C2C-New Cap

-

DATABASE (397)

-

ARTICLES (697)

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

Co-founder and CEO of Orange 100

Prior to co-founding Orange 100, Leng ran a company that provided creative PR ideas to shopping malls. He also worked for Baidu's C2C e-commerce platform youa.com, which was subsequently integrated into leho.com. Leng has significant experience in business operations, marketing, sales and business development.

Prior to co-founding Orange 100, Leng ran a company that provided creative PR ideas to shopping malls. He also worked for Baidu's C2C e-commerce platform youa.com, which was subsequently integrated into leho.com. Leng has significant experience in business operations, marketing, sales and business development.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Co-founder of DuduBus

Ouyang Fujin graduated in 2012 with a bachelor's degree in Software Engineering from Guangdong University of Foreign Studies. Upon graduation, he worked for Tencent till 2015 on open.qq.com's Midas, a charging system for mobile game apps. In 2015, he co-founded DuduBus. In 2018, he co-founded CSC, a C2C car sharing platform using blockchain technology.

Ouyang Fujin graduated in 2012 with a bachelor's degree in Software Engineering from Guangdong University of Foreign Studies. Upon graduation, he worked for Tencent till 2015 on open.qq.com's Midas, a charging system for mobile game apps. In 2015, he co-founded DuduBus. In 2018, he co-founded CSC, a C2C car sharing platform using blockchain technology.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

Co-founder of ATRenew (formerly Aihuishou)

Sun Wenjun graduated from Fudan University with a master’s degree in Computer Science. He worked as a research fellow at his alma mater, where he met his future business partner, Chen Xuefeng. After graduating, he worked at Sykes Enterprises as director of technology solutions, drawing an annual salary of RMB1 million. Sun later left his full-time job to co-found customer-to-customer (C2C) second-hand goods trading platform Leyi with Chen in 2010. When that business failed, they co-founded Aihuishou.

Sun Wenjun graduated from Fudan University with a master’s degree in Computer Science. He worked as a research fellow at his alma mater, where he met his future business partner, Chen Xuefeng. After graduating, he worked at Sykes Enterprises as director of technology solutions, drawing an annual salary of RMB1 million. Sun later left his full-time job to co-found customer-to-customer (C2C) second-hand goods trading platform Leyi with Chen in 2010. When that business failed, they co-founded Aihuishou.

CEO and founder of ATRenew (formerly Aihuishou)

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

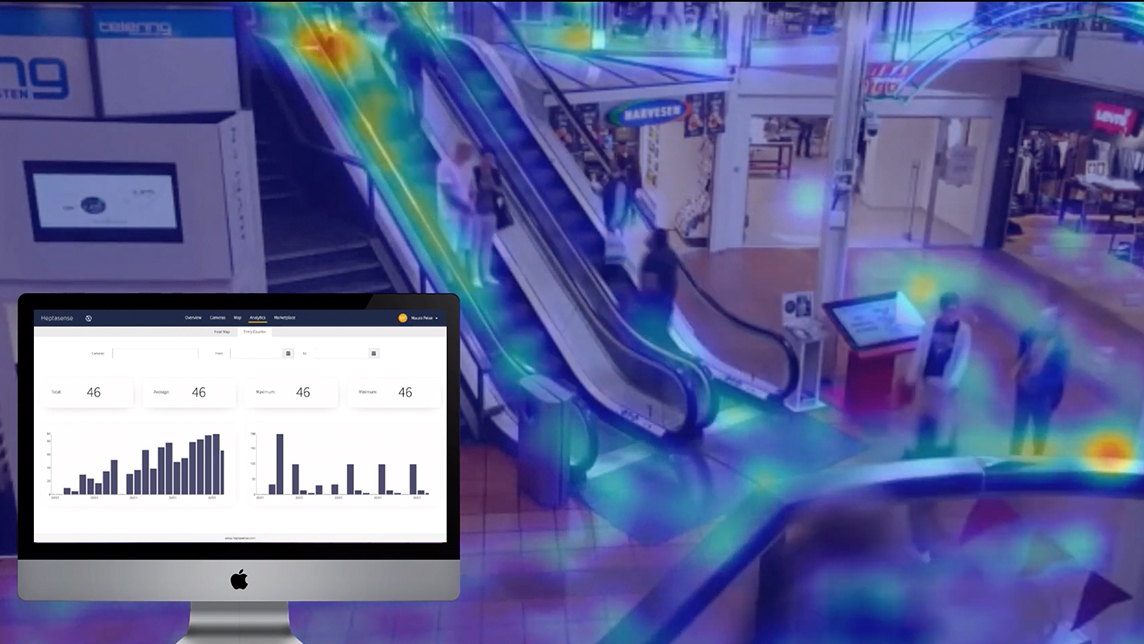

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Zhang Yiming: The man who said no to Baidu, Alibaba and Tencent

