Chevron Technology Ventures’ Catalyst Program

-

DATABASE (934)

-

ARTICLES (645)

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Founded in 2008, KIZOO Technology Ventures is a seed and early-stage VC. Current CEO Michael Greve, who founded Flug.de and Web.de, has many years of experience in the German-speaking Internet industry. KIZOO generally focuses on SaaS, Internet and mobile startups, although it has recently ventured into rejuvenation biotech, investing in companies such as CellAge and LysoClear.

Founded in 2008, KIZOO Technology Ventures is a seed and early-stage VC. Current CEO Michael Greve, who founded Flug.de and Web.de, has many years of experience in the German-speaking Internet industry. KIZOO generally focuses on SaaS, Internet and mobile startups, although it has recently ventured into rejuvenation biotech, investing in companies such as CellAge and LysoClear.

Founded in 1986 by global industrialist and philanthropist Len Blavatnik, Access Industries is a privately held industrial group with long-term holdings worldwide. It is headquartered in New York City with additional offices in London and Moscow. In 2015, Access Industries established Access Technology Ventures which has invested in Snapchat, Yelp, Alibaba, Spotify, etc.

Founded in 1986 by global industrialist and philanthropist Len Blavatnik, Access Industries is a privately held industrial group with long-term holdings worldwide. It is headquartered in New York City with additional offices in London and Moscow. In 2015, Access Industries established Access Technology Ventures which has invested in Snapchat, Yelp, Alibaba, Spotify, etc.

Co-founder of Jala

Liris Maduningtyas graduated in 2014 with a degree in Electrical Engineering from Universitas Gadjah Mada, Indonesia. She had worked as an assistant teacher for a program run by the university and Schneider Electric. After finishing her final year project at Chevron, she joined Schlumberger as a field engineer stationed in Riau, Indonesia. Liris left a year later to join fellow UGM graduates to establish electronics startup Atnic. Liris managed the marketing and financial affairs of Atnic that created Jala for shrimp farmers, and was promoted to CEO of Jala in 2018.

Liris Maduningtyas graduated in 2014 with a degree in Electrical Engineering from Universitas Gadjah Mada, Indonesia. She had worked as an assistant teacher for a program run by the university and Schneider Electric. After finishing her final year project at Chevron, she joined Schlumberger as a field engineer stationed in Riau, Indonesia. Liris left a year later to join fellow UGM graduates to establish electronics startup Atnic. Liris managed the marketing and financial affairs of Atnic that created Jala for shrimp farmers, and was promoted to CEO of Jala in 2018.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Focus Technology was founded in 1996 and headquartered in Nanjing, following a state policy to strengthen and develop the industrialization and digitalization of China. In 2013, the company expanded to the US and started its cross-border e-commerce business.Focus is mainly involved in Internet Plus, bringing digitalization to overseas trading, insurance, business procurement, education and medical services. Made-in-China.com, Abiz.com and xyz.cn are the main e-commerce platforms of Focus.

Focus Technology was founded in 1996 and headquartered in Nanjing, following a state policy to strengthen and develop the industrialization and digitalization of China. In 2013, the company expanded to the US and started its cross-border e-commerce business.Focus is mainly involved in Internet Plus, bringing digitalization to overseas trading, insurance, business procurement, education and medical services. Made-in-China.com, Abiz.com and xyz.cn are the main e-commerce platforms of Focus.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

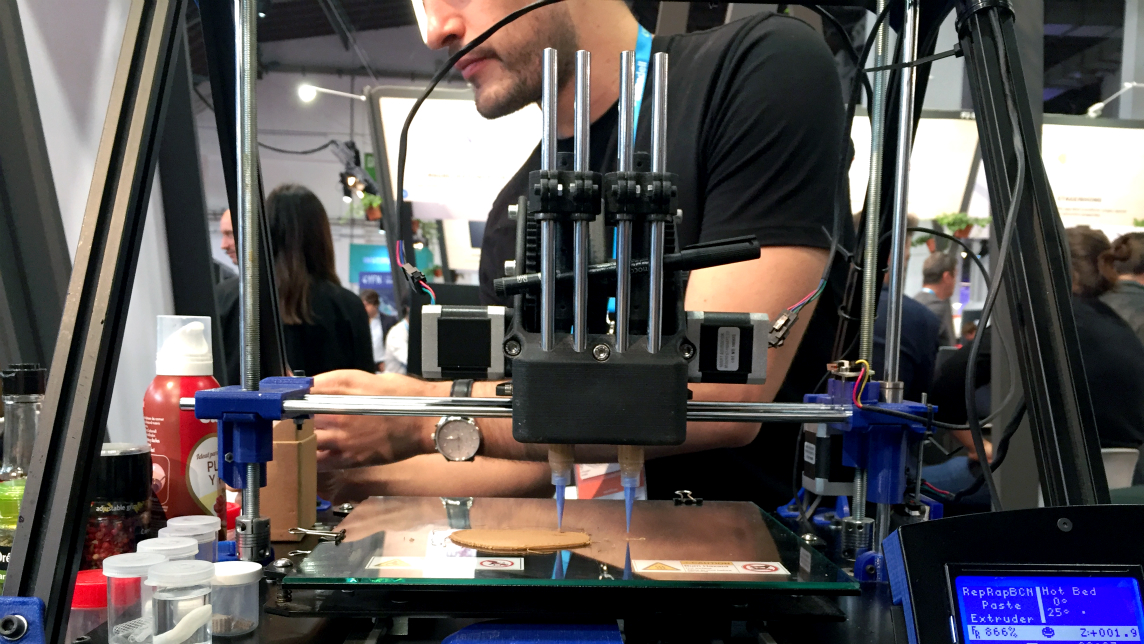

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

Luo Yonghao: Maverick founder who gave Smartisan its allure, but couldn't build a winner

