Draper Venture Network

-

DATABASE (580)

-

ARTICLES (337)

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

Co-Founder of Qraved

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Founded by Mark Mai and Tim Draper in 2005, VenturesLab is the first internet-business incubator in China. To date it has incubated and invested in about 100 internet-related companies including Mr Food, Yunchou, Yuanchuangpai, Xiaoxianliang and Weitoutiao.

Founded by Mark Mai and Tim Draper in 2005, VenturesLab is the first internet-business incubator in China. To date it has incubated and invested in about 100 internet-related companies including Mr Food, Yunchou, Yuanchuangpai, Xiaoxianliang and Weitoutiao.

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Founder and CEO of SCOOP, Founder of EV Hive

East Ventures co-founder Willson Cuaca graduated from Bina Nusantara University with a bachelor’s degree in Computer Science. He worked at Singapore-based Red Sentry, a cyber security and network performance optimization company. In 2010 he co-founded East Ventures, a seed-early stage venture capital firm. That same year, he also co-founded Apps Foundry, a mobile company that developed the e-reader app SCOOP, among other things.

East Ventures co-founder Willson Cuaca graduated from Bina Nusantara University with a bachelor’s degree in Computer Science. He worked at Singapore-based Red Sentry, a cyber security and network performance optimization company. In 2010 he co-founded East Ventures, a seed-early stage venture capital firm. That same year, he also co-founded Apps Foundry, a mobile company that developed the e-reader app SCOOP, among other things.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Shanghai Songheng Network Technology Co., Ltd.

Shanghai Songheng Network Technology Co., Ltd., is an internet software company founded in 2014. It has registered capital of RMB 11.6 million and annual turnover of hundreds of millions of RMB. It specializes in design, R&D and operation and marketing of internet-based products.

Shanghai Songheng Network Technology Co., Ltd., is an internet software company founded in 2014. It has registered capital of RMB 11.6 million and annual turnover of hundreds of millions of RMB. It specializes in design, R&D and operation and marketing of internet-based products.

Aiming to entice more Chinese manufacturers to Africa, Clever Home plans to improve the O2O retail and supply chain infrastructure in key African markets.

Aiming to entice more Chinese manufacturers to Africa, Clever Home plans to improve the O2O retail and supply chain infrastructure in key African markets.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

