Straight Teeth Direct

-

DATABASE (36)

-

ARTICLES (113)

This online platform lets businesses book hotel rooms directly, bypassing costly brokers and the time- and labor-consuming processes of comparing prices and bargaining.

This online platform lets businesses book hotel rooms directly, bypassing costly brokers and the time- and labor-consuming processes of comparing prices and bargaining.

Solving the last-mile problem of absent recipients that frustrates many e-commerce and delivery companies, the Citibox mailbox-plus-app solution lets customers collect their shopping 24/7.

Solving the last-mile problem of absent recipients that frustrates many e-commerce and delivery companies, the Citibox mailbox-plus-app solution lets customers collect their shopping 24/7.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1982, Ade Gestión Sodical is an investment firm that specializes in the direct funding of startups at seed, early and growth stages. It also provides finance for VC and management buy-out /buy-in ventures.Sodical mainly focuses on enterprises connected to the Spanish region of Castilla y León to promote economic development in local areas. It normally invests between €180,000 and €2 million, taking minority stakes in small and medium-sized companies.

Founded in 1982, Ade Gestión Sodical is an investment firm that specializes in the direct funding of startups at seed, early and growth stages. It also provides finance for VC and management buy-out /buy-in ventures.Sodical mainly focuses on enterprises connected to the Spanish region of Castilla y León to promote economic development in local areas. It normally invests between €180,000 and €2 million, taking minority stakes in small and medium-sized companies.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

A first-mover in spotting the potentially explosive growth of China’s luxury market, Secoo is today a leading luxury retailer, with e-commerce and offline stores worldwide.

A first-mover in spotting the potentially explosive growth of China’s luxury market, Secoo is today a leading luxury retailer, with e-commerce and offline stores worldwide.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

Smile Formula offers orthodontic treatment online, and 70% cheaper

Unaffected by the coronavirus outbreak, Smile Formula served 2,000 customers within nine months of launch and raised RMB 10m seed funding in April

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

Indonesia's Rata offers customized aligners for quicker teeth straightening

Founded by two dentists, Alpha JWC Ventures-backed Rata seeks to offer an affordable alternative to conventional braces by tapping AI in orthodontics

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

CloudGuide: Bringing museum tourism into the 21st century

CloudGuide, an app hosting official multimedia content from museums and tourist attractions, seeks post-seed funding to scale in Europe

Last-mile delivery tech pioneer Mox expands into e-commerce amid Covid-19 online shopping surge

Last-mile logistical solutions provider Mox scaled its business across markets during the Covid-19 lockdown and is looking to raise €8.2m

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Alex Sicart: Democratizing the Internet with blockchain

The 20-year-old tech wiz and blockchain advocate is seeking a digital revolution where decentralized systems will empower societies

