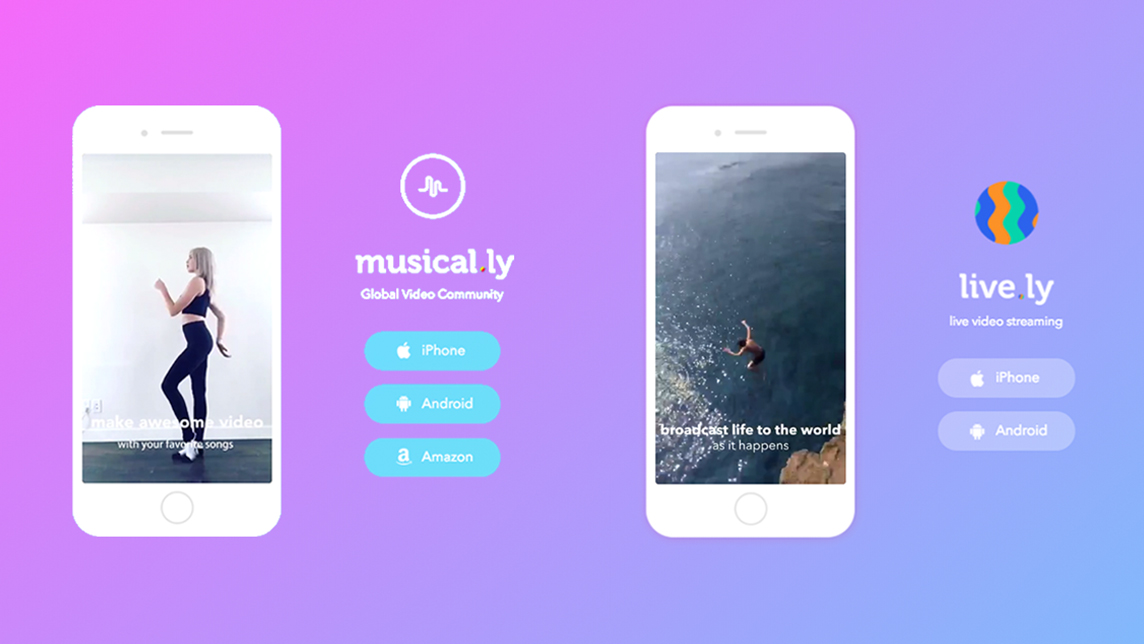

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.