Active%20Venture%20Partners

-

DATABASE (62)

-

ARTICLES (117)

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Sandeep Tandon is a serial entrepreneur and investor, with a bachelor’s and a master’s in Electrical Engineering from the University of Southern California, USA. He is currently the managing director of Tandon Technology Ventures, part of Sandeep’s Tandon Group that is based in San Jose in California. He also co-founded Freecharge that was recently sold to Paytm, an e-commerce brand owned by India’s mobile internet company One97 Communications. Sandeep is an active angel investor and mentor, with personal investments in 15 startups including a first Series A funding of US$ 4.5 million in Unacademy in January 2017.

Sandeep Tandon is a serial entrepreneur and investor, with a bachelor’s and a master’s in Electrical Engineering from the University of Southern California, USA. He is currently the managing director of Tandon Technology Ventures, part of Sandeep’s Tandon Group that is based in San Jose in California. He also co-founded Freecharge that was recently sold to Paytm, an e-commerce brand owned by India’s mobile internet company One97 Communications. Sandeep is an active angel investor and mentor, with personal investments in 15 startups including a first Series A funding of US$ 4.5 million in Unacademy in January 2017.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

In September 2003, Chen Weixing started studying at the College of Civil Engineering and Architecture, Zhejiang University. The civil engineer founded the web game developer FunCity Inc during his third college year in August 2006. In June 2012, he launched the taxi app Kuaidadi in Hangzhou. In September 2012, he invested in Hangzhou Enniu Network Technology Co Ltd, the parent company of 51 Credit Card Manager, China's largest credit card service based on monthly active users. He also founded online insurance company Weiease Technology in April 2014. In May 2018, he launched the blockchain-based taxi app VV Share.

In September 2003, Chen Weixing started studying at the College of Civil Engineering and Architecture, Zhejiang University. The civil engineer founded the web game developer FunCity Inc during his third college year in August 2006. In June 2012, he launched the taxi app Kuaidadi in Hangzhou. In September 2012, he invested in Hangzhou Enniu Network Technology Co Ltd, the parent company of 51 Credit Card Manager, China's largest credit card service based on monthly active users. He also founded online insurance company Weiease Technology in April 2014. In May 2018, he launched the blockchain-based taxi app VV Share.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

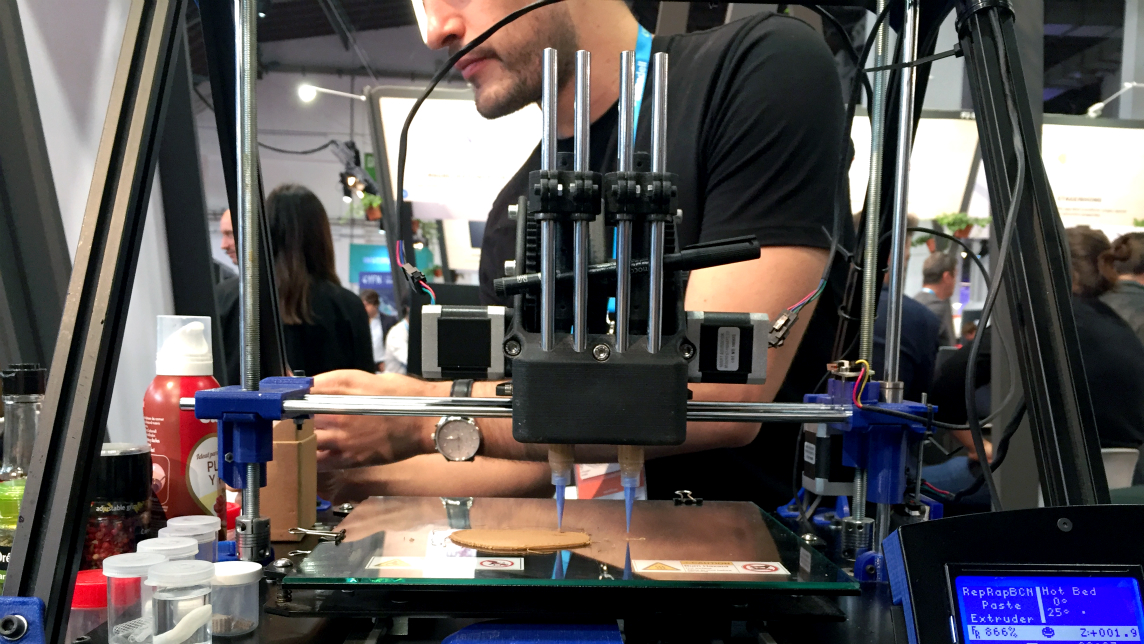

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Yimutian: China agriculture e-commerce's comeback kid

As the world’s most populous country faces potential food supply shortages, Yimutian, China’s No. 1 agro trading marketplace, is seeing more opportunities

