we-media

-

DATABASE (285)

-

ARTICLES (745)

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Dharmash Mistry is non-executive director of the British Business Bank and the BBC. He is also a partner at LGT Lightstone, Balderton Capital and Lakestar. As an experienced venture capitalist and entrepreneur Mistry has raised and managed investment funds totaling $1bn. He is a board member and one of the early investors of unicorns like Revolut and Glovo.Mistry is the former MD of Ascential plc, formerly EMAP, B2B media business specializing in exhibitions and information services and listed on the London Stock Exchange (LSE). He was also the chair and co-founder of Blow Ltd, an on-demand beauty services provider in the UK. Mistry also previously held non-executive director roles in companies like Dixons Retail and Hargreaves Lansdown.

Dharmash Mistry is non-executive director of the British Business Bank and the BBC. He is also a partner at LGT Lightstone, Balderton Capital and Lakestar. As an experienced venture capitalist and entrepreneur Mistry has raised and managed investment funds totaling $1bn. He is a board member and one of the early investors of unicorns like Revolut and Glovo.Mistry is the former MD of Ascential plc, formerly EMAP, B2B media business specializing in exhibitions and information services and listed on the London Stock Exchange (LSE). He was also the chair and co-founder of Blow Ltd, an on-demand beauty services provider in the UK. Mistry also previously held non-executive director roles in companies like Dixons Retail and Hargreaves Lansdown.

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Torch Capital is a venture capital firm based in New York, primarily investing in seed and Series A rounds with check sizes ranging from $500,000 to $3m. Founded in 2018, the firm raised its first fund of $60m in June 2019, making 15 investments within its first year of operations. Torch Capital has made a total of 46 investments and 10 exits to date. Two investees, Compass and Digital Ocean, are now public-listed companies.Founder and managing partner Jonathan Keidan previously worked for McKinsey and Company and for General Electric CEO Jack Welsh. Keidan is also the co-founder of digital media publication InsideHook.

Partnerships Director of Eliport

Patrick Synge has lived in Spain for eight years since he left Britain after studying music at Warwick School. He has worked in sales since graduating from the University of the West of England. He started his sales career at Euro Sports Media and deVere Group. Synge was the head of sales at food-delivery startup Degustabox before joining Eliport as co-founder and director of partnerships. He and co-founder Dmitry Skorinko created Eliport to solve the last-mile delivery problem by using autonomous delivery robots in local neighborhoods. Since March 2019, Synge has also joined Alias Robotics as VP for sales.

Patrick Synge has lived in Spain for eight years since he left Britain after studying music at Warwick School. He has worked in sales since graduating from the University of the West of England. He started his sales career at Euro Sports Media and deVere Group. Synge was the head of sales at food-delivery startup Degustabox before joining Eliport as co-founder and director of partnerships. He and co-founder Dmitry Skorinko created Eliport to solve the last-mile delivery problem by using autonomous delivery robots in local neighborhoods. Since March 2019, Synge has also joined Alias Robotics as VP for sales.

COO and co-founder of Because Animals

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

Joshua Errett graduated in philosophy in 2004 and completed a postgraduate degree in journalism in 2006. He also completed an MBA in entrepreneurial and small business operations in Indiana University in 2015.In 2004, he co-founded Torontoist.com, a media website that attracted thousands of views per day. He left the startup to join New Brunswick Telegraph Journal as a reporter for one year before becoming digital managing editor for NOW magazine. In 2013, he went on to work for three years as a senior producer at the Canadian Broadcasting Corporation (CBC).He met Shannon Falconer at a cat rescue project in Toronto. The two pet owners co-founded the biotech Because Animals in 2016 to create more sustainable food for dogs and cats. Errett worked as a marketing manager at Equitable (EQ) Bank before working full-time as COO at Because Animals.

