Funding Society

-

DATABASE (209)

-

ARTICLES (568)

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Founded in 2017 by the ex-COO of Deutsche Bank Henry Ritchotte, Ritmir Ventures is based in London and has invested in nine companies internationally. Ritchotte is passionate about digital innovation within the banking sector and established Ritmir specifically to invest in fintech startups during the seed and Series A funding stages.

Founded in 2017 by the ex-COO of Deutsche Bank Henry Ritchotte, Ritmir Ventures is based in London and has invested in nine companies internationally. Ritchotte is passionate about digital innovation within the banking sector and established Ritmir specifically to invest in fintech startups during the seed and Series A funding stages.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Entrepreneurs Roundtable Accelerator

New York City’s largest accelerator program, founded in 2011, provides each accepted company with an initial $100,000 investment and the potential for follow-on funding from its fund. The accelerator also provides up to $120,000 of Azure benefits for two years from Microsoft, plus $100,000 in webhosting credits from Amazon Web Services and $100,000 from Google Cloud Platform, among other benefits. Its four-month program provides access to the largest mentor network in New York. It has accelerated and invested in more than 200 companies to date across sectors and makes diversity investments. Selected companies have a US market ambition. Its most recent cohorts include Portuguese VR gaming and cognitive training software Virtuleap, and online tire retailer Tire Agent.

New York City’s largest accelerator program, founded in 2011, provides each accepted company with an initial $100,000 investment and the potential for follow-on funding from its fund. The accelerator also provides up to $120,000 of Azure benefits for two years from Microsoft, plus $100,000 in webhosting credits from Amazon Web Services and $100,000 from Google Cloud Platform, among other benefits. Its four-month program provides access to the largest mentor network in New York. It has accelerated and invested in more than 200 companies to date across sectors and makes diversity investments. Selected companies have a US market ambition. Its most recent cohorts include Portuguese VR gaming and cognitive training software Virtuleap, and online tire retailer Tire Agent.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Can AI make ethical decisions? Ethyka by Acuilae wants to train AI systems to reason like humans

Ethyka, an AI training module, sets the ethical principles and conditioning for AI systems in applications ranging from chatbots to autonomous cars

Alex Sicart: Democratizing the Internet with blockchain

The 20-year-old tech wiz and blockchain advocate is seeking a digital revolution where decentralized systems will empower societies

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

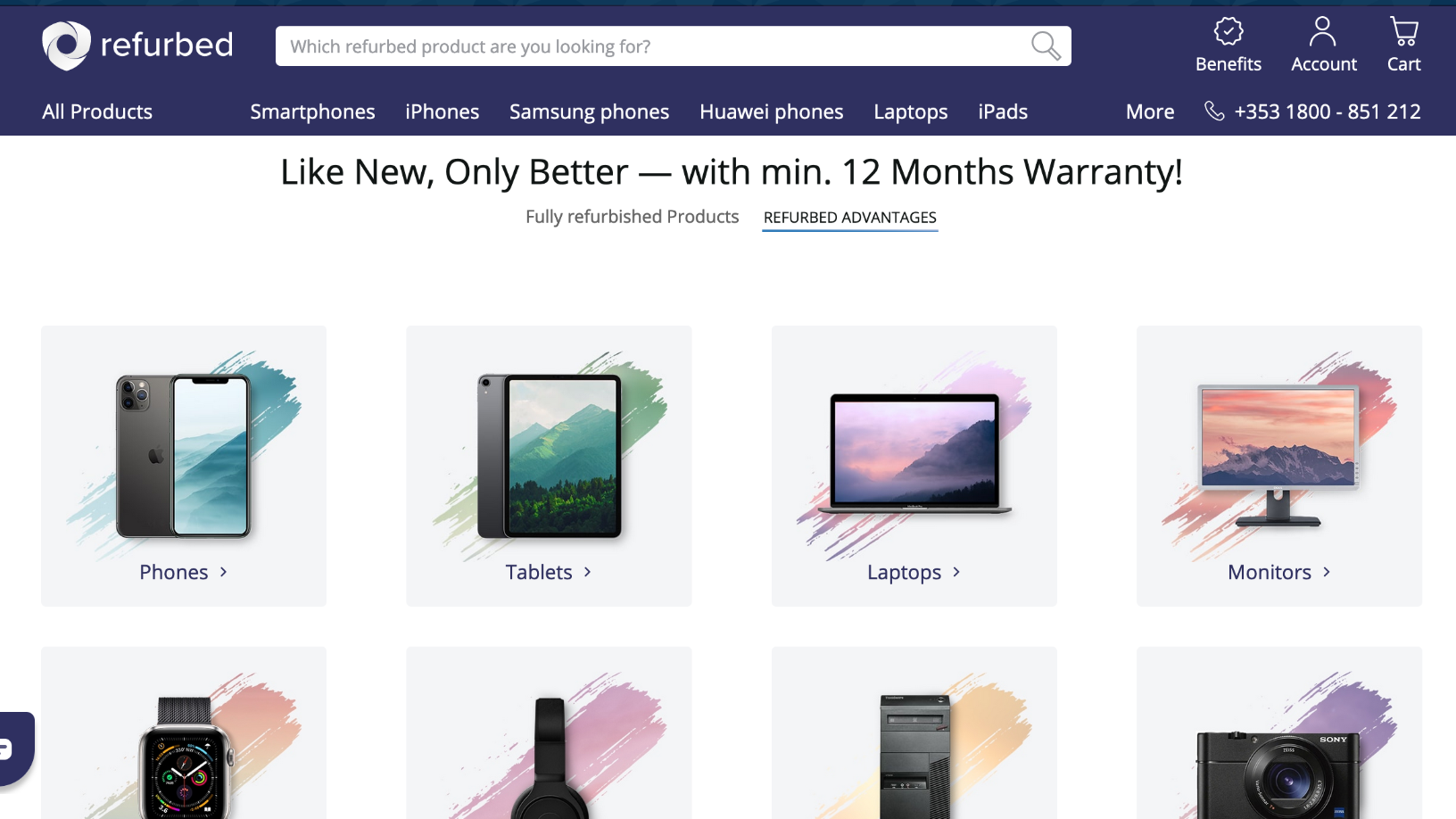

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Sorry, we couldn’t find any matches for“Funding Society”.