social media

-

DATABASE (411)

-

ARTICLES (385)

Managing Director and co-founder of String Bio

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Vinod Kumar originally founded Samrat Wears clothing company in India in 1993 and went on to graduate in mechanical engineering in 1997 at BMS College of Engineering in India.In 2000, he completed a master’s in supply chain management, industrial and manufacturing systems engineering at Ohio University in the US. He started his career at Bell Labs as a product engineer. In 2000, he worked at telco Alcatel-Lucent that later became part of Nokia. In 2008, he held various senior roles and became senior director at tech company Juniper Networks in Silicon Valley. In 2013, he joined his wife Ezhil Subbian to set up String Bio in India. He became a full-time managing director of the company in 2015. In 2019, he became a fellow member at Unreasonable, an investment fund and organization for supporting innovative entrepreneurs to solve social and environmental issues worldwide.

Born in 1979, Cheng is an entrepreneur from Hong Kong. He is the third-generation heir of the Cheng Yu-tung family, which founded the New World and Chow Tai Fook empire. With a BA from Harvard University, Cheng joined the family business in 2015, serving as executive vice chairman at New World Development. In 2008, he invented the concept of “museum-retail” - incorporating art into shopping - by founding the K11 luxury shopping mall brand. In 2017, Cheng and veteran investor Clive Ng cofounded C Ventures, which funds technology-driven businesses from the art, media and fashion sectors.

Born in 1979, Cheng is an entrepreneur from Hong Kong. He is the third-generation heir of the Cheng Yu-tung family, which founded the New World and Chow Tai Fook empire. With a BA from Harvard University, Cheng joined the family business in 2015, serving as executive vice chairman at New World Development. In 2008, he invented the concept of “museum-retail” - incorporating art into shopping - by founding the K11 luxury shopping mall brand. In 2017, Cheng and veteran investor Clive Ng cofounded C Ventures, which funds technology-driven businesses from the art, media and fashion sectors.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Twitter co-founder Evan Williams is also CEO at media company Medium and an angel investor with disclosed investments in 18 startups to date. His investments are across multiple market segments and are all based in the US. His most recent disclosed investments include participation in the $4.6m seed round of compensation fintech player OpenComp in March 2021, as well as in the $30m Series B round of audio and video creation platform Descript in January 2021.

Twitter co-founder Evan Williams is also CEO at media company Medium and an angel investor with disclosed investments in 18 startups to date. His investments are across multiple market segments and are all based in the US. His most recent disclosed investments include participation in the $4.6m seed round of compensation fintech player OpenComp in March 2021, as well as in the $30m Series B round of audio and video creation platform Descript in January 2021.

Chow Tai Fook Jewellery Group Limited

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Founder and CEO of Orain

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

Dharmash Mistry is non-executive director of the British Business Bank and the BBC. He is also a partner at LGT Lightstone, Balderton Capital and Lakestar. As an experienced venture capitalist and entrepreneur Mistry has raised and managed investment funds totaling $1bn. He is a board member and one of the early investors of unicorns like Revolut and Glovo.Mistry is the former MD of Ascential plc, formerly EMAP, B2B media business specializing in exhibitions and information services and listed on the London Stock Exchange (LSE). He was also the chair and co-founder of Blow Ltd, an on-demand beauty services provider in the UK. Mistry also previously held non-executive director roles in companies like Dixons Retail and Hargreaves Lansdown.

Dharmash Mistry is non-executive director of the British Business Bank and the BBC. He is also a partner at LGT Lightstone, Balderton Capital and Lakestar. As an experienced venture capitalist and entrepreneur Mistry has raised and managed investment funds totaling $1bn. He is a board member and one of the early investors of unicorns like Revolut and Glovo.Mistry is the former MD of Ascential plc, formerly EMAP, B2B media business specializing in exhibitions and information services and listed on the London Stock Exchange (LSE). He was also the chair and co-founder of Blow Ltd, an on-demand beauty services provider in the UK. Mistry also previously held non-executive director roles in companies like Dixons Retail and Hargreaves Lansdown.

