Filinvest Development Corporation (FDC)

-

DATABASE (448)

-

ARTICLES (398)

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

Established in 1998, Infoteria Corporation is an enterprise software company founded in Tokyo. Its flagship product "ASTERIA" is used by companies such as Sony, Panasonic and Mitsubishi.

Established in 1998, Infoteria Corporation is an enterprise software company founded in Tokyo. Its flagship product "ASTERIA" is used by companies such as Sony, Panasonic and Mitsubishi.

China Reform Capital Corporation, Ltd.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

Huayi Brothers Media Corporation

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Weijing Culture Development Co., Ltd.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Born in 1969, Pan Yingjiu had worked at Zhuhai Nanping Enterprise Corporation from September 1990 to July 1991. He also worked as an engineer at Canon Zhuhai until August 1994 when he left to start a new career as an investment manager at Zhuhai Pingsha Jinyan Tourism Corporation.In December 1999, he became a financial investment manager at China Materials Development Investment Corporation and rose to become a board director in May 2005 at a Hong Kong-based luminescent material manufacturer. In March 2007, he became the GM of Lanshi VC until March 2011. Since September 2010, he has also been working as a board director at Weibang Investment in Shenzhen and Beijing IN-Power Electric Co Ltd.

Born in 1969, Pan Yingjiu had worked at Zhuhai Nanping Enterprise Corporation from September 1990 to July 1991. He also worked as an engineer at Canon Zhuhai until August 1994 when he left to start a new career as an investment manager at Zhuhai Pingsha Jinyan Tourism Corporation.In December 1999, he became a financial investment manager at China Materials Development Investment Corporation and rose to become a board director in May 2005 at a Hong Kong-based luminescent material manufacturer. In March 2007, he became the GM of Lanshi VC until March 2011. Since September 2010, he has also been working as a board director at Weibang Investment in Shenzhen and Beijing IN-Power Electric Co Ltd.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Plantruption: Transforming Irish seaweed into sustainable alt-protein seafood

Using abundant local seaweed as highly nutritious, eco-friendly alternatives to fish, the Dublin-based startup is gearing up to tap into new markets in Europe and the US

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

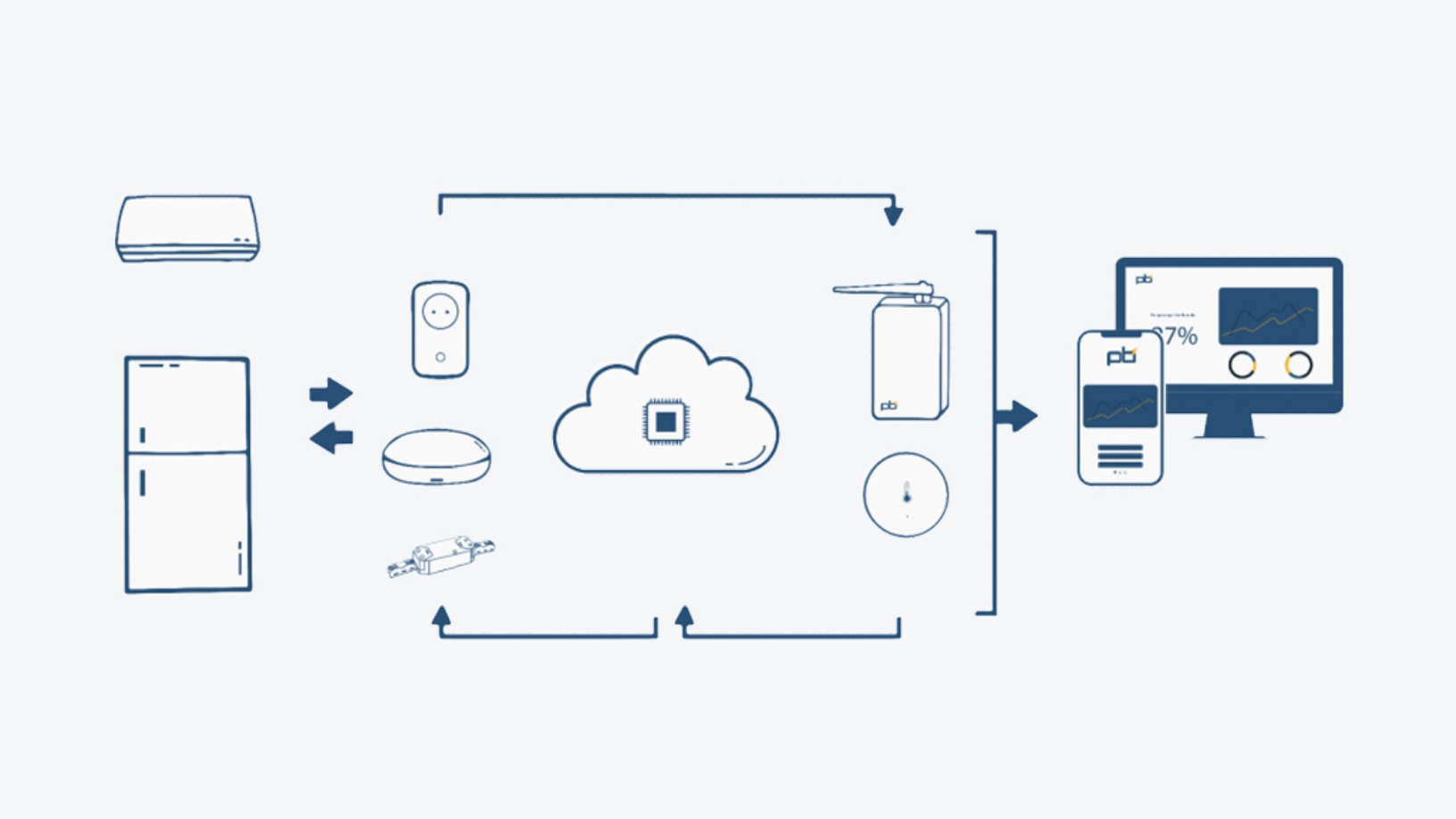

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

New Food Invest: Building a plant-based business in the US

With plant-based startups experiencing exponential growth but facing increasingly intense competition, experts consider the opportunities and barriers in the sector

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Delman helps enterprises wrangle data for machine learning and automation

With fresh $1.6m seed funding and high-profile partners, Delman’s data services are helping Indonesian clients achieve digital transformation

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Allen Zhang: Father of WeChat and its string of innovations

Get to know the man behind the app in every Chinese user's smartphone

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

How Sea Water Analytics is using IoT to help keep beaches safe in Covid-19 era

Sea Water Analytics checks water quality, overcrowding, even jelly fish threats in Spanish beaches

Sorry, we couldn’t find any matches for“Filinvest Development Corporation (FDC)”.