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

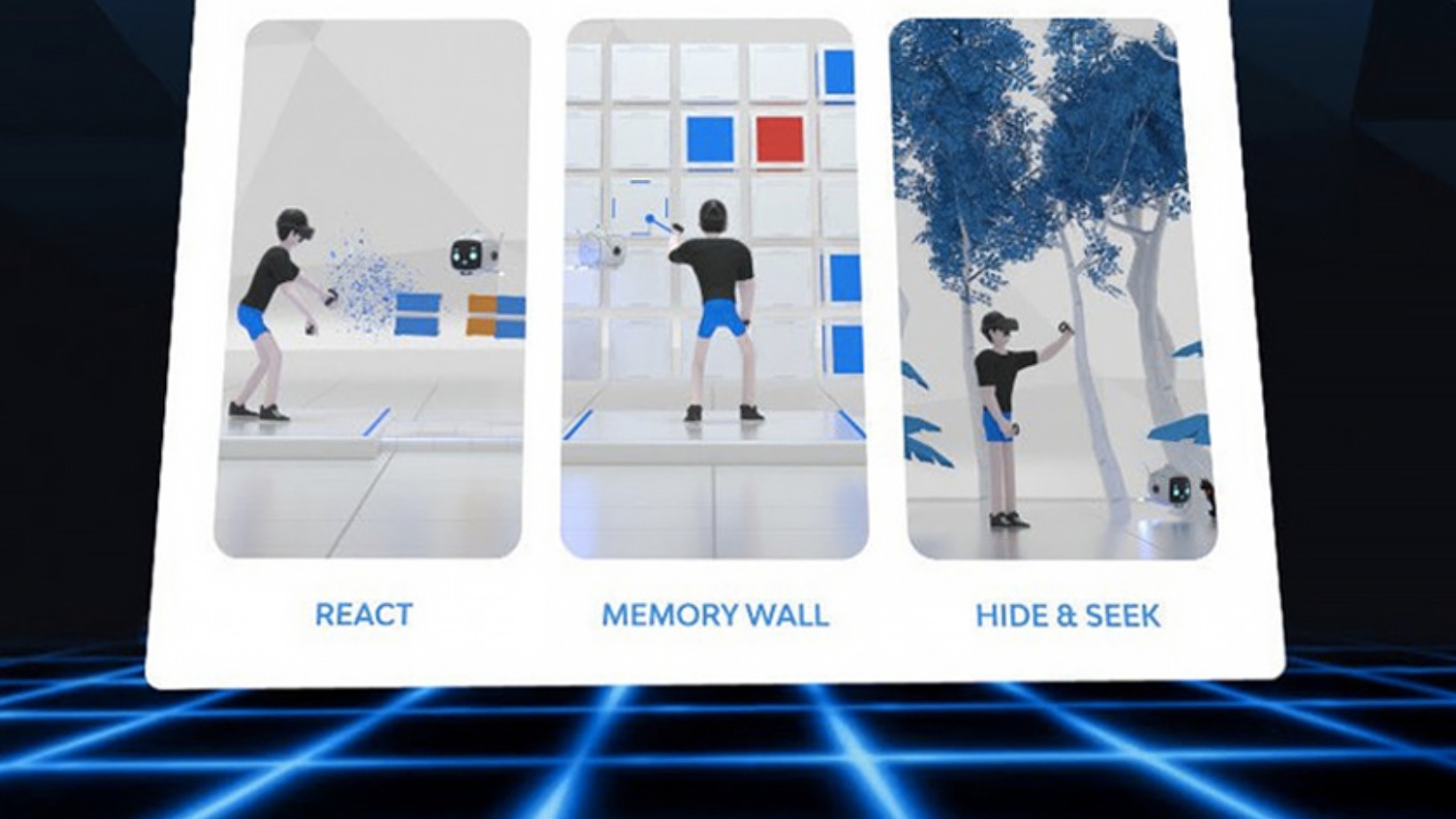

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

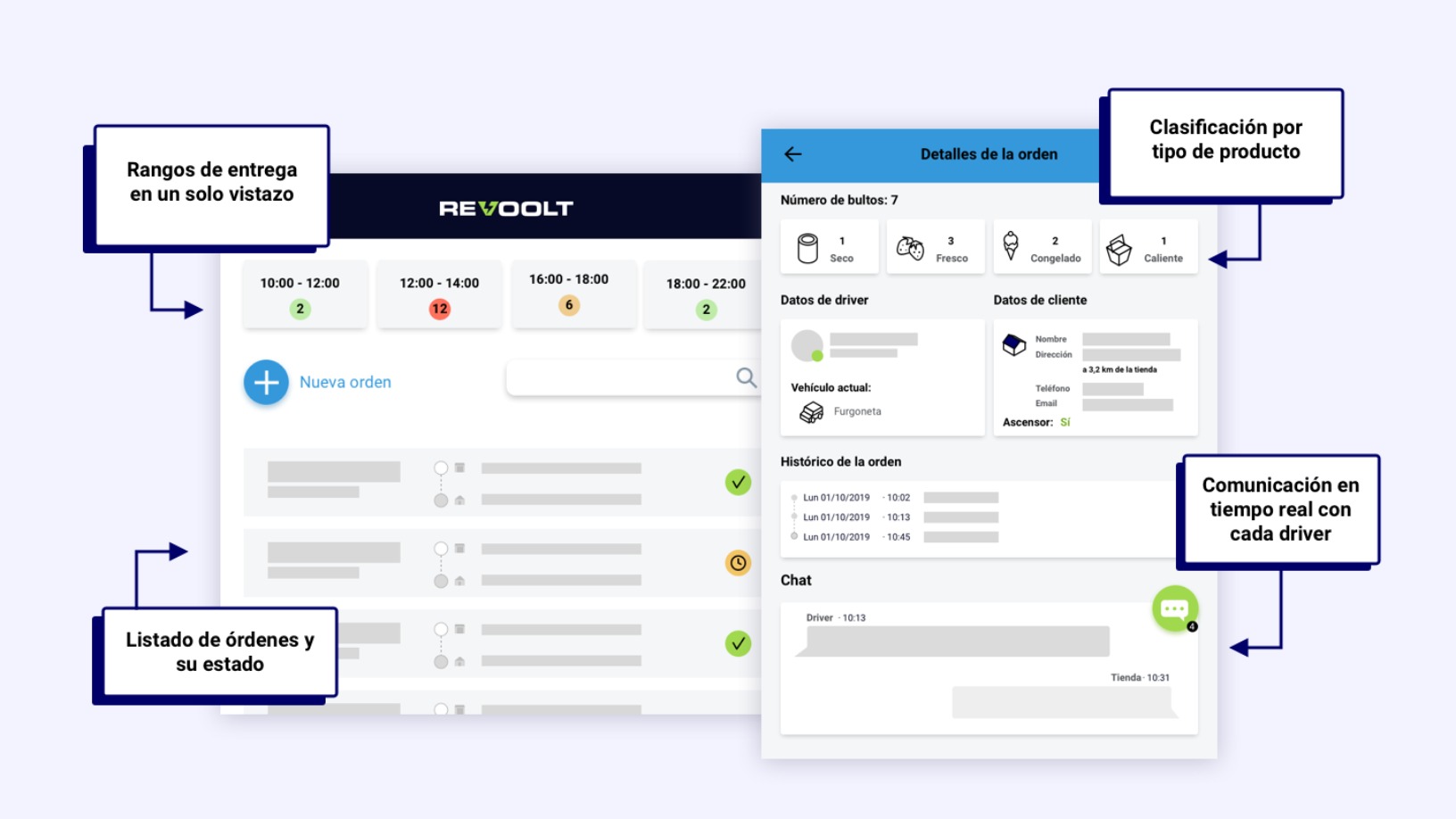

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Sorry, we couldn’t find any matches for“Straight Teeth Direct”.