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Next-generation social media app YouClap targets engagement over reach

Already valued at €5m one year after launching, the YouClap platform for online challenges will seek Series A investment before the end of 2019

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Get.AI: Using artificial intelligence to help humans write more efficiently

Writing productivity tool Get.AI automates mundane tasks, such as tracking the latest trending topics and speeding up research, improving writers' efficiency by as much as 70%

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

How influential is your influencer? This startup has the metrics to turn buzz into gold

Influencity is a new way for companies and brands to win in social media marketing

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

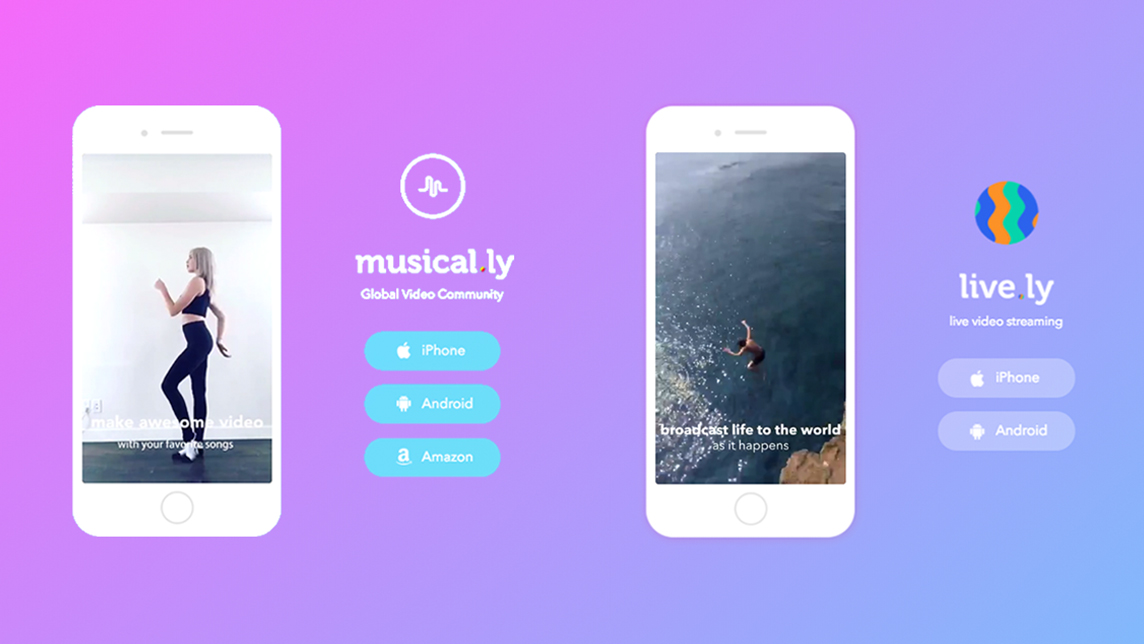

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

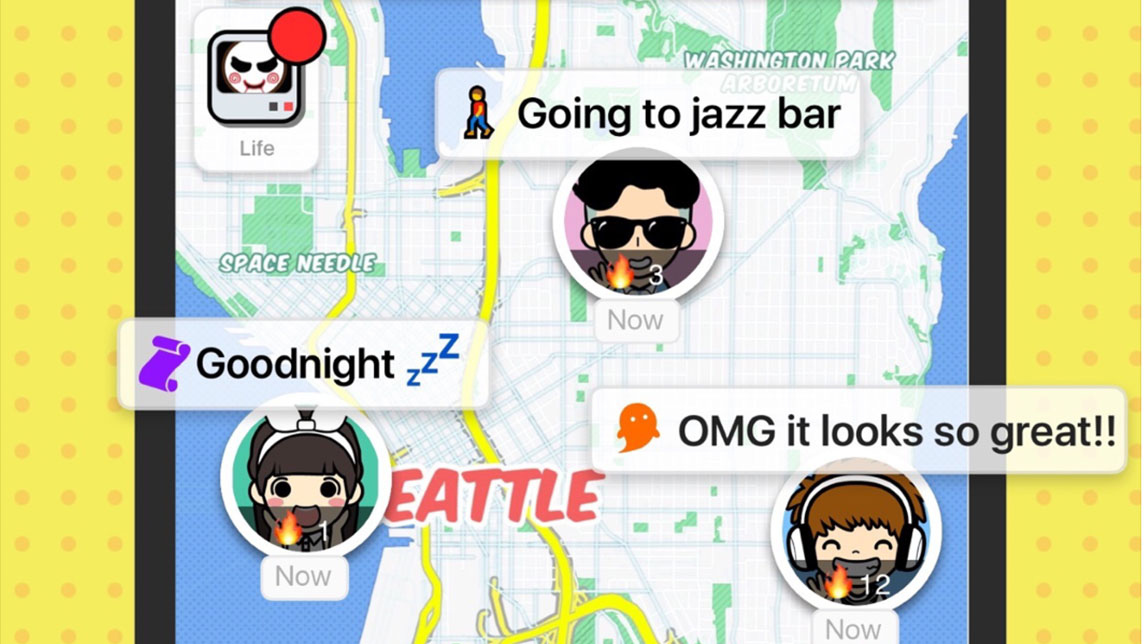

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

Sorry, we couldn’t find any matches for“social media”.