from

-

DATABASE (992)

-

ARTICLES (802)

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

China’s first wardrobe-leasing app for women – the largest in Asia – allows customers to rent designer pieces from more than 500 high-end brands.

China’s first wardrobe-leasing app for women – the largest in Asia – allows customers to rent designer pieces from more than 500 high-end brands.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

Apostolos Apostolakis is a serial entrepreneur turned investor. He has a Civil Engineering degree from NTUA and an MBA from Columbia Business School. His entrepreneurial career started after working two years as a consultant for the Boston Consulting Group until 2004. He became a co-founder and board member of various companies including VentureFriends, InstaShop, Douleutaras.gr, e-food.gr, Doctoranytime.gr and Blueground (formerly Openfund and Taxibeat). In 2010, he started investing in other startups, focusing on e-marketplaces and SaaS.

Apostolos Apostolakis is a serial entrepreneur turned investor. He has a Civil Engineering degree from NTUA and an MBA from Columbia Business School. His entrepreneurial career started after working two years as a consultant for the Boston Consulting Group until 2004. He became a co-founder and board member of various companies including VentureFriends, InstaShop, Douleutaras.gr, e-food.gr, Doctoranytime.gr and Blueground (formerly Openfund and Taxibeat). In 2010, he started investing in other startups, focusing on e-marketplaces and SaaS.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

One of the largest institutional investors, GIC is a sovereign wealth fund managed by the Singapore government. With over US$100 billion under management, GIC invests in companies from over 40 countries.

#WahyooChallenge: From charity to publicity

Inspired by social media trends, the Wahyoo team came up with a way to give back to society, and found their idea going viral

