Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

Chairman and co-founder of Everimpact

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Skype co-founder Toivo Annus currently is the founder and partner at Ambient Sound Investments (ASI) and has invested in 30 investments via ASI.

Skype co-founder Toivo Annus currently is the founder and partner at Ambient Sound Investments (ASI) and has invested in 30 investments via ASI.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

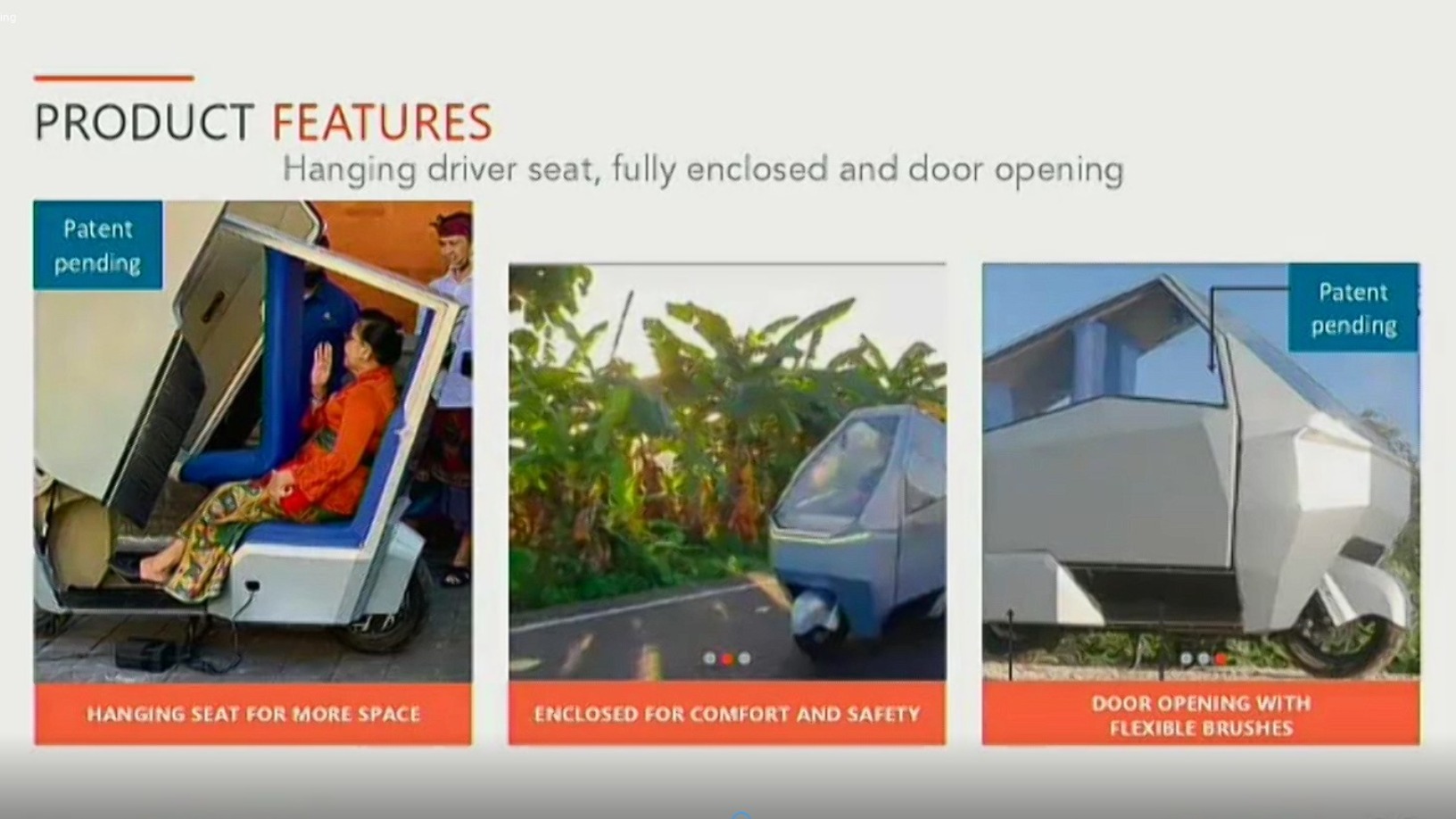

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.