La Bolsa Social

-

DATABASE (227)

-

ARTICLES (312)

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

Founder and CEO of Joyowo (Jinyouwang)

A serial entrepreneur since 2009, Guo Wei graduated from the Central University of Finance and Economics and founded Jinyuan Group, the company behind HR services and social insurance management SaaS startup Joyowo, in 2014.He is currently the CEO of Jinyuan Group and Joyowo.

A serial entrepreneur since 2009, Guo Wei graduated from the Central University of Finance and Economics and founded Jinyuan Group, the company behind HR services and social insurance management SaaS startup Joyowo, in 2014.He is currently the CEO of Jinyuan Group and Joyowo.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Founder & CEO of Gengmei

Chunyu Yisheng co-founder and Renmin University graduate. Liu was also vice-president (product and marketing) at Chunyu Yisheng, a popular doctor consultation app. Another earlier startup of Liu’s was a social community for patients with rare diseases (inspired by Patientslikeme.com), which fell through because of its uncertain business model.

Chunyu Yisheng co-founder and Renmin University graduate. Liu was also vice-president (product and marketing) at Chunyu Yisheng, a popular doctor consultation app. Another earlier startup of Liu’s was a social community for patients with rare diseases (inspired by Patientslikeme.com), which fell through because of its uncertain business model.

Co-founder and COO of Tanijoy

Kukuh Budi Santoso graduated from Indonesia’s Universitas Brawijaya with a degree in Agriculture. While at university, he was an active in student organizations such as the IAAS (an international organization of agriculture students) and founded social enterprises. Prior to co-founding agri-investment platform Tanijoy, Kukuh ran Escape.id, a community-based tourism business.

Kukuh Budi Santoso graduated from Indonesia’s Universitas Brawijaya with a degree in Agriculture. While at university, he was an active in student organizations such as the IAAS (an international organization of agriculture students) and founded social enterprises. Prior to co-founding agri-investment platform Tanijoy, Kukuh ran Escape.id, a community-based tourism business.

Co-founder of Karsa

Yudha Kartohadiprodjo formerly worked as an editor and publisher at Femina Group, one of Indonesia’s leading magazine and media groups. In 2016, he joined forces with agritech veteran Alihan Tjohjono to establish Karsa, a social platform for farmers and agricultural stakeholders.

Yudha Kartohadiprodjo formerly worked as an editor and publisher at Femina Group, one of Indonesia’s leading magazine and media groups. In 2016, he joined forces with agritech veteran Alihan Tjohjono to establish Karsa, a social platform for farmers and agricultural stakeholders.

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Taihecap (formerly TH Capital)

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Co-founder of Zaihui

Zhao graduated from the University of California, Berkeley in 2013 with a bachelor’s degree in Computer Science. An award-winning product designer, he worked at VMware, LinkedIn and Totango from 2013 to 2015. Prior to joining Zaihui in 2015, Zhao ran a startup of his own on the social networking app Sobrr.

Zhao graduated from the University of California, Berkeley in 2013 with a bachelor’s degree in Computer Science. An award-winning product designer, he worked at VMware, LinkedIn and Totango from 2013 to 2015. Prior to joining Zaihui in 2015, Zhao ran a startup of his own on the social networking app Sobrr.

Founder and CEO of Haoqipei of Haoqipei

Haoqipei Founder and CEO Chen Xi graduated from Tianjin University's Special Class for the Gifted Young. He is a serial entrepreneur with over 20 years of experience in the gaming and social networking sectors. Before founding Haoqipei in 2016, Chen co-founded corporate management solutions provider Redsoft, mobile gaming startup CMF Mobile Game, mobile marketing solution provider CMF Mobile and business social networking startup Renmaitong.

Haoqipei Founder and CEO Chen Xi graduated from Tianjin University's Special Class for the Gifted Young. He is a serial entrepreneur with over 20 years of experience in the gaming and social networking sectors. Before founding Haoqipei in 2016, Chen co-founded corporate management solutions provider Redsoft, mobile gaming startup CMF Mobile Game, mobile marketing solution provider CMF Mobile and business social networking startup Renmaitong.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Yangon-based social impact investor Phandeeyar Accelerator was born out of Code for Change Myanmar, a series of hackathons in 2014 and its accelerator is the Yangon chapter of Founder Institute. It is a keen part of Myanmar’s nascent tech ecosystem.With a $2m fund, the VC began investing in local startups in 2017 with a maximum funding of $25,000. It has invested in 17 companies including restaurant booking app Resdi and apartment sharing app Nay Var.

