A*Star

-

DATABASE (997)

-

ARTICLES (811)

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

NYSE-listed TAL Education Group, which operates under the brand "Xueersi," is a leading K-12 after-school tutoring services provider in China.

NYSE-listed TAL Education Group, which operates under the brand "Xueersi," is a leading K-12 after-school tutoring services provider in China.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

Established in 2013, ZP Capital is a venture capital fund. It invests mainly in companies in the internet and consumer technology sectors.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

Softbank-Indosat Fund (SB-ISAT Fund)

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

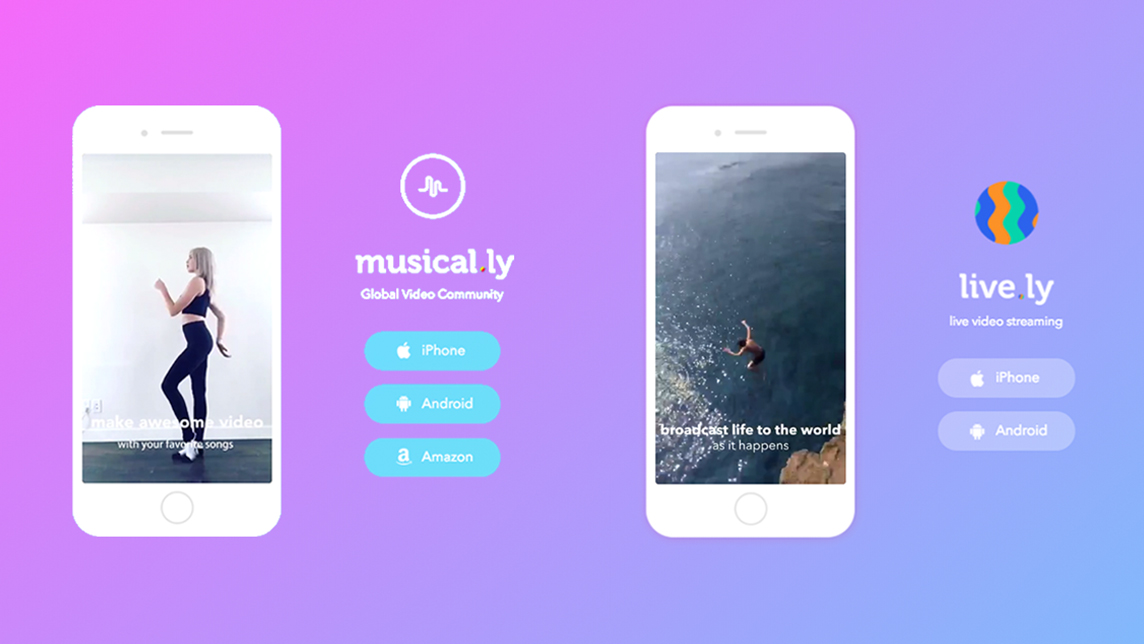

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.