social impact

-

DATABASE (234)

-

ARTICLES (395)

Founder and CEO of Spot

Roger Chen (Chen Ziling) went to the University of Chicago in 2013 to read Economics and Computer Science. But he dropped out one year later to become an entrepreneur and created the social app SketchMe in March 2015. He founded Shenzhen That Technology Co Ltd in July 2015. The company launched social app Remark in December 2015 and the Spot app in January 2018.

Roger Chen (Chen Ziling) went to the University of Chicago in 2013 to read Economics and Computer Science. But he dropped out one year later to become an entrepreneur and created the social app SketchMe in March 2015. He founded Shenzhen That Technology Co Ltd in July 2015. The company launched social app Remark in December 2015 and the Spot app in January 2018.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Engage Capital was set up by social media platform YY Inc.’s investment department. The equity fund invests primarily in TMT, entertainment and consumer products. Engage Capital manages a USD fund and an RMB fund.

Engage Capital was set up by social media platform YY Inc.’s investment department. The equity fund invests primarily in TMT, entertainment and consumer products. Engage Capital manages a USD fund and an RMB fund.

Co-founder and former CTO of GetSocial

Pedro Moura combines his knowledge of Computer Science and Sociology – the former as a graduate of the Instituto Superior Technico and the latter as a postgraduate of the University of Evora – in his line of work. Moura started his career co-founding several companies such as social shopping platform Wishareit and e-commerce social platform GetSocial, where he served as CTO. He is currently an adviser for the latter and is the CEO of mobile software platform Mobizy.

Pedro Moura combines his knowledge of Computer Science and Sociology – the former as a graduate of the Instituto Superior Technico and the latter as a postgraduate of the University of Evora – in his line of work. Moura started his career co-founding several companies such as social shopping platform Wishareit and e-commerce social platform GetSocial, where he served as CTO. He is currently an adviser for the latter and is the CEO of mobile software platform Mobizy.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Co-founder and CTO of Kerjabilitas

Tety Sianipar believes that technology can be used to solve social issues. Armed with a degree in Information Technology, she worked briefly as a game developer before moving to an international NGO. In 2014, she co-founded Saujana, a social enterprise focusing on disability issues and environmental conservation. Tety is also the CTO of Saujana that developed a job search platform for disabled people that was launched as Kerjabilitas a year later.

Tety Sianipar believes that technology can be used to solve social issues. Armed with a degree in Information Technology, she worked briefly as a game developer before moving to an international NGO. In 2014, she co-founded Saujana, a social enterprise focusing on disability issues and environmental conservation. Tety is also the CTO of Saujana that developed a job search platform for disabled people that was launched as Kerjabilitas a year later.

Co-founder of Shuaidanbao

Serial entrepreneur Lu Tong is co-founder of college social networking app Shixiongbangbangmang, microcredit processing platform Shuaidanbao and a luxury brand leasing venture.

Serial entrepreneur Lu Tong is co-founder of college social networking app Shixiongbangbangmang, microcredit processing platform Shuaidanbao and a luxury brand leasing venture.