Yangon-based social impact investor Phandeeyar Accelerator was born out of Code for Change Myanmar, a series of hackathons in 2014 and its accelerator is the Yangon chapter of Founder Institute. It is a keen part of Myanmar’s nascent tech ecosystem.With a $2m fund, the VC began investing in local startups in 2017 with a maximum funding of $25,000. It has invested in 17 companies including restaurant booking app Resdi and apartment sharing app Nay Var.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Co-founder and Co-chairman of Momo

Lei Xiaoliang is a product veteran and the former product manager of Netease. He became an entrepreneur, co-founding social networking app Momo in 2011, through the invitation of Momo founder Tang Yan (who was chief editor at Netease then). Lei first headed product development at Momo, and has been the co-president of Momo since June 2014. He currently heads its game business.

Lei Xiaoliang is a product veteran and the former product manager of Netease. He became an entrepreneur, co-founding social networking app Momo in 2011, through the invitation of Momo founder Tang Yan (who was chief editor at Netease then). Lei first headed product development at Momo, and has been the co-president of Momo since June 2014. He currently heads its game business.

Co-founder & PM of Triporate

Asier Vitorica is a Psychology graduate who has over six years of social media management experience. In 2016, he joined Demium Startups' incubation program and subsequently co-founded Triporate, a startup that applies AI to corporate travel planning. At Triporate, Vitorica oversees strategic integration, manages product and competitor analysis and is responsible for the design and control of project roadmaps.

Asier Vitorica is a Psychology graduate who has over six years of social media management experience. In 2016, he joined Demium Startups' incubation program and subsequently co-founded Triporate, a startup that applies AI to corporate travel planning. At Triporate, Vitorica oversees strategic integration, manages product and competitor analysis and is responsible for the design and control of project roadmaps.

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Councilbox: Lawtech that helps cut corporate meeting costs by up to 80%

The startup behind legally validated meeting software is one of the first market movers, targeting some 3m companies in Spain

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

The death of Wazypark: A tale of too much money, and no business model

It was an investors’ and media darling. But the story of Wazypark got bitter in 2017, when management disputes and ballooning losses culminated in the startup’s final days

