Origin of the Buddha Head

-

DATABASE (995)

-

ARTICLES (811)

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

Media professionals and amateurs can upload a text file onto Zen Video's cloud platform to generate a video clip and further edit it online.

Media professionals and amateurs can upload a text file onto Zen Video's cloud platform to generate a video clip and further edit it online.

Beyond clever marketing, Kopi Kenangan offers affordable quality coffee for Indonesian tastes; with 300+ outlets in 3 years and profitable, Southeast Asia expansion is next.

Beyond clever marketing, Kopi Kenangan offers affordable quality coffee for Indonesian tastes; with 300+ outlets in 3 years and profitable, Southeast Asia expansion is next.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2010, Jumei is one of the world’s leading online cosmetics shopping platforms. With over 30 million registered users, Jumei’s monthly sales have exceeded RMB 600 million and it is now one of the fastest growing e-commerce companies in China.

Founded in 2010, Jumei is one of the world’s leading online cosmetics shopping platforms. With over 30 million registered users, Jumei’s monthly sales have exceeded RMB 600 million and it is now one of the fastest growing e-commerce companies in China.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

China Minsheng Investment Group

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

Rolf Schrömgens is best known as the CEO and co-founder of travel marketplace Trivago, where he has worked since 2006. The German entrepreneur is also a prolific early-stage investor.His most recent investments include participation in the €1.15m seed round of fintech StudentFinance and €8m Series A funding for German biotech innes.

Rolf Schrömgens is best known as the CEO and co-founder of travel marketplace Trivago, where he has worked since 2006. The German entrepreneur is also a prolific early-stage investor.His most recent investments include participation in the €1.15m seed round of fintech StudentFinance and €8m Series A funding for German biotech innes.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

China new retail: A blend of the best of online and offline shopping

Players big and small are contributing to China’s new retail revolution

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

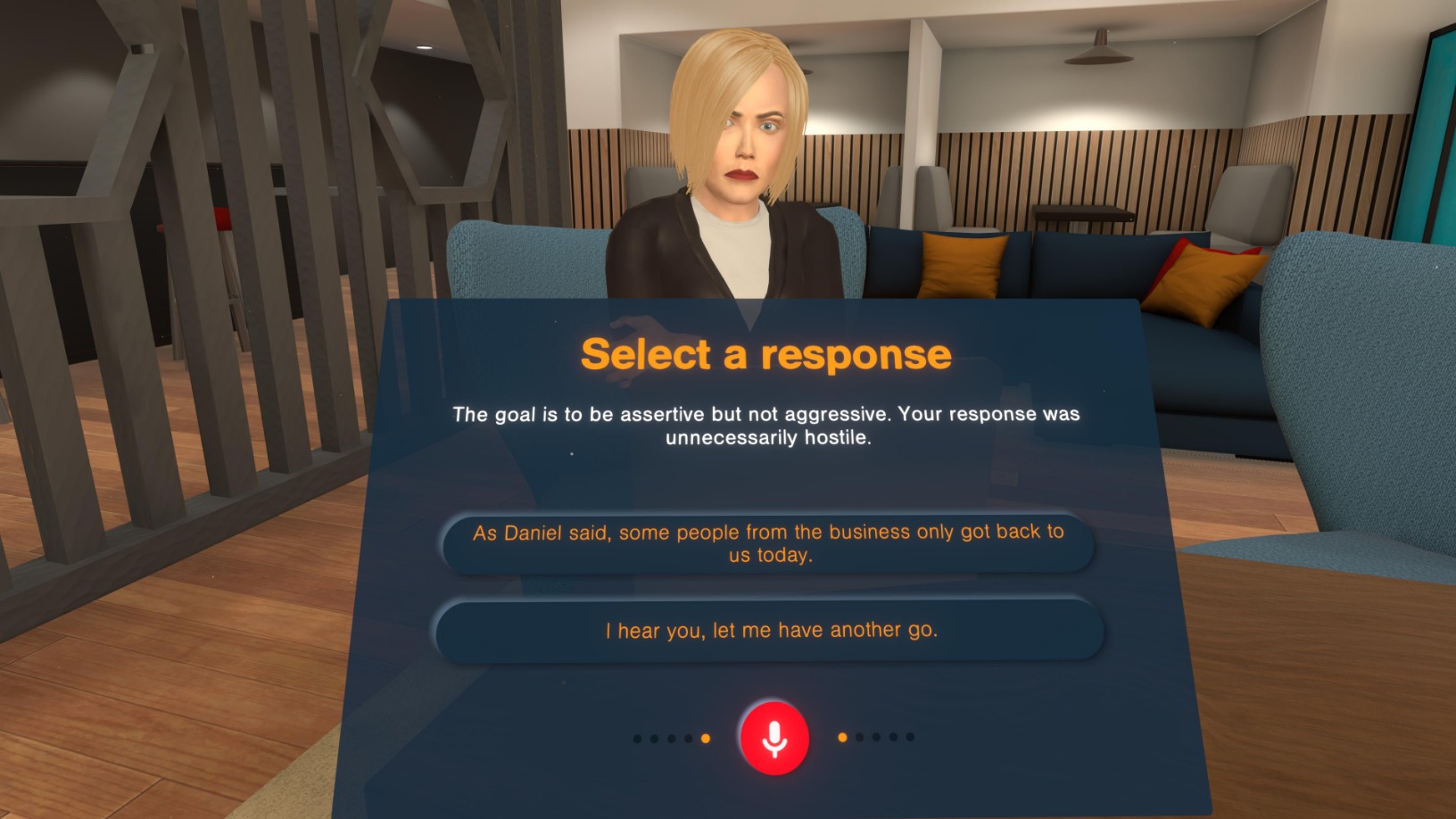

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Founder and CEO Gao Lufeng on Ninebot's acquisition of American motorized scooter maker Segway, China’s rise in technology and innovation, and the company’s plans for the US market

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Indonesian esports team RRQ dreams of being "the king of kings"

The Jakarta team is growing its brand with collaborations and its academy, expects more esports interest amid Covid-19 home confinements

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Sorry, we couldn’t find any matches for“Origin of the Buddha Head”.