Chairman and co-founder of Everimpact

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

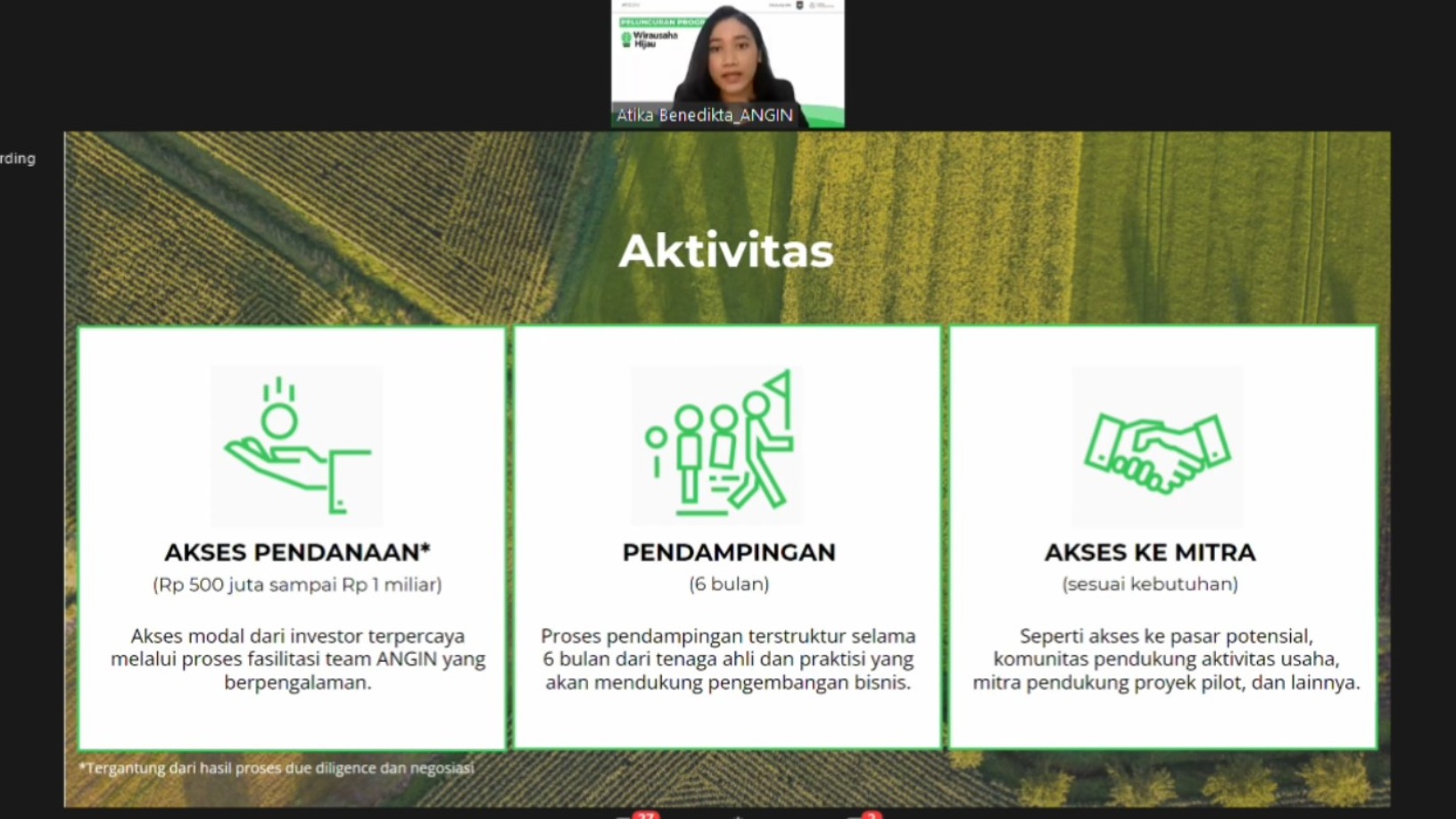

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

Co-founder and CEO of Kerjabilitas

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

Co-founder and CEO of 8villages

Sanny Gaddafi has been a technopreneur since graduating in 2004 from Universitas Bina Nusantara, Indonesia. He launched a social media platform FUPEI that offered local language options to Indonesian users. He also launched other social media ventures and eventually closed FUPEI in 2012. A chance meeting with French agronomist Mathieu Le Bras led to the development of an SMS-based information network for farmers and the creation of 8villages. Sanny became the CEO when Mathieu exited and moved to the UK.

Sanny Gaddafi has been a technopreneur since graduating in 2004 from Universitas Bina Nusantara, Indonesia. He launched a social media platform FUPEI that offered local language options to Indonesian users. He also launched other social media ventures and eventually closed FUPEI in 2012. A chance meeting with French agronomist Mathieu Le Bras led to the development of an SMS-based information network for farmers and the creation of 8villages. Sanny became the CEO when Mathieu exited and moved to the UK.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Civiclytics is a Covid-19 information crowdsourcing and sharing platform supported by the Inter-American Development Bank, as Citibeats reports increased demand for its data analytics and actionable insights

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

Citibeats, a social trends monitoring tool for governments and businesses, wins €1.4m funding

Citibeats tracks and analyzes what the public is saying online in any language; wants to boost its presence in LatAm and Asia

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Sorry, we couldn’t find any matches for“social impact”.