Active Venture Partners

-

DATABASE (655)

-

ARTICLES (472)

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

One year on, Logisly gears up for expansion and a busy holiday period

Amid tough competition, Logisly is confident in its unit economics, extensive network and customer satisfaction

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

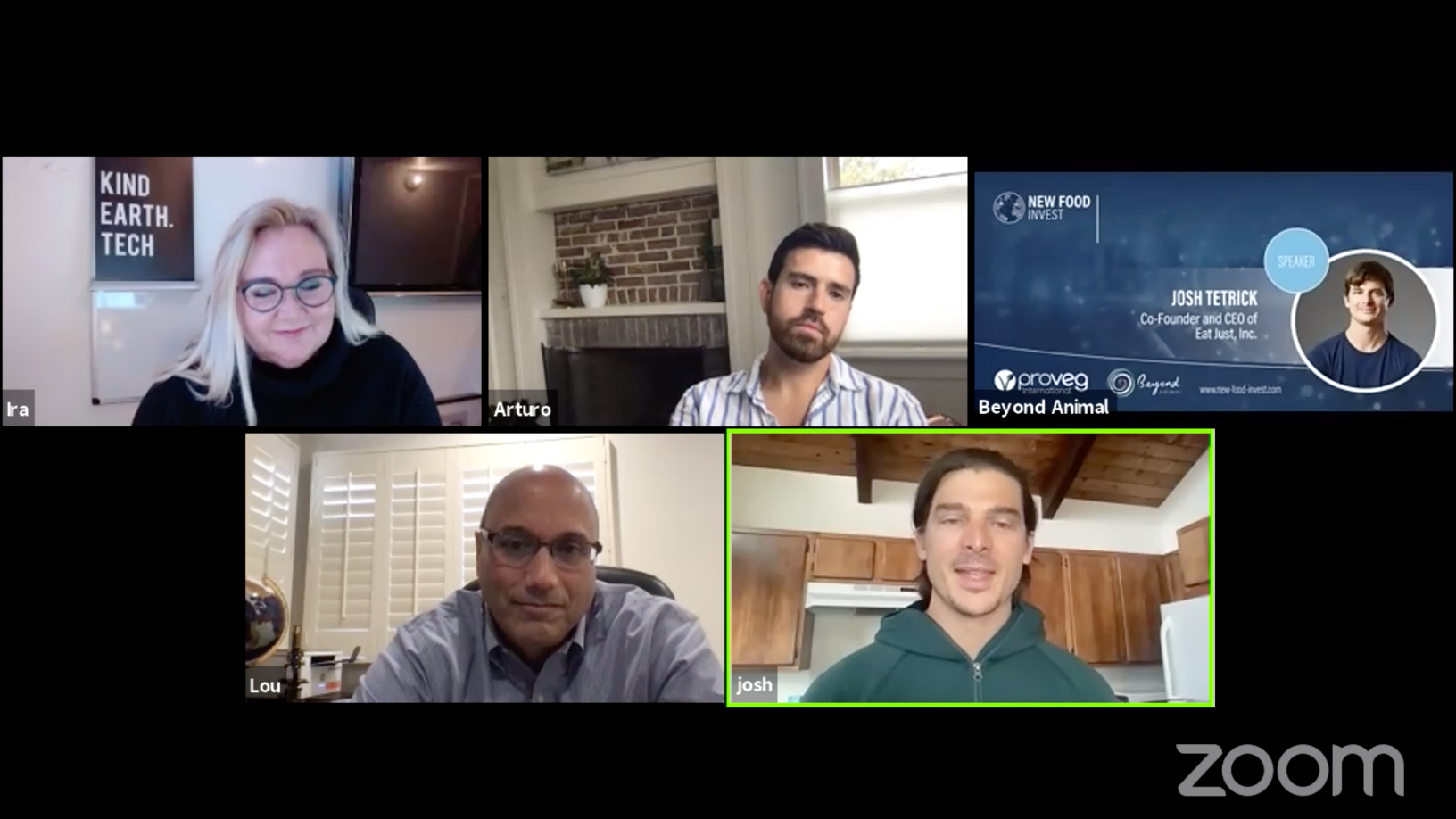

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

RecyGlo, Myanmar's first circular economy waste management system, targets regional growth

Turning trash into cash, Yangon-based recycling pioneer RecyGlo wants to extend its zero-waste circular economy model to the rest of Southeast Asia

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

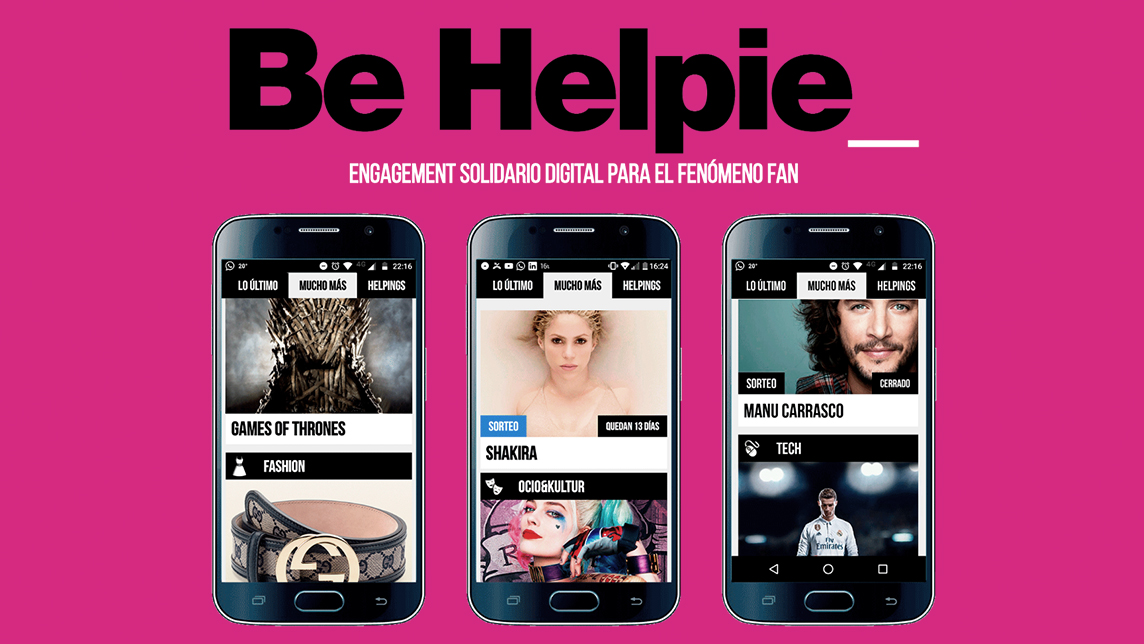

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Sorry, we couldn’t find any matches for“Active Venture Partners”.