Edtech

This function is exclusive for Premium subscribers

-

DATABASE (163)

-

ARTICLES (75)

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

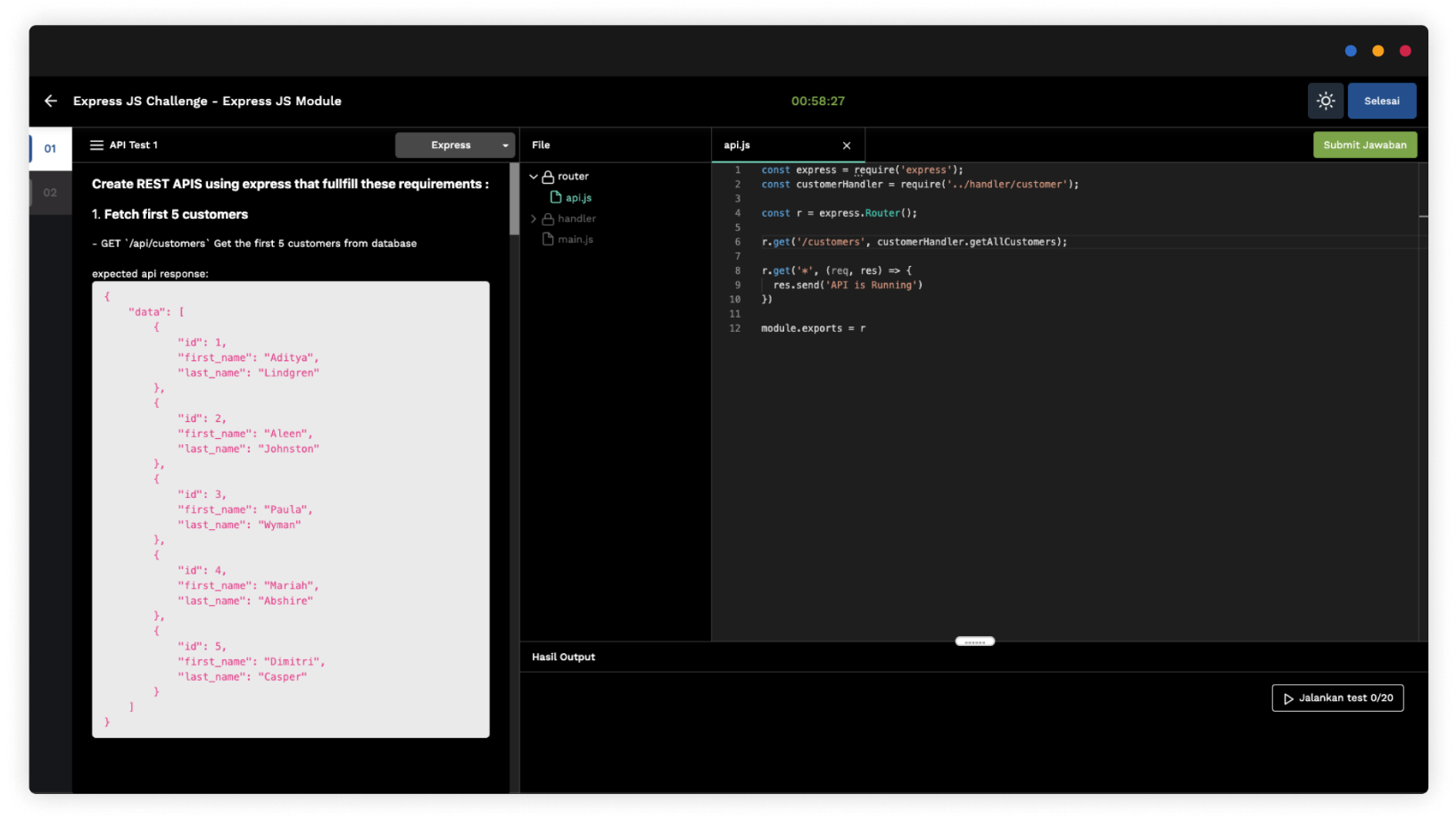

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

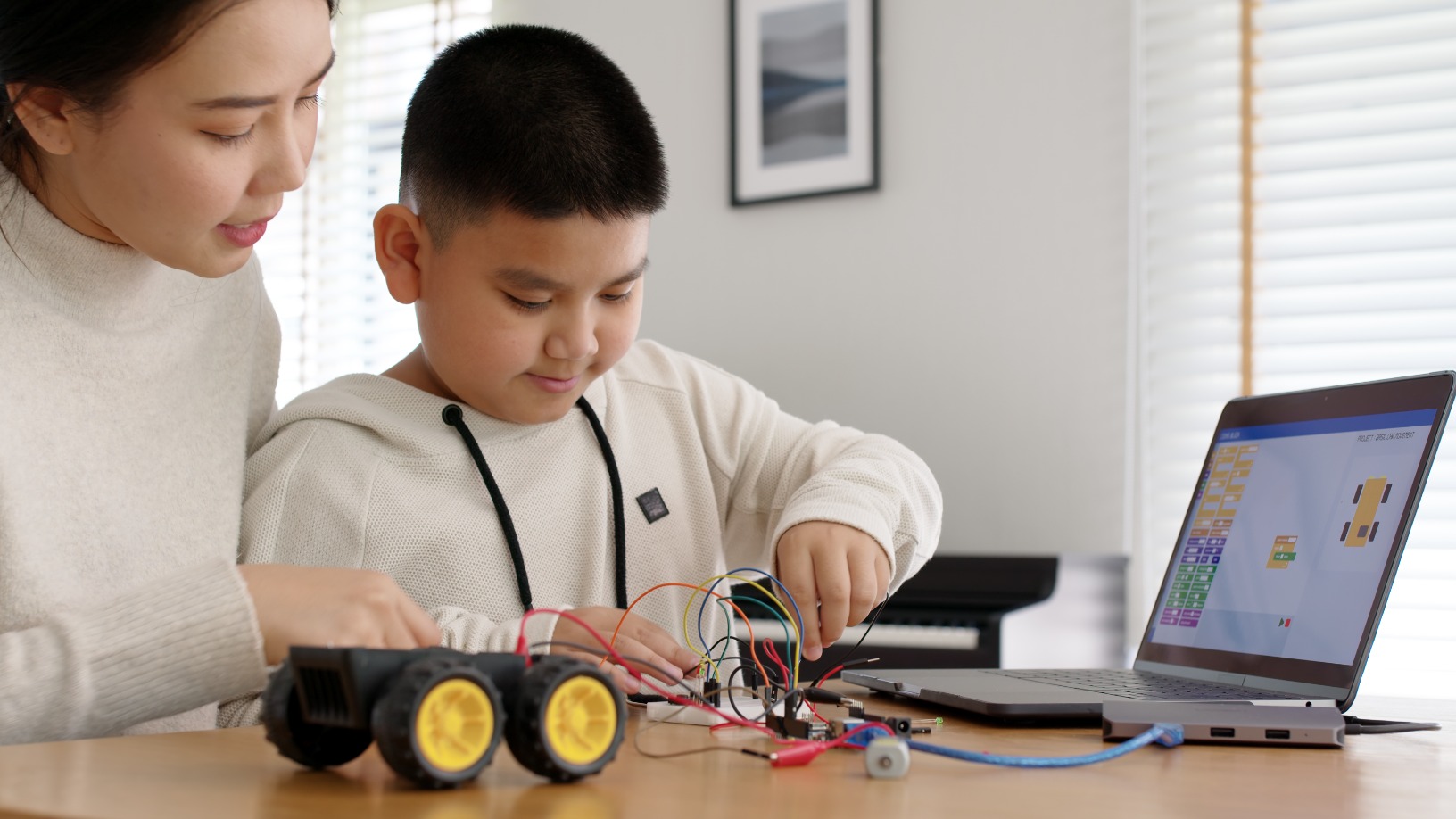

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Intelligent Learning: math app helps students improve their exam score in weeks

Intelligent Learning prepares K7–11 math students for the national senior high school entrance exam, or "zhongkao," by trawling through past questions and predicting what might be tested