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Lesielle: Award-winning personalized cosmetics that adapt to changing skincare needs

This Spanish AI-powered device combines with a mobile app to track the daily condition of your skin and tailor-make cosmetics for each customer

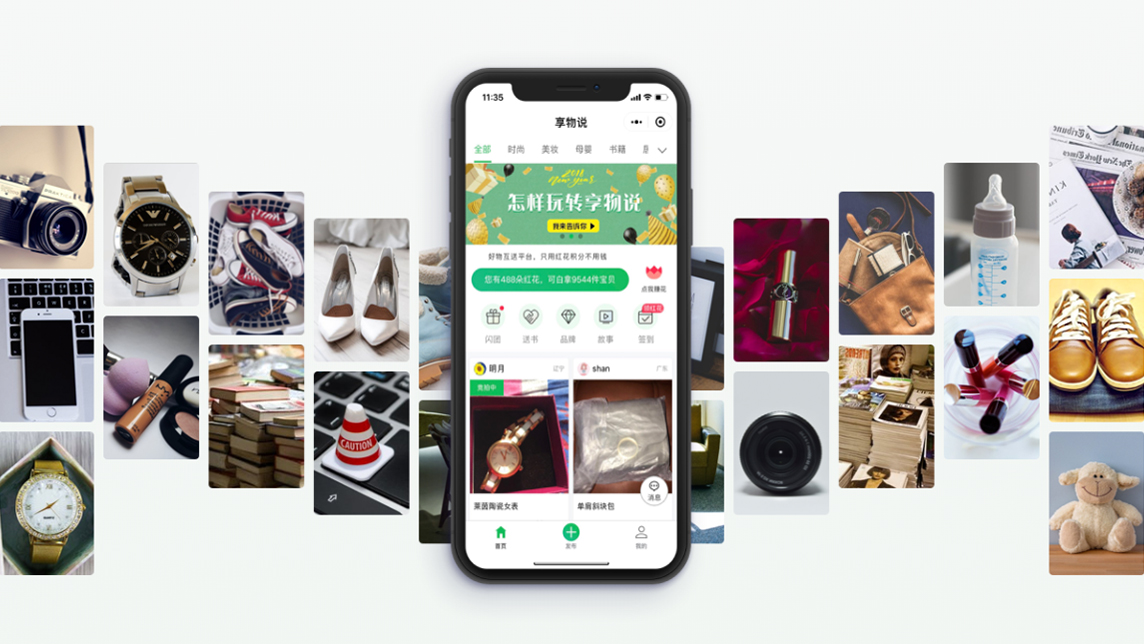

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

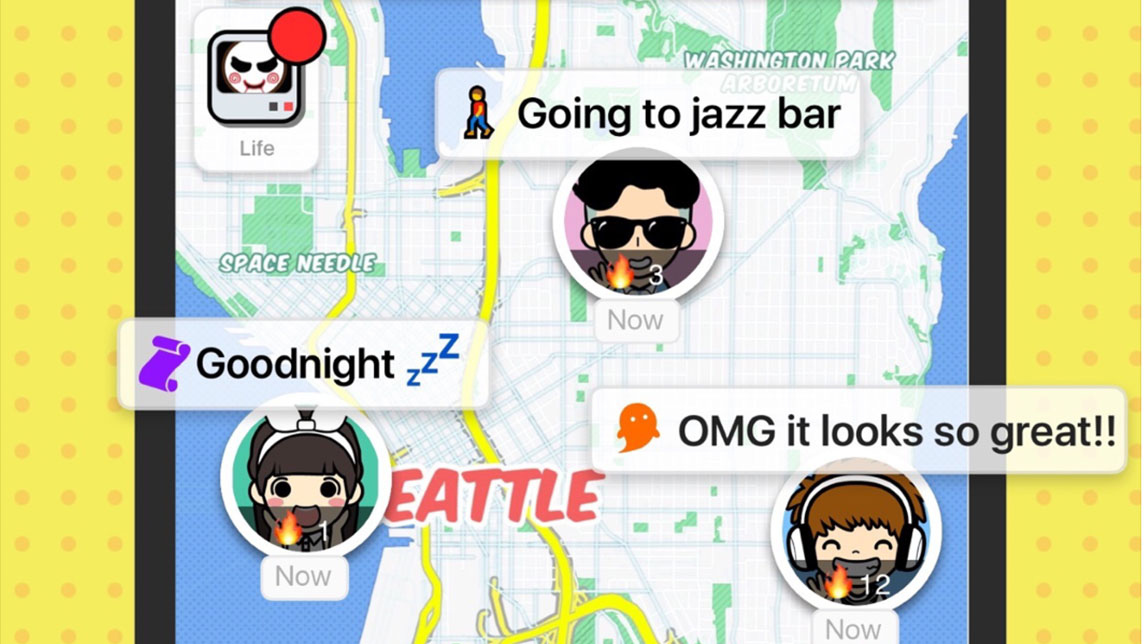

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

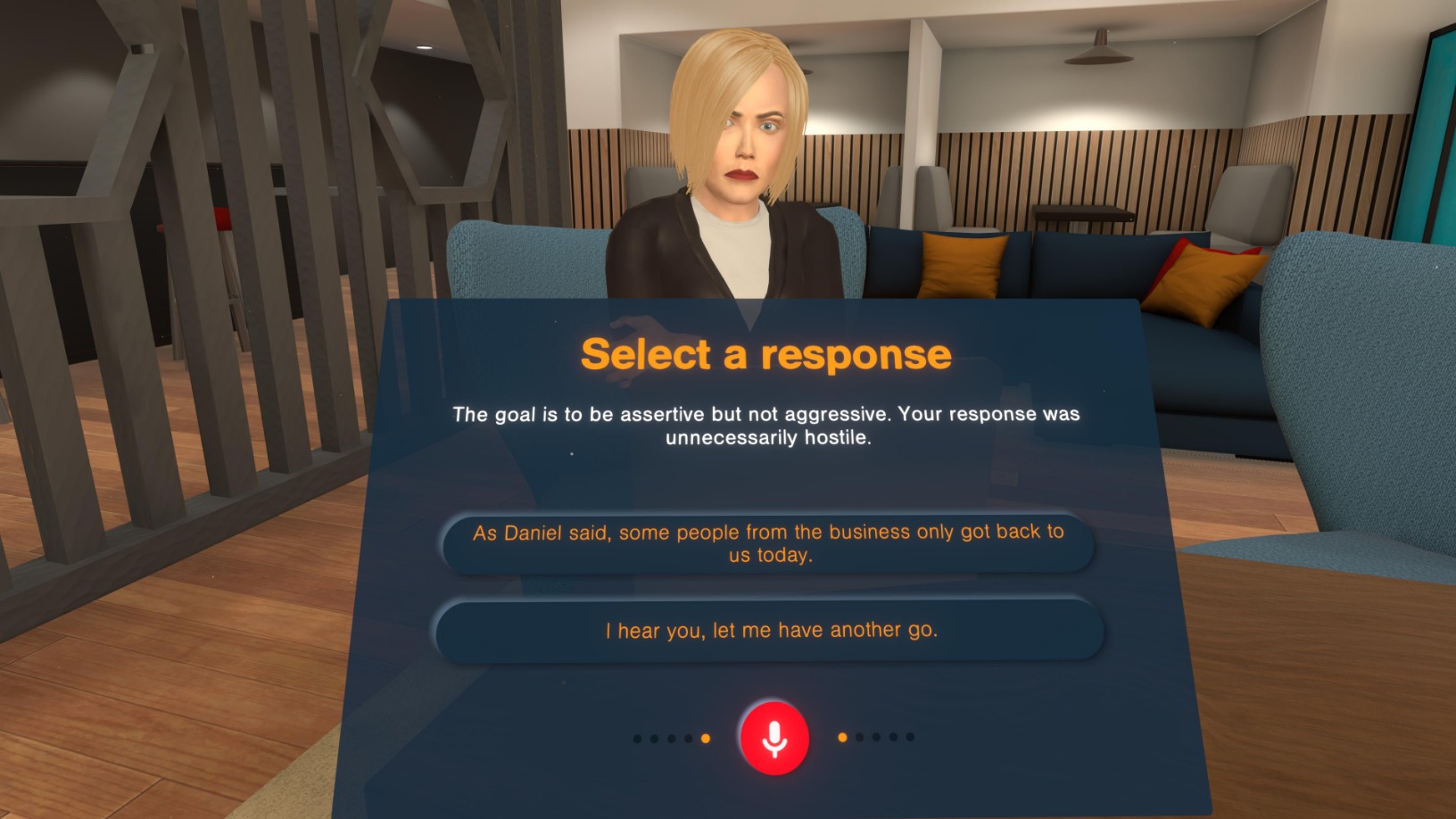

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Zhang Tong Jia Yuan is working to narrow the regional education gap in China

This startup started with the objective of relieving parental concerns about child safety in kindergarten but has since set its sights much higher

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

Unicorn Xiaohongshu refines social commerce model after stumble, as bigger players jostle in

Once the epitome of China's O2O social commerce success, Xiaohongshu (RED) tries to reinvent itself amid challenges from internet giants, influencers and short videos

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Zhang Yiming: The man who said no to Baidu, Alibaba and Tencent

Rejecting offers from BAT to grow ByteDance, Zhang Yiming has quickly built up a social media content empire that includes TikTok and Toutiao, challenging the incumbents

Sorry, we couldn’t find any matches for“Active%20Venture%20Partners”.