Australia

-

DATABASE (50)

-

ARTICLES (51)

VP, CMO and co-founder of XAG

Justin Gong graduated in business information systems at the University of Sydney Business School in 2010. He also has a master’s degree from Sydney Film School and Top Education Institute in Australia.While working at XAG, he attended a doctorate program jointly launched by Paris Dauphine University and Tsinghua University from 2017 to 2020. Gong joined XAG in September 2013, responsible for corporate strategy, overseas expansion and marketing.In October 2016, he founded XAIRCRAFT Academy to educate a new generation of farmers by providing them with online courses and offline training. In 2018, Gong was named in the Forbes China “30 Under 30” list. He now serves as VP and CMO at XAG.

Justin Gong graduated in business information systems at the University of Sydney Business School in 2010. He also has a master’s degree from Sydney Film School and Top Education Institute in Australia.While working at XAG, he attended a doctorate program jointly launched by Paris Dauphine University and Tsinghua University from 2017 to 2020. Gong joined XAG in September 2013, responsible for corporate strategy, overseas expansion and marketing.In October 2016, he founded XAIRCRAFT Academy to educate a new generation of farmers by providing them with online courses and offline training. In 2018, Gong was named in the Forbes China “30 Under 30” list. He now serves as VP and CMO at XAG.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

CEO and co-founder of Refurbed

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

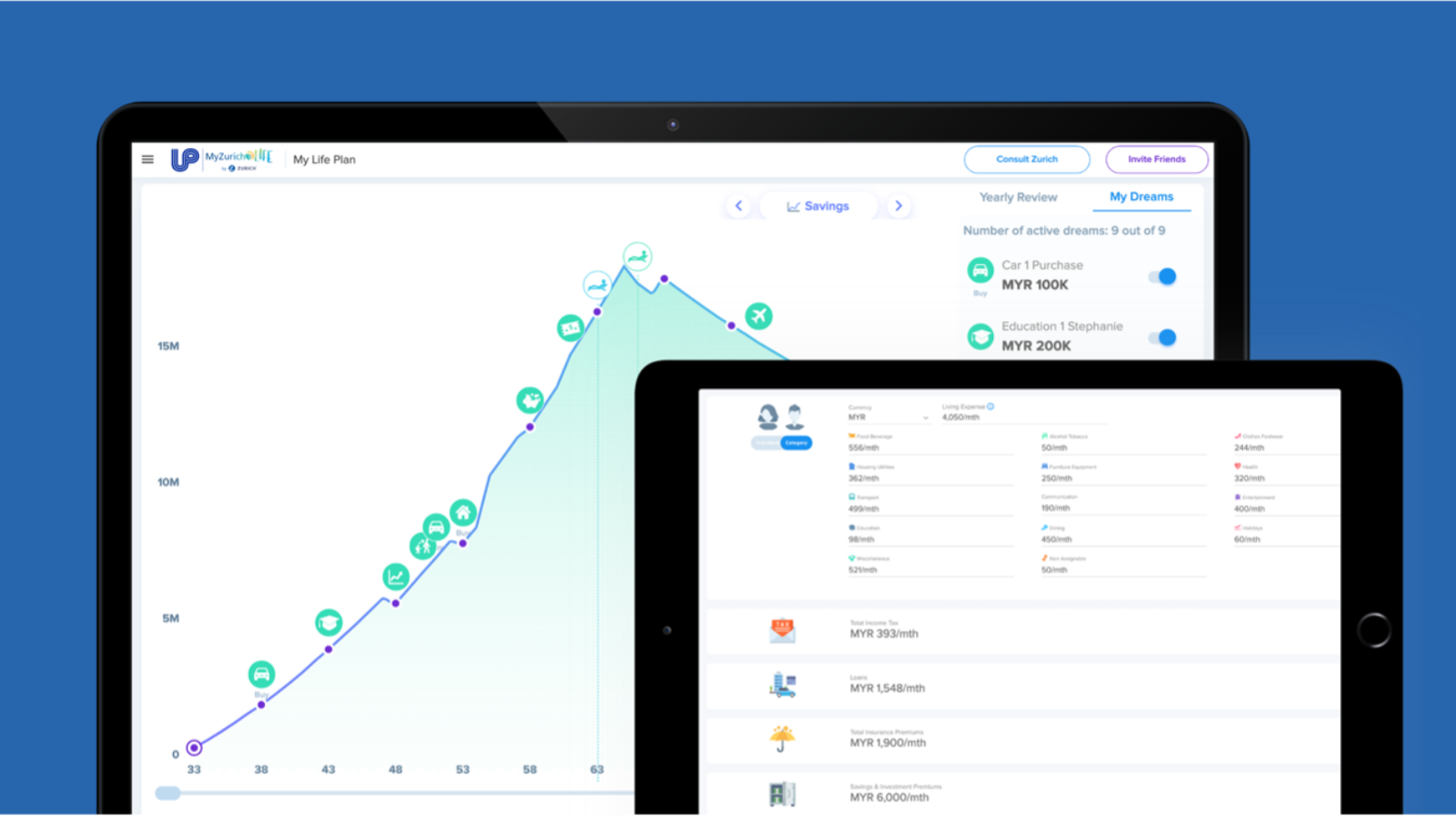

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Switch Automation: On-demand, data-driven building management

The Denver-based company kicked off operations in Singapore last year, intends to use the city-state as a spring board to expand in the Asia Pacific

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Inspired by kangaroos, ProAgni wants to wean the livestock farming industry off antibiotics

Australia’s ProAgni is making grain-feed supplements to improve livestock growth, negate antibiotic use and even reduce methane emissions, all based on kangaroo gut health research

Bringing Indonesia's research to the world: Interview with Anton Lucanus, Neliti CEO

The former biologist talks about online repositories and his vision for improving Indonesia's research culture

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Ambit Robotics: Automated crop spraying for Southeast Asia's smallholder farmers

Small, affordable crop-spraying robots can help farmers save on labor costs and protect humans from exposure to harmful chemicals

Sorry, we couldn’t find any matches for“Australia”.