Virtual Reality

This function is exclusive for Premium subscribers

-

DATABASE (23)

-

ARTICLES (27)

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

- 1

- 2

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

ScentRealm: Digitally reproducing scents on demand

Unlike colors and sounds, scents are hard to code and digitalize. ScentRealm has not only done it, but has also opened its scent editor and database to the public

Thousands of Farmers: Creative subscription model to help farms sell seasonal produce

Just a few months old, Thousands of Farmers plans to add more entertaining features to its farm-to-table social commerce, attracting young consumers

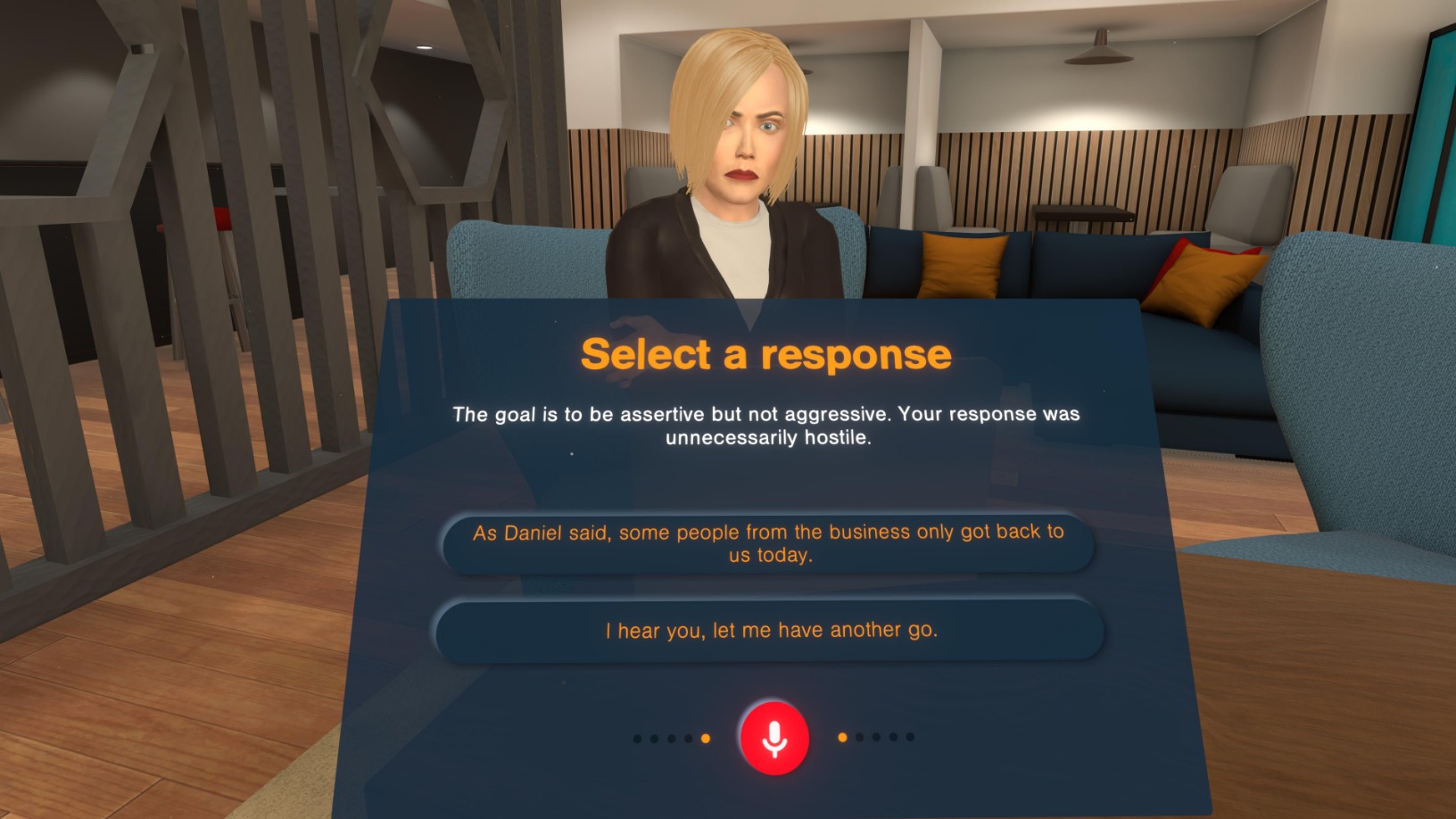

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

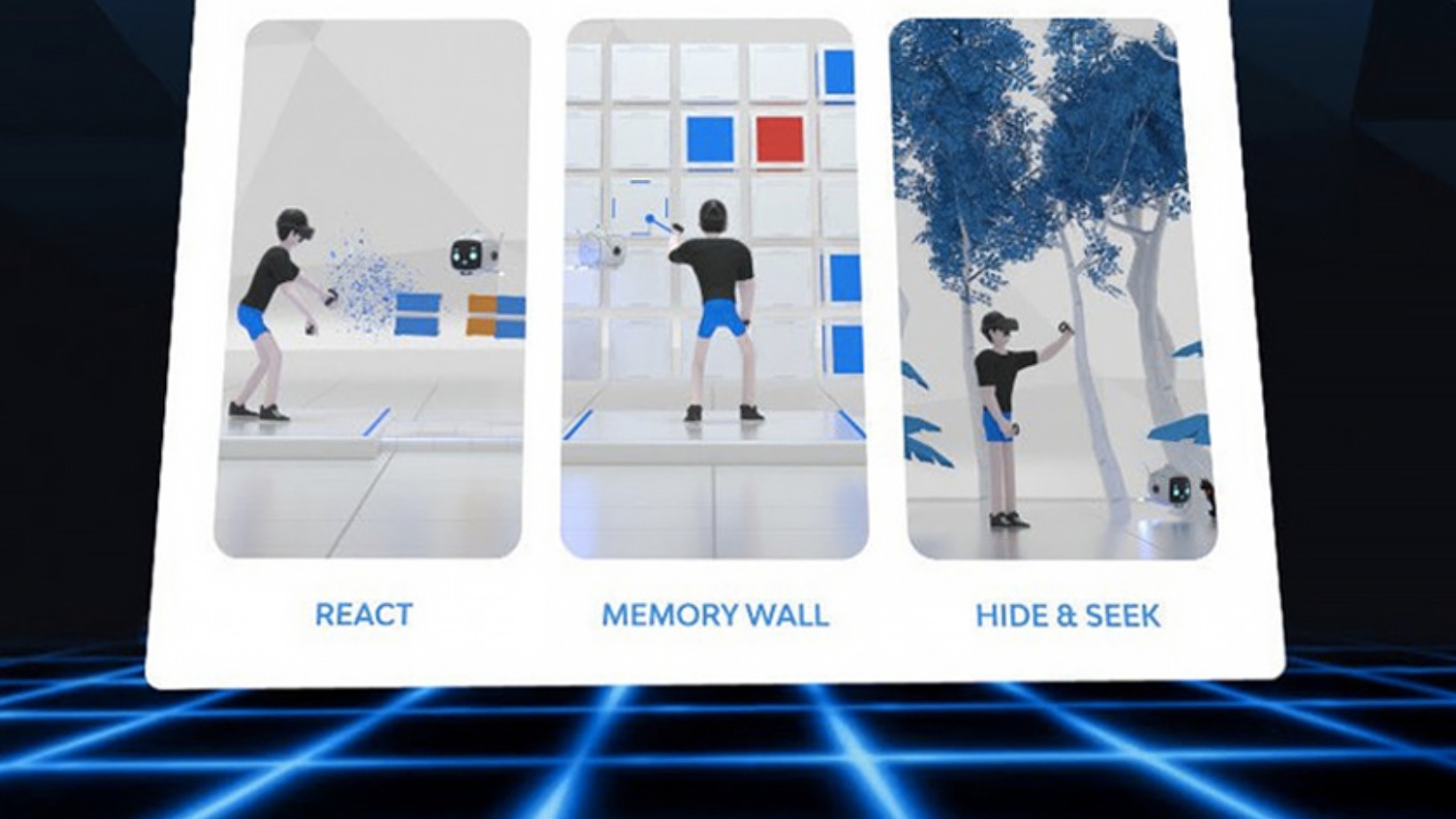

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Game developer Digital Happiness promotes Indonesia with its ghosts and ghouls

The Indonesian studio behind the popular horror game, DreadOut, recently released a sequel after its first game saw 2.5m downloads worldwide and raked in $7.5m, and was even made into a movie

Indonesia gaming and esports – Covid-19 brings increased interest but also challenges

Canceled industry events may have curtailed promotion and investment opportunities, but interest in gaming and esports has increased

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Gestoos: The future is in the present with gesture recognition tech for consumers

From spotting and alerting sleepy drivers in their cars to switching on a washing machine with the wave of a hand, Gestoos's gesture and behavior recognition tech has wide application across devices and industries

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

- 1

- 2

Search instead for portugal, b2b, hospitality