Filinvest Development Corporation (FDC)

-

DATABASE (448)

-

ARTICLES (398)

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Adidas is a German multinational corporation manufacturing shoes, clothing and accessories. It is the largest sportswear manufacturer in Europe, and the second-largest in the world, after Nike. The Adidas brand is part of the Adidas Group which also includes Reebok sportswear company, a 8.33% stake in football club Bayern München and also has interest in Runtastic, an Austrian fitness technology company. Total revenue exceeded €21bn in 2018.

Adidas is a German multinational corporation manufacturing shoes, clothing and accessories. It is the largest sportswear manufacturer in Europe, and the second-largest in the world, after Nike. The Adidas brand is part of the Adidas Group which also includes Reebok sportswear company, a 8.33% stake in football club Bayern München and also has interest in Runtastic, an Austrian fitness technology company. Total revenue exceeded €21bn in 2018.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

Shanghai Zhangjiang Haocheng Venture Capital Co., Ltd. (Zhangjiang Haocheng) was founded in 2007 as a wholly-owned subsidiary of listed real estate developer Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. It has invested RMB 2.5 billion in high-tech startups.

COO and co-founder of Because Animals

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

CAS Investment Management Co., Ltd.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

Kim Jung is a South Korean businessman and the man behind Nexon, Korea's largest gaming company. He is Chairman and CEO of NXC Corporation, Nexon’s holding company. NXC diversified into cryptocurrency and holds 83% of Korbit, a Seoul-based exchange.In 2016, Kim was accused of bribery, having favoured a prosecutor who was his university friend. Although he was found not guilty due to lack of evidence, Kim resigned as a director of Nexon.Kim is also partner at Collaborative Fund, a New York-based VC firm.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Security Trading Oy is a Finnish investment company located in Helsinki generating a turnover of $125m in sales. The firm recently invested in the biotech material startup Infinited Fiber, along with Adidas and Invest FWD A/S, which is BESTSELLER’s investment arm for sustainable fashion. Security Trading Oy was part of the Kone Corporation group that was re-organized by the Herlin family, with Antti Herlin as the controlling shareholder in 2005.

Security Trading Oy is a Finnish investment company located in Helsinki generating a turnover of $125m in sales. The firm recently invested in the biotech material startup Infinited Fiber, along with Adidas and Invest FWD A/S, which is BESTSELLER’s investment arm for sustainable fashion. Security Trading Oy was part of the Kone Corporation group that was re-organized by the Herlin family, with Antti Herlin as the controlling shareholder in 2005.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM)

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Navarre-based Orizont is a Spanish accelerator that invests in its accelerated companies at the pre-seed and seed stages. It invests in agritech and local startups. Established in 2015, Orizont is managed by Sodena, the development agency of the Navarre Autonomous Community. It has accelerated 22 companies to date.

Navarre-based Orizont is a Spanish accelerator that invests in its accelerated companies at the pre-seed and seed stages. It invests in agritech and local startups. Established in 2015, Orizont is managed by Sodena, the development agency of the Navarre Autonomous Community. It has accelerated 22 companies to date.

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Teliman: Driver-centered mobility model assisting Malian development

The startup addresses a basic necessity with its on-demand ride-hailing services while supporting the personal and economic progress of its drivers, including empowering women

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Smart Bees wants to capitalize on China's two-children policy

High property prices fuel demand for Smart Bees' bespoke smart tech-equipped furniture that maximizes living spaces for families and young homeowners

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

SOURCE Global's solar-run panels turn air into drinking water

The US startup’s adapted solar panels extract water vapor from the air to produce potable water, a vital resource for distressed communities in disaster zones and remote areas

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

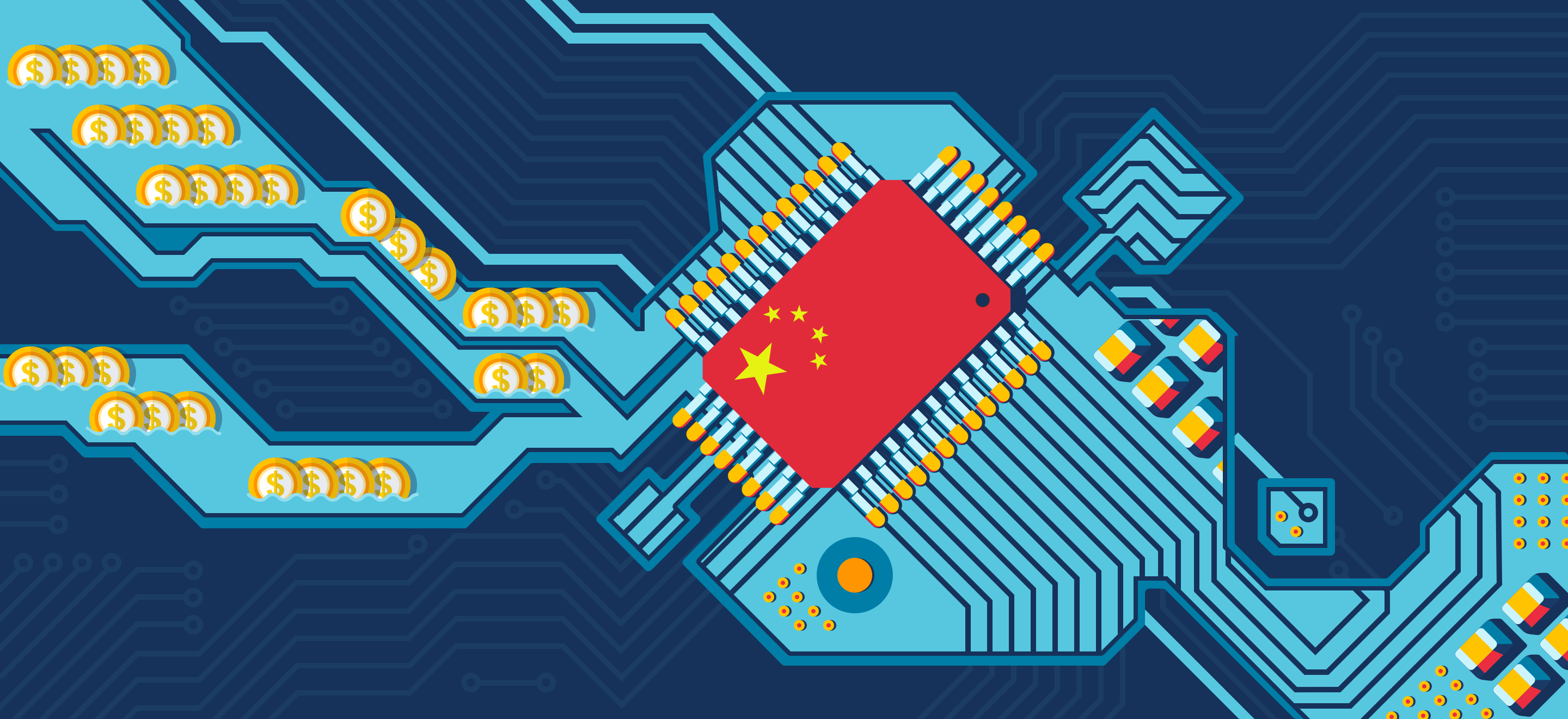

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

Sorry, we couldn’t find any matches for“Filinvest Development Corporation (FDC)”.