M&A

-

DATABASE (998)

-

ARTICLES (811)

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Co-founder of Jimaisong

A former senior executive of eFuture, Zhang Sen specializes in marketing and customer management. He was also once employed at home furnishing & DIY stores Orient Home and B&Q.

A former senior executive of eFuture, Zhang Sen specializes in marketing and customer management. He was also once employed at home furnishing & DIY stores Orient Home and B&Q.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

World’s most stylish unicorn Farfetch presents an extensive yet coveted selection of luxury fashion, while offering brick-and-mortar boutiques, a global reach, and competitive technology solutions.

World’s most stylish unicorn Farfetch presents an extensive yet coveted selection of luxury fashion, while offering brick-and-mortar boutiques, a global reach, and competitive technology solutions.

An integrated communication and information platform for schools, accessible by teachers, students and parents, which aims to modernize and improve the Indonesian education system.

An integrated communication and information platform for schools, accessible by teachers, students and parents, which aims to modernize and improve the Indonesian education system.

Doctor Che is a We-Media influencer that provides professionally-generated content and digital tool kits to users making decisions about buying new automobiles.

Doctor Che is a We-Media influencer that provides professionally-generated content and digital tool kits to users making decisions about buying new automobiles.

A plug&play digital health SaaS that connects remotely to medical devices, patients’ smartphones and sensors, which grew HumanITcare’s client base sixfold during Covid-19.

A plug&play digital health SaaS that connects remotely to medical devices, patients’ smartphones and sensors, which grew HumanITcare’s client base sixfold during Covid-19.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Founder and CEO of Babytree

With a degree in electrical engineering from Tsinghua University, a master’s in sociology from Columbia and an MBA from Georgetown University, Wang is the former chief marketing officer of Google Asia. He has also worked at McKinsey & Co., P&G, and Yahoo.

With a degree in electrical engineering from Tsinghua University, a master’s in sociology from Columbia and an MBA from Georgetown University, Wang is the former chief marketing officer of Google Asia. He has also worked at McKinsey & Co., P&G, and Yahoo.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

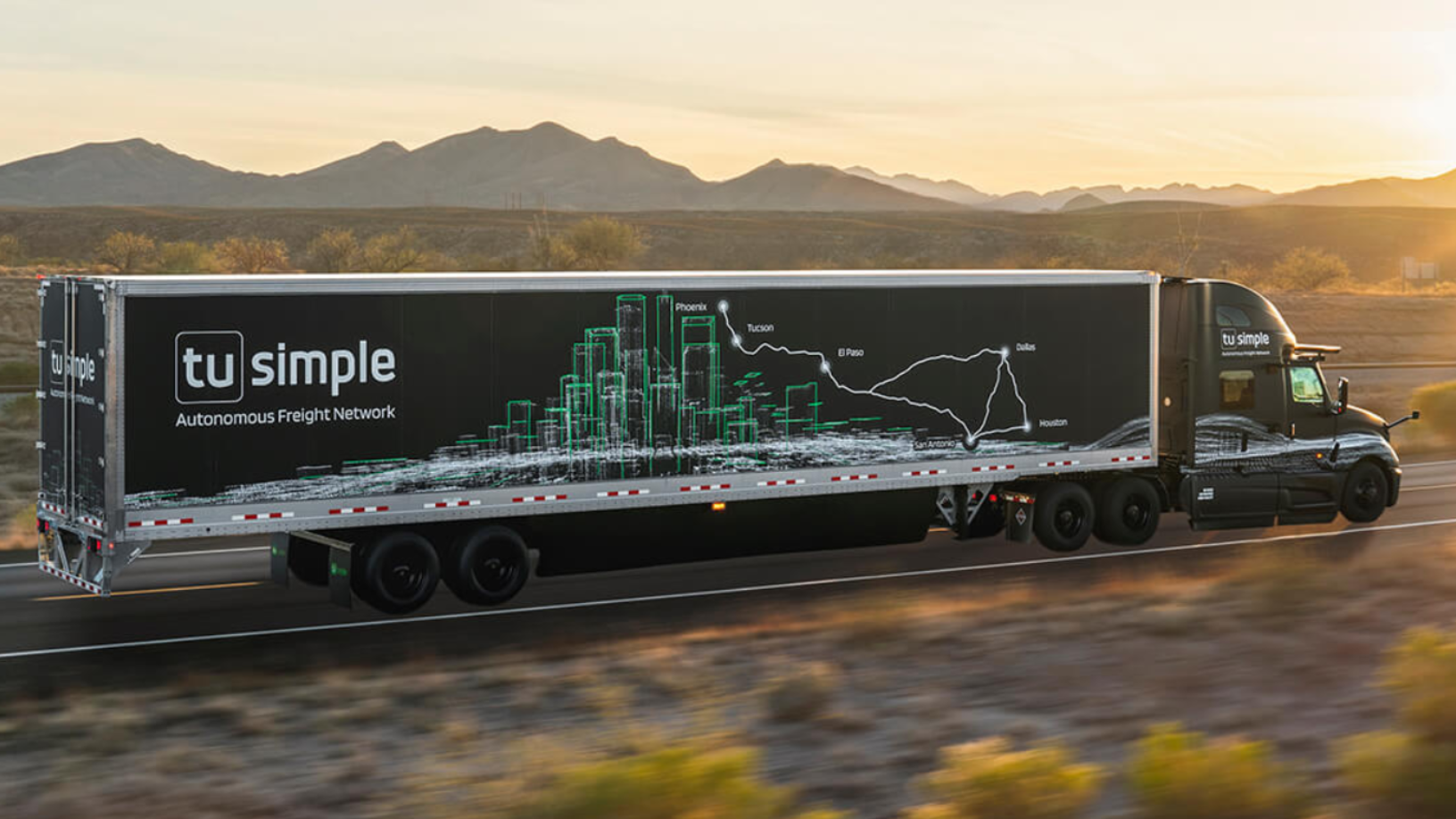

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Geometry Healthcare: Smart toilets that warn you if you are sick, or at risk

Using a biochip for urinalysis and offline health management services, Geometry Healthcare aims to differentiate itself in the smart toilet business

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

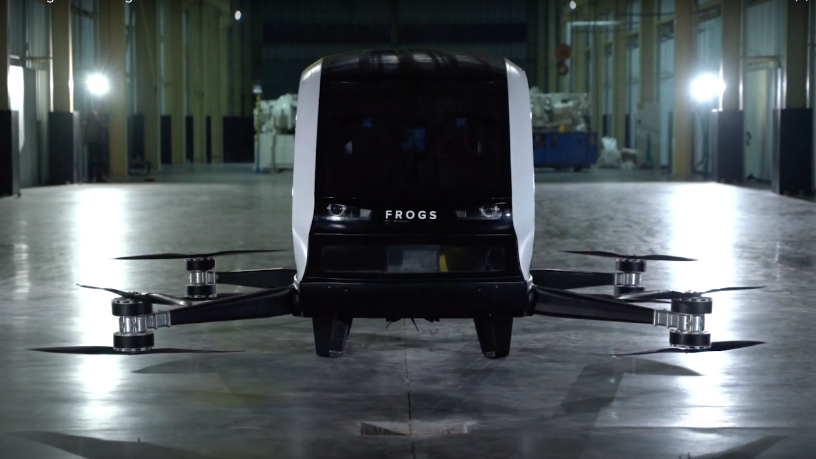

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Sorry, we couldn’t find any matches for“M&A”.