Rejecting offers from BAT to grow ByteDance, Zhang Yiming has quickly built up a social media content empire that includes TikTok and Toutiao, challenging the incumbents

Startups join the fight in China's coronavirus crisis

Chinese startups have discovered their technologies can play a major role in the nationwide efforts to battle the coronavirus epidemic

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Xuebacoming: Promising edtech had compliance issues from day one

Other hefty mistakes also contributed to Xuebacoming's demise – proof that investor and media support, and a booming market, won't guarantee success

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

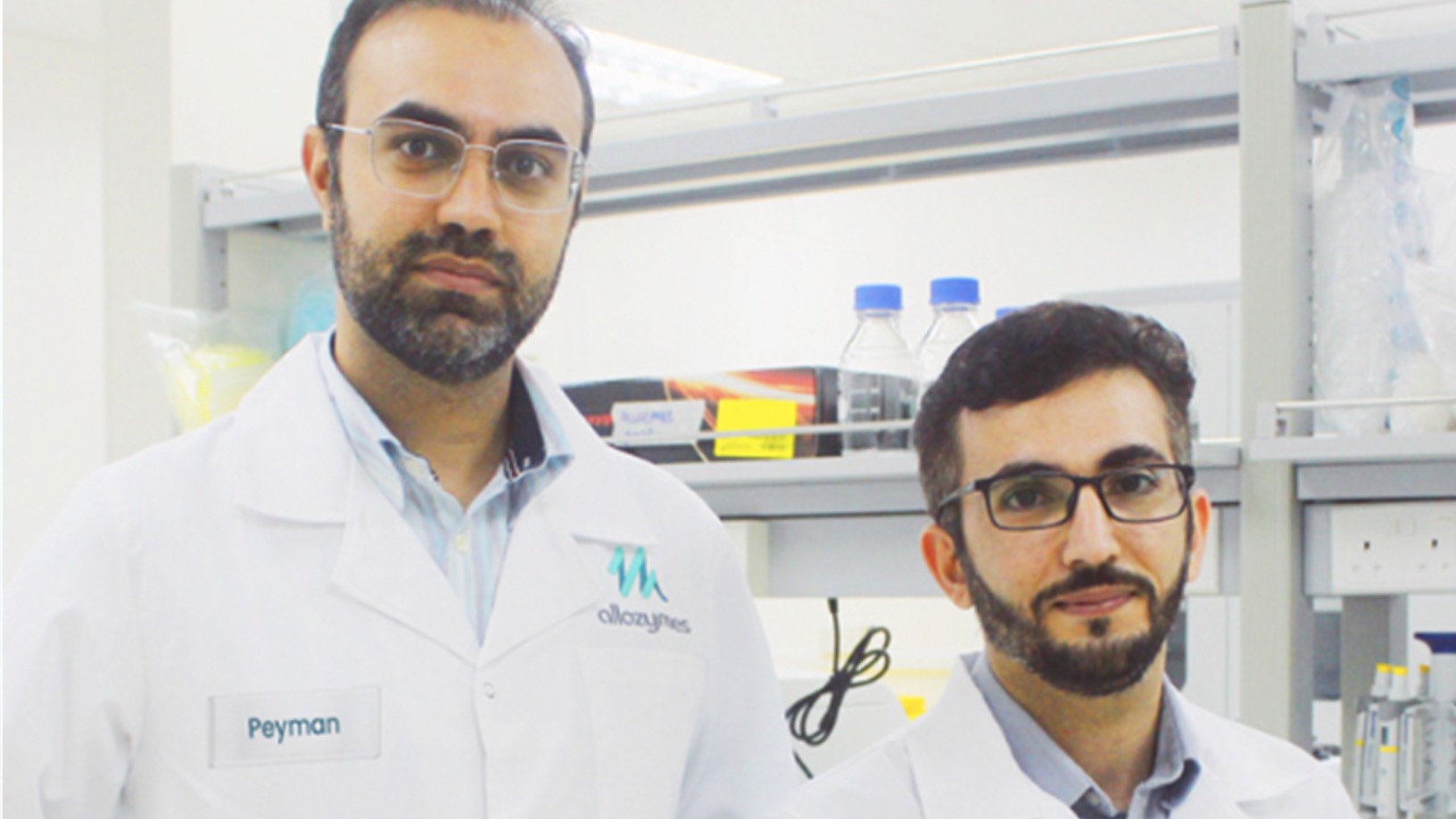

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

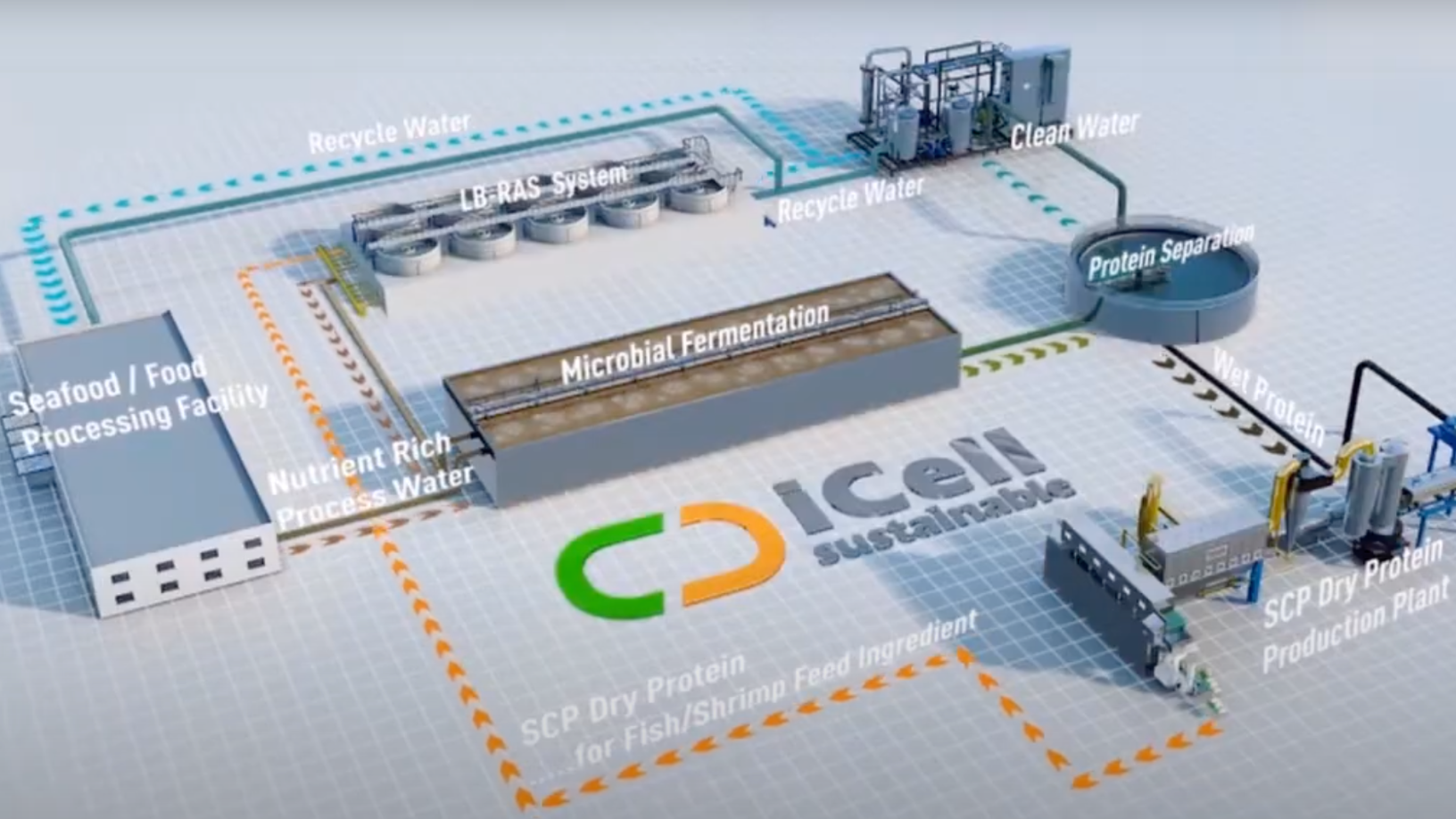

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Wahyoo wins seed funding in push to upgrade Indonesia's street food sector

It's launching a B2C app and an integrated POS system in 2019 to boost street food sales and hawkers' productivity, CEO Peter Shearer tells CompassList

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Sorry, we couldn’t find any matches for“C2C-New Cap”.