Chevron Technology Ventures’ Catalyst Program

-

DATABASE (934)

-

ARTICLES (645)

OneRagtime is a platform that brings together ventures, startups and advisory services, providing access to capital, industry expertise and operational resources. It also uses a fully-digitalized investment process for its users to carry out due diligence and negotiations. Founded in 2014 by Stéphanie Hospital and Jean-Marie Messier, One Ragtime is headquartered in London with offices in Paris and Barcelona. The company’s mentors include Josep Solé and Laurence Bret, who advise Spanish/Latin American and European technology companies, respectively.

OneRagtime is a platform that brings together ventures, startups and advisory services, providing access to capital, industry expertise and operational resources. It also uses a fully-digitalized investment process for its users to carry out due diligence and negotiations. Founded in 2014 by Stéphanie Hospital and Jean-Marie Messier, One Ragtime is headquartered in London with offices in Paris and Barcelona. The company’s mentors include Josep Solé and Laurence Bret, who advise Spanish/Latin American and European technology companies, respectively.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

Co-founder and CTO of ProSehat

Titus Wiguno forged a career in the tech industry since 2007, with more than 10 years of experience in building websites and developing apps. He was part of the team that localized Citibank’s CitiRewards program for the Indonesian market. In August 2015, he joined Atoma Medical as CTO to build the e-commerce site for ProSehat, develop mobile apps and to run the backend systems for the startup.

Titus Wiguno forged a career in the tech industry since 2007, with more than 10 years of experience in building websites and developing apps. He was part of the team that localized Citibank’s CitiRewards program for the Indonesian market. In August 2015, he joined Atoma Medical as CTO to build the e-commerce site for ProSehat, develop mobile apps and to run the backend systems for the startup.

Co-founder and CMO of Periksa.id

Indri Hardianti graduated from Indonesia’s Universitas Bina Nusantara (Binus) with a degree in Information Systems, where she was active in the IT students’ association and the promotion team of the university’s international branch. She established Binary Art in 2015, an app development house, together with fellow Binus alumni Sutan Imam Abu Hanifah. After a year, the two embarked on another startup, Periksa.id, a web-based hospital management program suite.

Indri Hardianti graduated from Indonesia’s Universitas Bina Nusantara (Binus) with a degree in Information Systems, where she was active in the IT students’ association and the promotion team of the university’s international branch. She established Binary Art in 2015, an app development house, together with fellow Binus alumni Sutan Imam Abu Hanifah. After a year, the two embarked on another startup, Periksa.id, a web-based hospital management program suite.

Co-founder of Ajaib

During her time as a consultant at McKinsey from 2012 to 2014, Yada Piyajomkwan worked with governments from the Association of South East Asian Nations (ASEAN) on financial inclusion. The topic became her focus of study when she enrolled at the Stanford Graduate School of Business’ MBA program as a Fulbright scholar. After earning her MBA, she and fellow Stanford alumnus Anderson Sumarli established online investment advisory startup Ajaib.

During her time as a consultant at McKinsey from 2012 to 2014, Yada Piyajomkwan worked with governments from the Association of South East Asian Nations (ASEAN) on financial inclusion. The topic became her focus of study when she enrolled at the Stanford Graduate School of Business’ MBA program as a Fulbright scholar. After earning her MBA, she and fellow Stanford alumnus Anderson Sumarli established online investment advisory startup Ajaib.

CEO and co-founder of Refurbed

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

COO and co-founder of Plant on Demand

Santiago Corral Rodriguez worked at Dutch online lighting supplier Any Amp as a video manager and country manager in Spain from 2013 to 2015. He also worked at Dutch produce distributor Direct Fresh International in administration and control assistance in 2016.After completing a business administration degree at Granada University in 2012, Corral went to Finland to study International Business at SeAMK (Seinäjoki University of Applied Sciences) and graduated in 2016. He also obtained a postgrad qualification in Entrepreneurship at University of Deusto in the Basque Country, Spain.He worked at Sonar Ventures in 2017 before co-founding Plant on Demand (POD) in 2018 as COO and Customer Success Manager. POD is an e-marketplace and online management platform for small-scale food producers.

Santiago Corral Rodriguez worked at Dutch online lighting supplier Any Amp as a video manager and country manager in Spain from 2013 to 2015. He also worked at Dutch produce distributor Direct Fresh International in administration and control assistance in 2016.After completing a business administration degree at Granada University in 2012, Corral went to Finland to study International Business at SeAMK (Seinäjoki University of Applied Sciences) and graduated in 2016. He also obtained a postgrad qualification in Entrepreneurship at University of Deusto in the Basque Country, Spain.He worked at Sonar Ventures in 2017 before co-founding Plant on Demand (POD) in 2018 as COO and Customer Success Manager. POD is an e-marketplace and online management platform for small-scale food producers.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

A mobile application where it’s free and fun to express yourself through selfies, as well as meet and chat with likeminded friends before dating.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Co-founder and CEO of Andalin

Rifki Pratomo established freight forwarding marketplace startup Andalin in 2016, where he is currently CEO. Rifki earned his bachelor's in Business Administration at Carnegie Mellon University in Qatar in 2011 before returning to Indonesia a year later to join Maybank's graduate program. From 2014 to end 2015, he was a finance manager at Shell's lubricant supply chain division in Indonesia, after which he had a brief stint with Garena before starting Andalin.

Rifki Pratomo established freight forwarding marketplace startup Andalin in 2016, where he is currently CEO. Rifki earned his bachelor's in Business Administration at Carnegie Mellon University in Qatar in 2011 before returning to Indonesia a year later to join Maybank's graduate program. From 2014 to end 2015, he was a finance manager at Shell's lubricant supply chain division in Indonesia, after which he had a brief stint with Garena before starting Andalin.