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

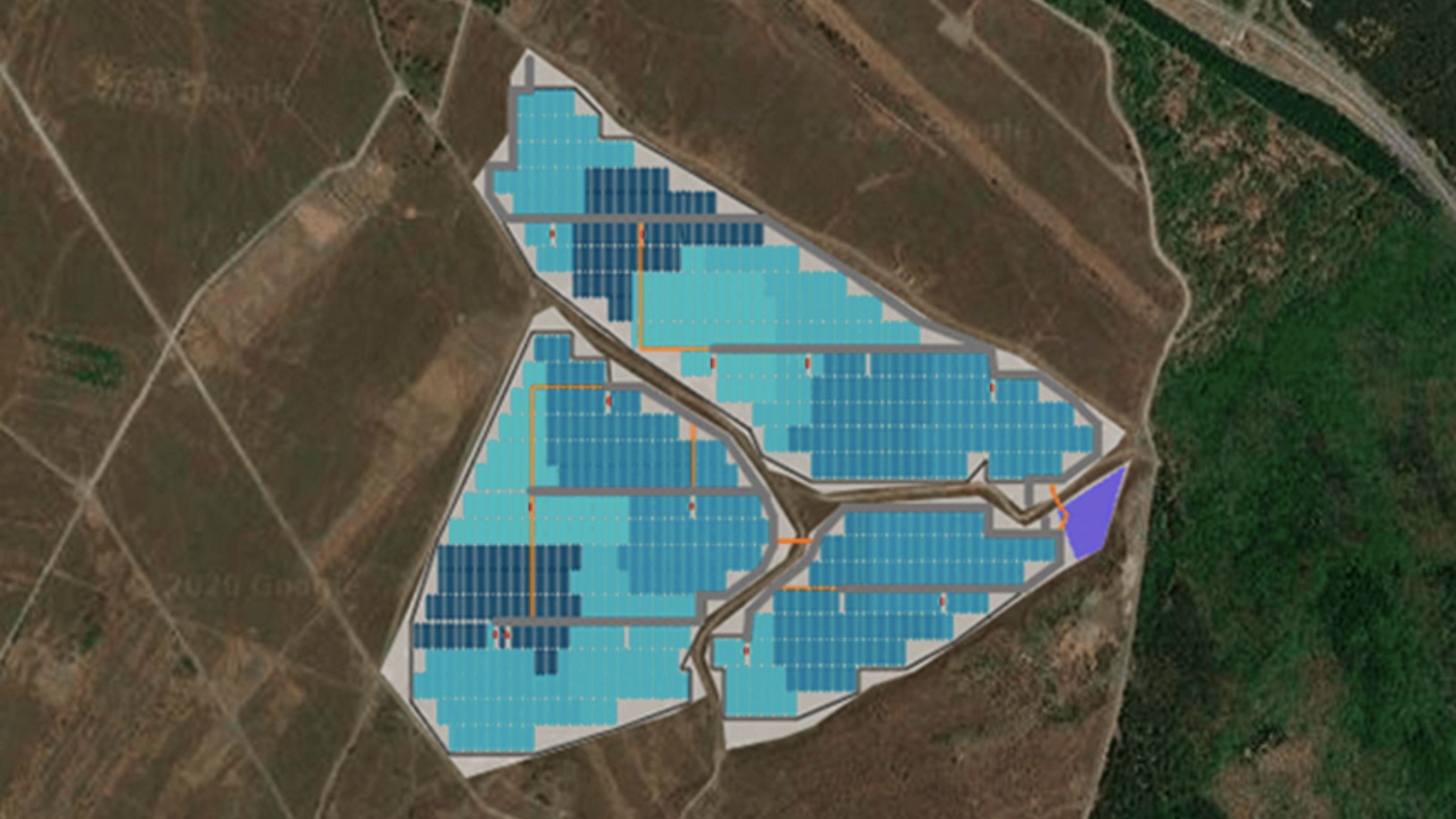

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Sound Particles: the CGI for sound effects taking Hollywood by storm

This revolutionary 3D audio software has propelled Portuguese founder Nuno Fonseca from teaching music to credits in Star Wars, Game of Thrones and Frozen II.

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

How Sea Water Analytics is using IoT to help keep beaches safe in Covid-19 era

Sea Water Analytics checks water quality, overcrowding, even jelly fish threats in Spanish beaches

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

Loones' cooperative e-marketplace connects farmers directly with agrifood businesses

Loones, Spain's first cooperative-based e-marketplace for bulk produce, helps traditional agricultural producers go digital

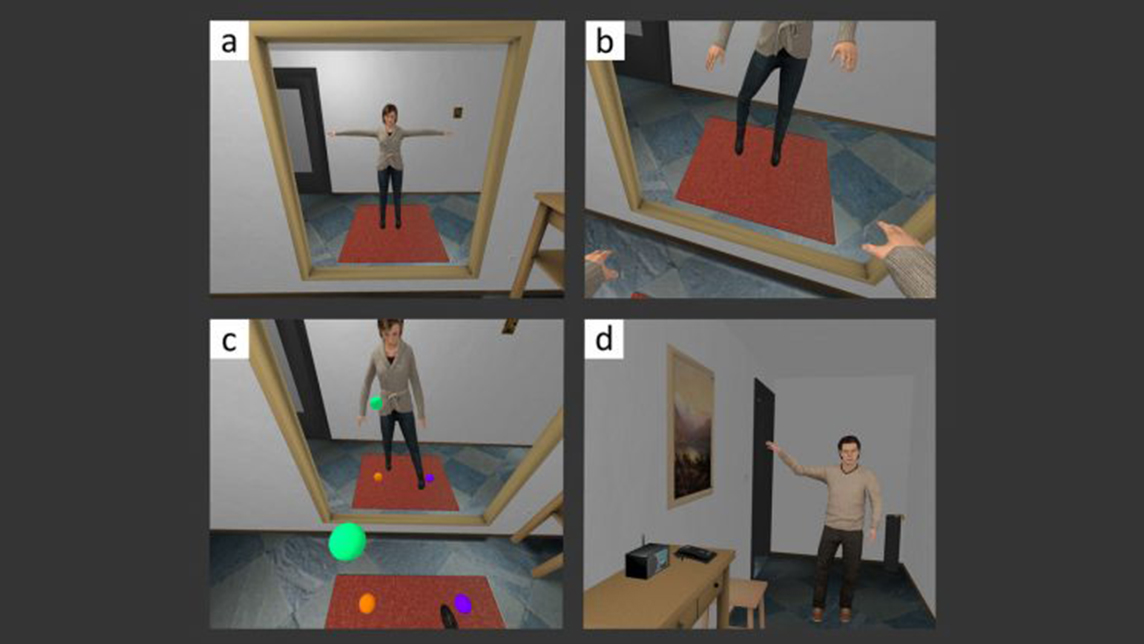

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Sorry, we couldn’t find any matches for“La Bolsa Social”.