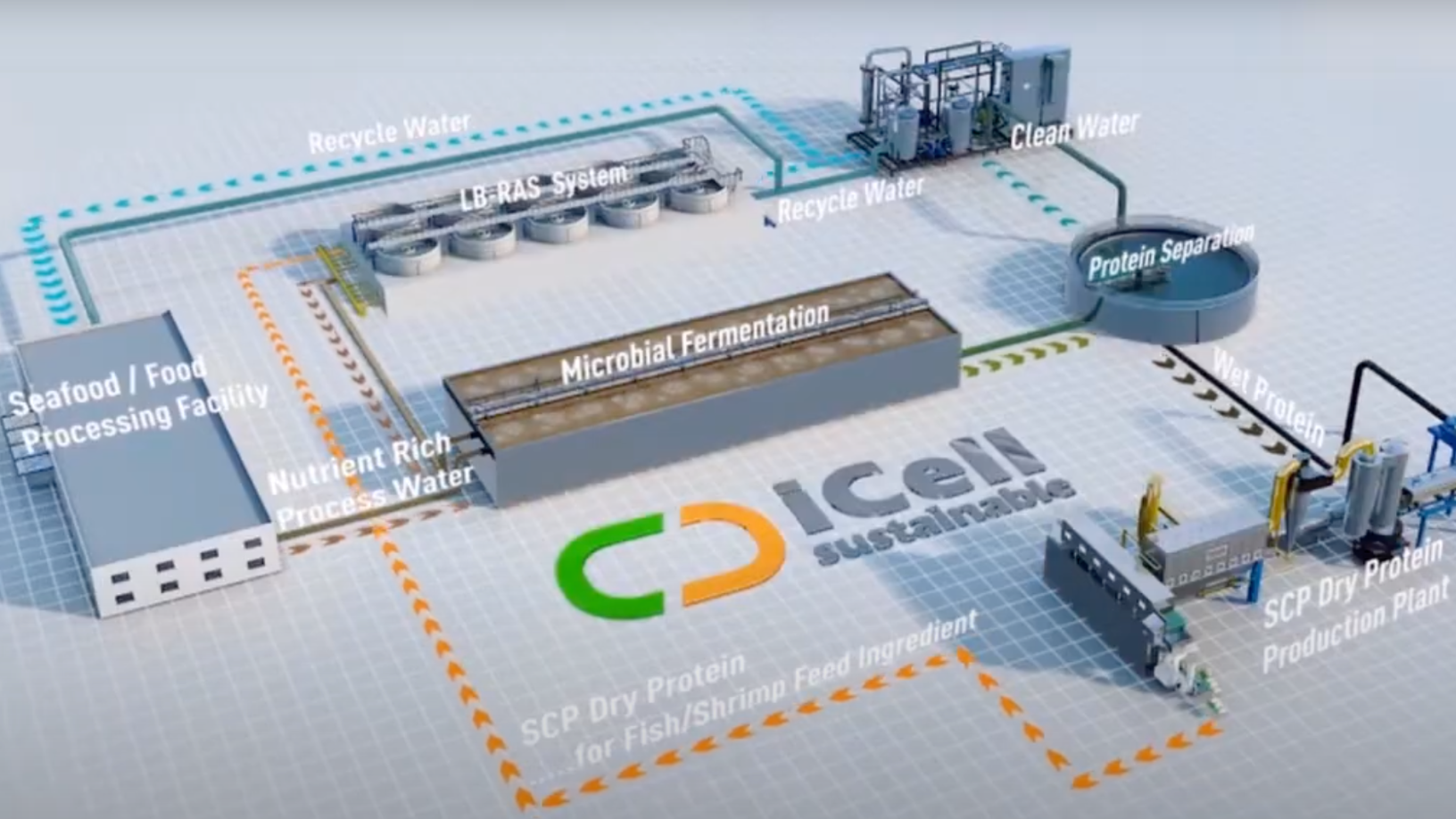

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

TOPDOX relaunched: from consumer to corporate

Half a million users later, productivity software startup TOPDOX made the jump to B2B. Its co-founder and CEO, Nelson Pereira, tells us why

Sophie's Bionutrients: Alternative protein from microalgae

Inspired by fish in the ocean, the startup developed microalgae-based flour that can take on unlimited forms, textures or colors to make almost any alt protein product

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Graviky Labs: Sustainable ink made from air pollution

Conceptualized at MIT and named among the Best Inventions of 2019 by TIME Magazine, Graviky Labs’ carbon-negative ink is made from upcycled emissions captured with a proprietary device

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

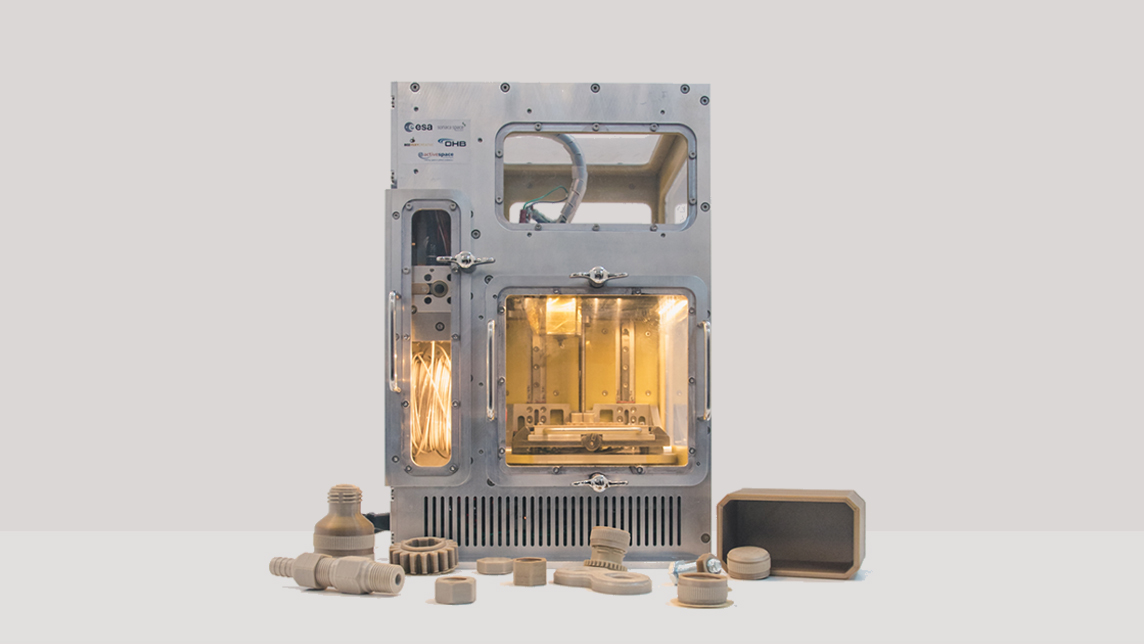

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Pahamify: From YouTube success to new popular edtech app

Created by ex-PhD students, Pahamify combines the scientific approach with animation and games to bring back the excitement of discovery in learning

eFishery poised to benefit from Indonesia's growing aquaculture sector

eFishery's IoT automatic feeding system is delivering efficiencies and boosting output for small fish farmers, driving strong growth for the aquaculture startup.

From Porto to Phnom Penh: Last2Ticket expands to Asia

Their first stop is Cambodia, where tourism-related ticketing is big business yet underserved by technology. Emilía Simões, founder and CEO of the Portuguese e-ticketing startup, tells us more

Choose from over 10,000 mental health therapists at Yidianling

Startup's 24/7 services will include AI-powered chatbots to help more Chinese cope with mental health issues, amid lack of therapists

Sorry, we couldn’t find any matches for“from”.