CEO and co-founder of Refurbed

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

Next-generation social media app YouClap targets engagement over reach

Already valued at €5m one year after launching, the YouClap platform for online challenges will seek Series A investment before the end of 2019

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Get.AI: Using artificial intelligence to help humans write more efficiently

Writing productivity tool Get.AI automates mundane tasks, such as tracking the latest trending topics and speeding up research, improving writers' efficiency by as much as 70%

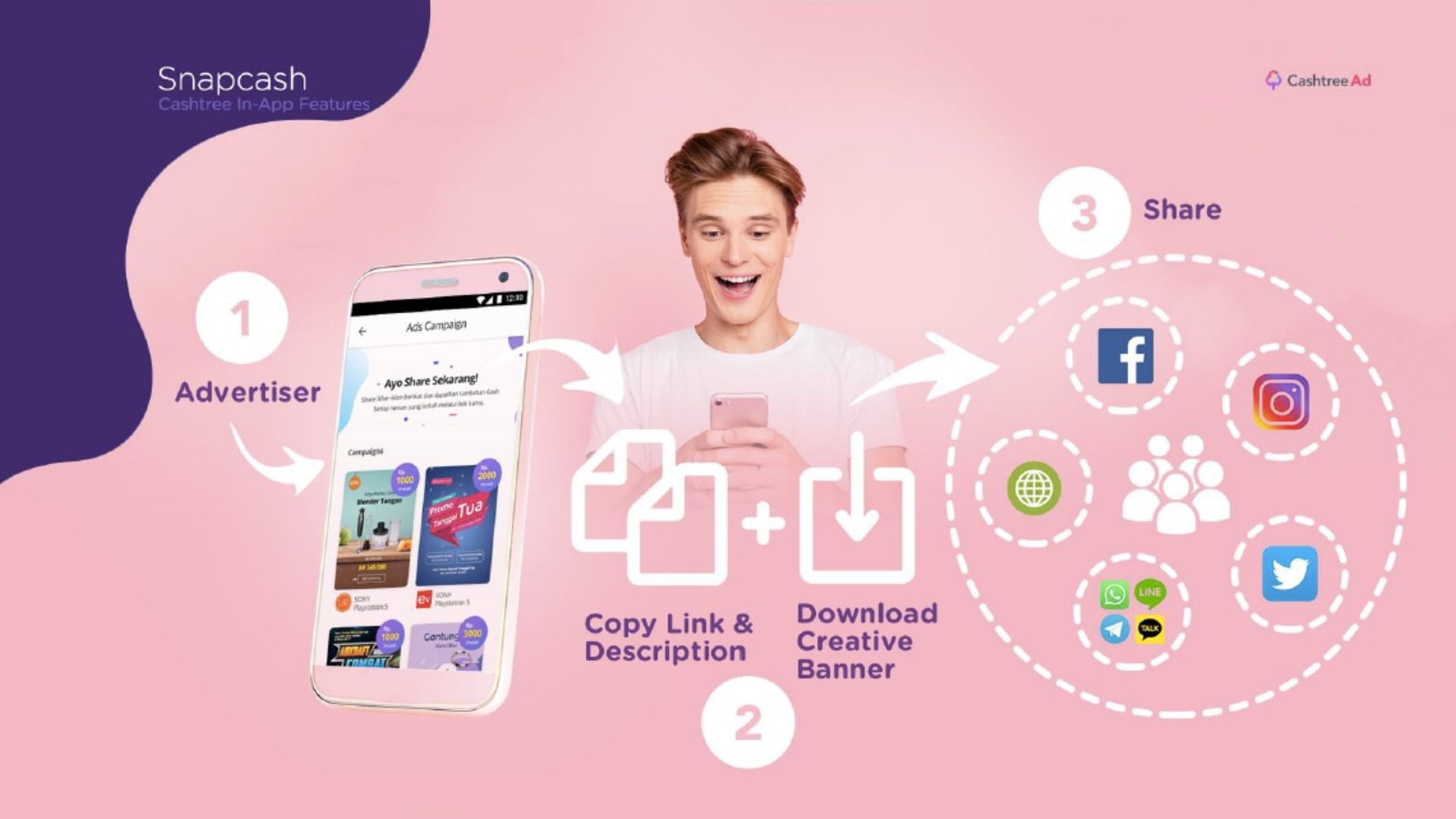

Cashtree combines locksreen ads and rewards-based marketing to help businesses go viral

The Indonesian mobile advertising platform encourages users to share ads on social media and WhatsApp so they go viral

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

Prosa.ai and Indonesian ministry fight fake news with "anti-hoax" chatbot

Launched a week before the elections, this Telegram-based chatbot provides alternative references to read before you share

Sorry, we couldn’t find any matches for“we-media”.