Co-founder and CTO of GoWork

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

Inveready Technology Investment Group was awarded Spain's best asset management firm in by ASCRI, the Spanish Venture Capital & Private Equity Association. It manages €92 million through six different investment vehicles, investing in technology companies through hybrid financial instruments. It has a portfolio that covers over 80 startups from B2B and B2C services to drug discovery and SaaS companies.

Inveready Technology Investment Group was awarded Spain's best asset management firm in by ASCRI, the Spanish Venture Capital & Private Equity Association. It manages €92 million through six different investment vehicles, investing in technology companies through hybrid financial instruments. It has a portfolio that covers over 80 startups from B2B and B2C services to drug discovery and SaaS companies.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Founded in July 2013, Liangjiang Capital directly manages a total asset of around RMB 5 billion. Liangjiang Capital mainly invests in the fields including telecommunication, new media, medical instrument, bio-engineering, clean technology, information technology, robotics, and artificial intelligence. Liangjiang Capital provides invested companies with both funding support and services of financial, legal and management consulting.

Founded in 2017, Shenzhen Yueke Xintai is a VC firm under the state-owned Technology Financial Group. Founded in 1992, Technology Financial Group began currently manages nine FOFs and 78 other funds, worth RMB 50bn in total. It has provided funding service to over 2,000 tech companies and helped more than 60 businesses go public.

Founded in 2017, Shenzhen Yueke Xintai is a VC firm under the state-owned Technology Financial Group. Founded in 1992, Technology Financial Group began currently manages nine FOFs and 78 other funds, worth RMB 50bn in total. It has provided funding service to over 2,000 tech companies and helped more than 60 businesses go public.

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Belva Devara: The whiz kid transforming Indonesia’s education sector

Recently made advisor to the Indonesian president, edtech Ruangguru founder and CEO Belva Devara has also begun mentoring and promoting new startups in Indonesia

NotCo: Will this Bezos-backed plant-based foodtech be Chile's first unicorn?

Armed with $85m Series C funding, NotCo has expanded to the US, competing head-on with popular US alt-protein brands for a foothold in the multibillion-dollar vegan market

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Alipay opens its platform to speed up digitalization of Chinese service providers amid Covid-19

As Alipay continues to battle WeChat for super-app supremacy, it's created a stronghold in China’s services industry, where 80% of businesses still operate under brick-and-mortar models

Zymvol Biomodeling: In the footsteps of Chemistry Nobel Prize winner Frances H. Arnold

Startup founded by scientists helps industries discover and develop enzymes cheaply through computer-driven innovation

3D printing foodtech Natural Machines joins Euronext's pre-IPO training program

With its 3D printed vegan candies and snowflake pizzas, Natural Machines already has more than 300 companies using its Foodini food printer, which it’s upgrading with laser tech for simultaneous cooking too

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

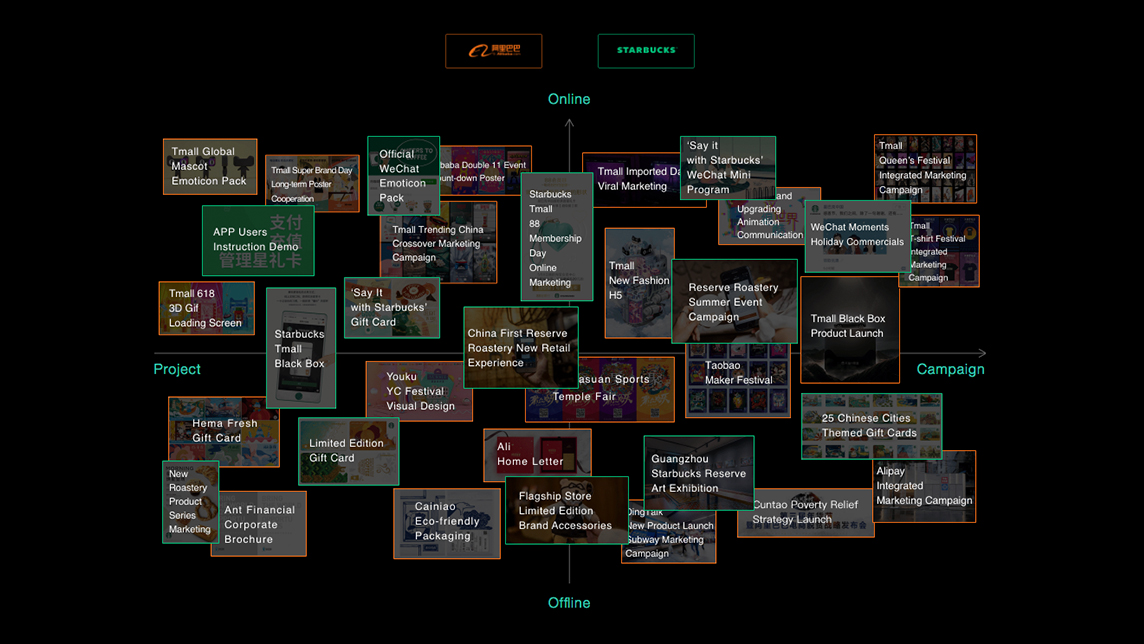

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Shrimp farming IoT startup JALA to launch franchise program by mid-2021

Despite delays to hardware manufacturing and global expansion during the pandemic, JALA achieved encouraging growth in 2020 and is gearing up for a pre-Series A fundraising round

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Sorry, we couldn’t find any matches for“Chevron Technology Ventures’ Catalyst Program”.