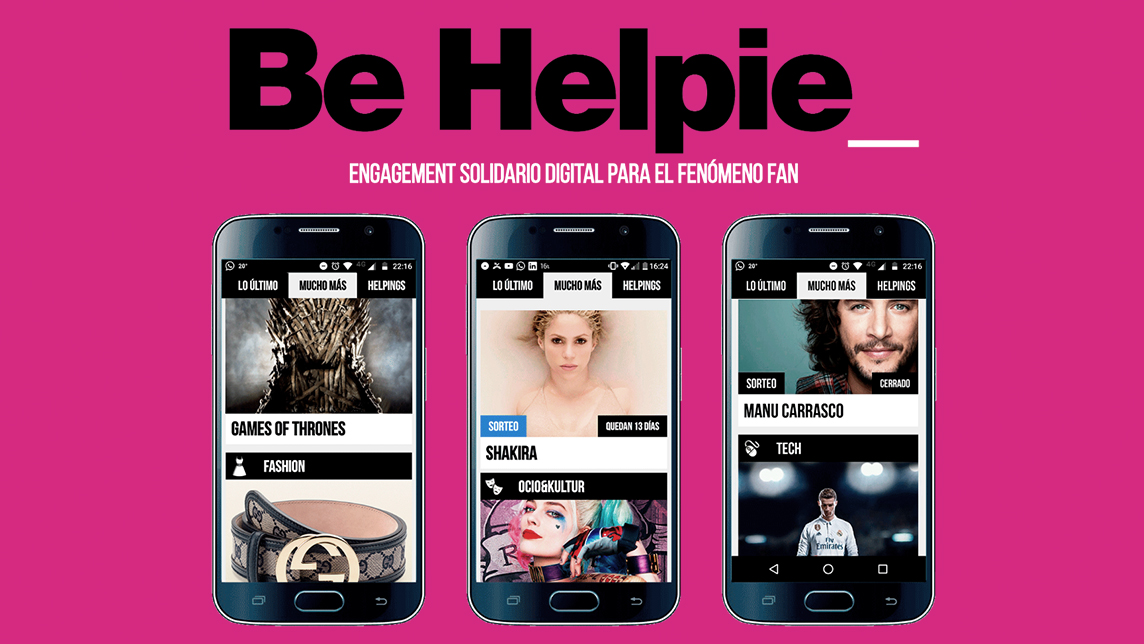

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

This AI startup helps Tencent, Xiaomi chatbots “think” and “talk” like humans

Trio.AI makes communicating with machines easier and more effective – even fun

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

Kuaikan Comic: Discover the potential of Chinese comics

This startup wants to prove Japan isn’t the only comic game in town

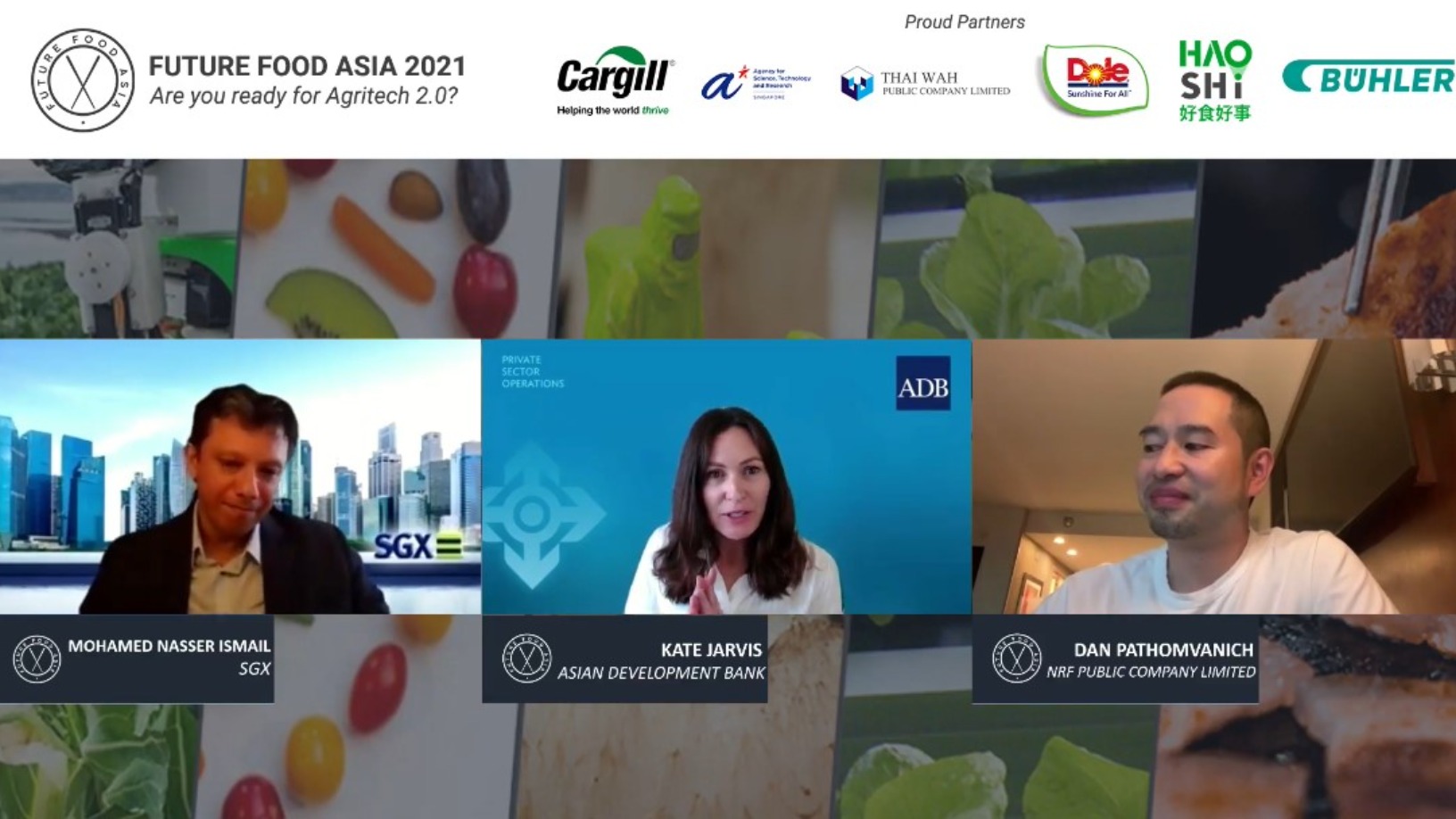

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Kibus Petcare: World's first auto-cook and -dispense healthy pet food device

Kibus Petcare applies the healthy eating revolution to the ever-growing pet-care business, eyes sales in 25 countries after crowdfunding launch

Sorry, we couldn’t find any matches for“Draper Venture Network”.