Beyond Meat

-

DATABASE (52)

-

ARTICLES (209)

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Bezos-backed Chile’s first unicorn uses proprietary AI algorithm to analyze food molecules to produce plant-based meat and dairy products that taste like the original.

Bezos-backed Chile’s first unicorn uses proprietary AI algorithm to analyze food molecules to produce plant-based meat and dairy products that taste like the original.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Co-founder, CEO of Foods for Tomorrow / Heura Foods

Marc Coloma is the co-founder and CEO of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. Earlier, he spent two years at the local government business promotion organization Barcelona Activa's Entrepreneur's With Ideas training program, where Food for Tomorrow’s business and Heura foods product ideas were conceived. Coloma's background includes stints at a Catalonian animal charity and Doctors Without Borders (MSF) in project work and fundraising respectively, and as COO of a catering company. A committed vegan and environmentalist, Coloma was named on Forbes list of 100 Most Creative People in Business in July 2019.

Marc Coloma is the co-founder and CEO of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. Earlier, he spent two years at the local government business promotion organization Barcelona Activa's Entrepreneur's With Ideas training program, where Food for Tomorrow’s business and Heura foods product ideas were conceived. Coloma's background includes stints at a Catalonian animal charity and Doctors Without Borders (MSF) in project work and fundraising respectively, and as COO of a catering company. A committed vegan and environmentalist, Coloma was named on Forbes list of 100 Most Creative People in Business in July 2019.

Co-founder, Chief Social Movement Officer of Foods for Tomorrow / Heura Foods

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

COO and co-founder of Modulous Tech

Christopher Mortensen is co-founder and Chief Operating Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. Before that, he worked for two years as technical director at engineering, sustainability and energy consultancy Hydrock. Previously, he was at Atelier Ten for ten years working as a senior engineer, an environmental design consultant, a building services engineer and a lighting designer. Mortensen’s previous posts were all in his native US: as a mechanical project engineer at Oregon-based Interface Engineering 2004-8, as a mechanical designer at Philadelphia-based Associated Engineering Consultants, and as an assistant hut master at the Appalachian Mountain Club. He holds an Executive MBA from Cass Business School in London and also studied Blockchain in 2018 at the University of Oxford’s Said Business School Mortensen is a keen public speaker and, in 2017, gave a TedX talk on ’Beyond Sustainable Design.’

Christopher Mortensen is co-founder and Chief Operating Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. Before that, he worked for two years as technical director at engineering, sustainability and energy consultancy Hydrock. Previously, he was at Atelier Ten for ten years working as a senior engineer, an environmental design consultant, a building services engineer and a lighting designer. Mortensen’s previous posts were all in his native US: as a mechanical project engineer at Oregon-based Interface Engineering 2004-8, as a mechanical designer at Philadelphia-based Associated Engineering Consultants, and as an assistant hut master at the Appalachian Mountain Club. He holds an Executive MBA from Cass Business School in London and also studied Blockchain in 2018 at the University of Oxford’s Said Business School Mortensen is a keen public speaker and, in 2017, gave a TedX talk on ’Beyond Sustainable Design.’

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

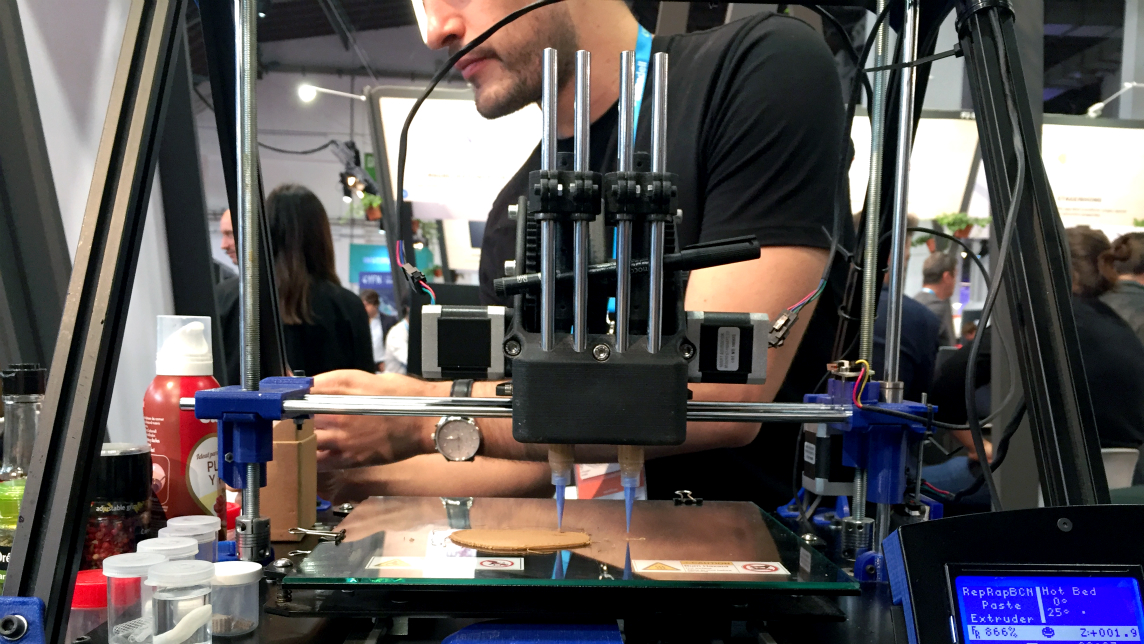

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

NotCo: Will this Bezos-backed plant-based foodtech be Chile's first unicorn?

Armed with $85m Series C funding, NotCo has expanded to the US, competing head-on with popular US alt-protein brands for a foothold in the multibillion-dollar vegan market

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Sorry, we couldn’t find any matches for“Beyond Meat”.