Origin of the Buddha Head

-

DATABASE (995)

-

ARTICLES (811)

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

With more than 175 years of history, Navistar is the fourth biggest truck-maker in the US. The company drives new innovations in engine technologies, with products ranging from commercial trucks and buses to defense vehicles.In June 2020, it partnered with self-driving trucking startup TuSimple to produce L4 autonomous trucks. It also invested in its first Chinese company TuSimple.In March 2021, Navistar stockholders approved acquisition by TRATON, part of the Volkswagen Group. TRATON has also invested in TuSimple.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

Founded in 1996, HMC Venture is a subsidiary of the Harmony Group, a conglomerate that specializes in startup investment and chemical trade. HMC Venture’s investments focus on Internet-based FinTech and the enterprise service business, the medical and biological business and private equity.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

58 Industry Fund is the VC arm of China’s leading local services provider 58 Group. Founded in 2018, the fund mainly invests in early- and mid-stage startups working on urban lifestyle and education & training.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

China new retail: A blend of the best of online and offline shopping

Players big and small are contributing to China’s new retail revolution

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

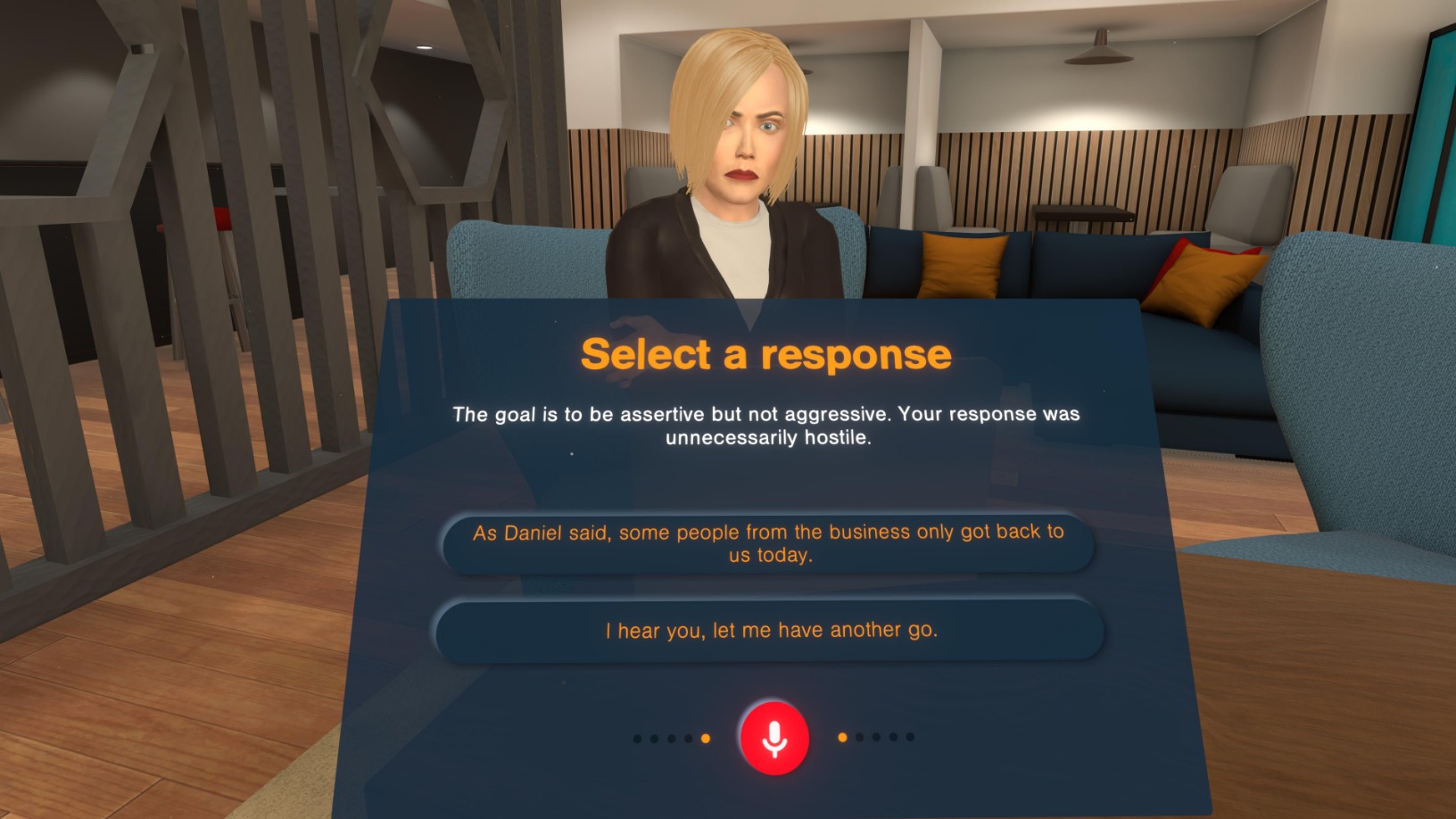

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Founder and CEO Gao Lufeng on Ninebot's acquisition of American motorized scooter maker Segway, China’s rise in technology and innovation, and the company’s plans for the US market

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Indonesian esports team RRQ dreams of being "the king of kings"

The Jakarta team is growing its brand with collaborations and its academy, expects more esports interest amid Covid-19 home confinements

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Sorry, we couldn’t find any matches for“Origin of the Buddha Head”.