Capital Today

-

DATABASE (729)

-

ARTICLES (495)

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Founder and Board Chairman of Panda iMedia

Leading media commentator and former Sina Weibo key man Shen Chen is a sociology graduate from Soochow University, and holds an MBA from the Capital University of Economics and Business. Previously at China Mobile and China Telecom, Shen, however, is better known for being part of the team at Sina Weibo who took the company public. With proceeds from his stock options, Shen founded Panda iMedia. Today, some 200 of his colleagues at Panda iMedia were also from Sina.

Leading media commentator and former Sina Weibo key man Shen Chen is a sociology graduate from Soochow University, and holds an MBA from the Capital University of Economics and Business. Previously at China Mobile and China Telecom, Shen, however, is better known for being part of the team at Sina Weibo who took the company public. With proceeds from his stock options, Shen founded Panda iMedia. Today, some 200 of his colleagues at Panda iMedia were also from Sina.

Transformed from the well-established state-owned Govtor Capital in 1992, Addor Capital is one of the most influential investment institutions in China today. It manages more than RMB 75 billion, and has set up more than 70 different investment funds, backing more than 650 startups.

Transformed from the well-established state-owned Govtor Capital in 1992, Addor Capital is one of the most influential investment institutions in China today. It manages more than RMB 75 billion, and has set up more than 70 different investment funds, backing more than 650 startups.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Founder and CEO of Fresh Market (Shihang Shengxian)

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

Thanks to Bridestory’s engaging pinboard interface and trusted client referrals, couples can easily complete all their wedding-related shopping in a single online marketplace.

Thanks to Bridestory’s engaging pinboard interface and trusted client referrals, couples can easily complete all their wedding-related shopping in a single online marketplace.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

NEA was founded in 1978 and is one of the largest venture capital firms in the world today. They have more than US$17 billion in committed capital across 15 funds. NEA has invested US$400 million in over 20 companies in China to date, including Uroaming, GrowingIO, Gushengtang, 51lietou and Baihe.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

The first on-demand mobility service in francophone West Africa, Teliman is boosting transportation links and drivers’ economic development, especially for women; eyes expanding to logistics.

The first on-demand mobility service in francophone West Africa, Teliman is boosting transportation links and drivers’ economic development, especially for women; eyes expanding to logistics.

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Intelligent Learning: math app helps students improve their exam score in weeks

Intelligent Learning prepares K7–11 math students for the national senior high school entrance exam, or "zhongkao," by trawling through past questions and predicting what might be tested

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

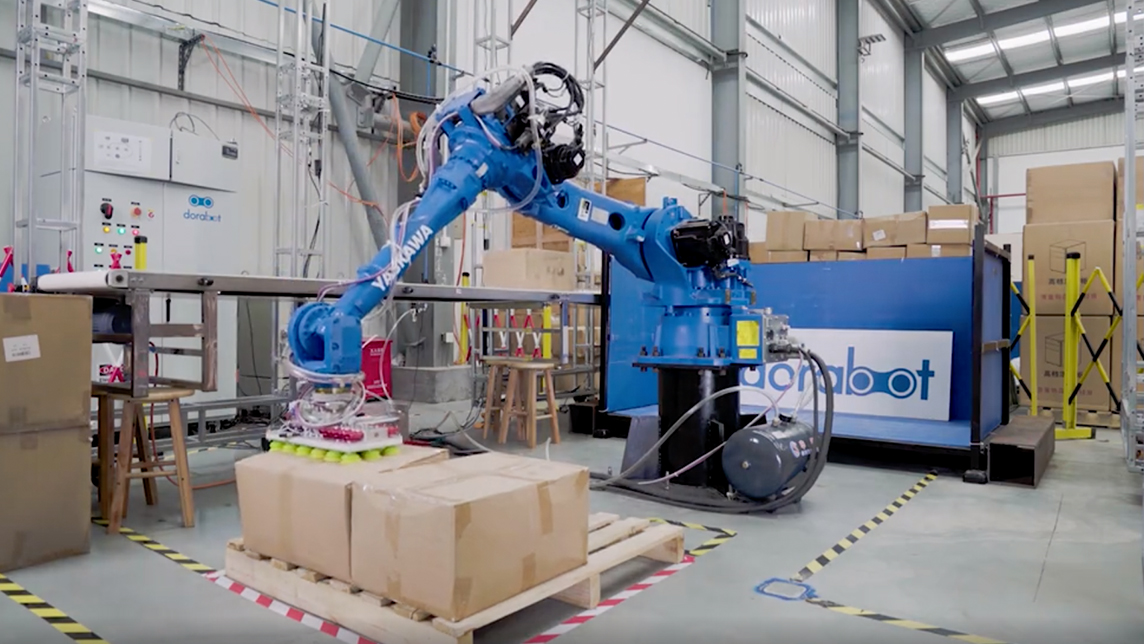

Dorabot's aim for warehousing: No humans allowed

With a combination of AI, global partnerships and speed, Dorabot is leaping into the future

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Graviky Labs: Sustainable ink made from air pollution

Conceptualized at MIT and named among the Best Inventions of 2019 by TIME Magazine, Graviky Labs’ carbon-negative ink is made from upcycled emissions captured with a proprietary device

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Proppos FastPay: Reducing food waste through food recognition tech for restaurants

In a market with few competitors, SaaS startup Proppos FastPay brings operational efficiency to the food services industry with self-checkout machines

Sorry, we couldn’t find any matches for“Capital Today”.