The Smartisan founder and internet celebrity is making a comeback with live commerce, after failing to sell enough smartphones at his own company

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

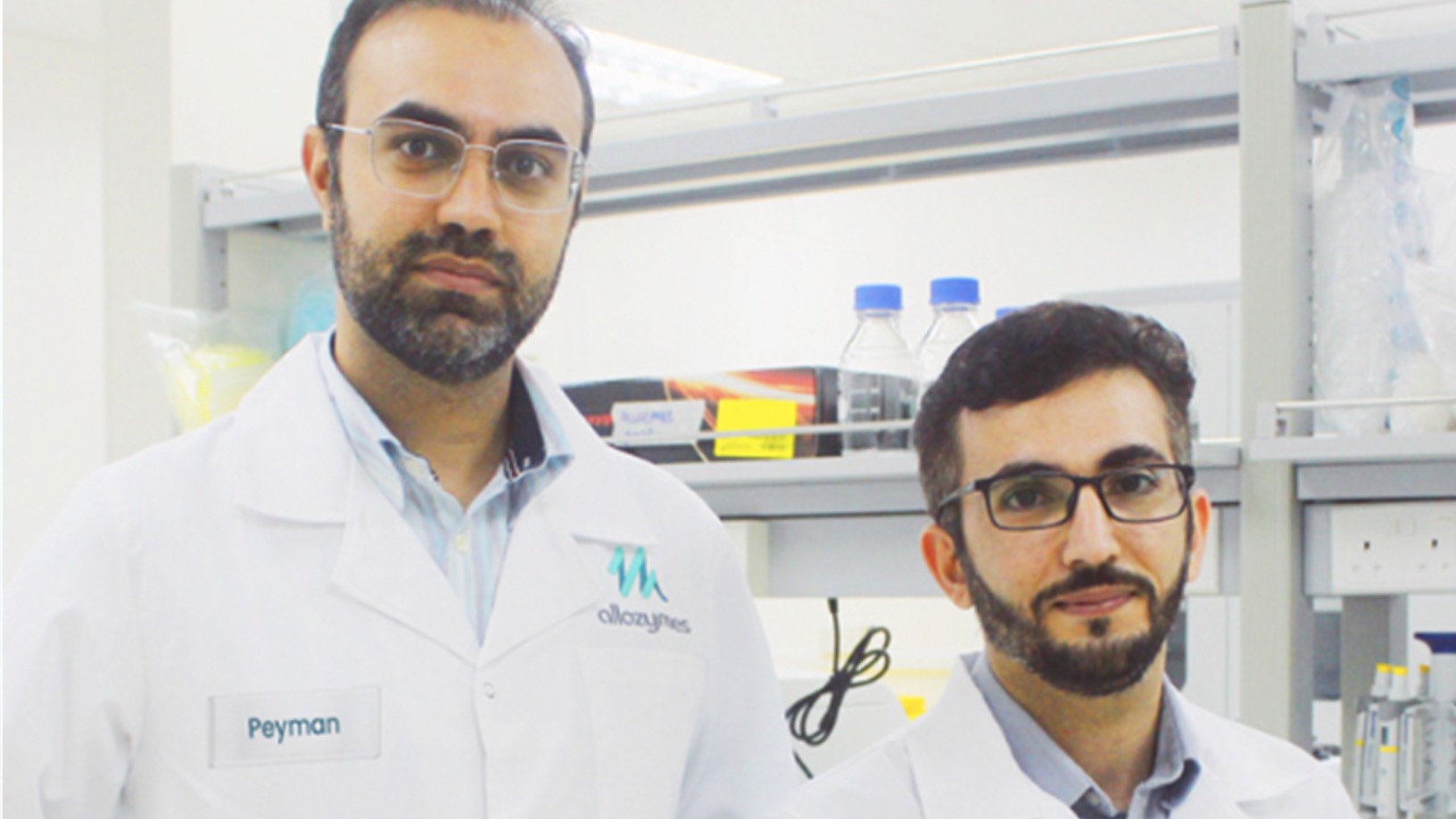

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

This AI-powered "pony" could usher us into an autonomous driving future

Despite all the red tape and public anxiety around self-driving cars, California- and Guangzhou-based Pony.ai is advancing steadily in its mission to bring autonomous vehicles to China

Now called Wanwu Xinsheng, the startup recycles over 70,000 used electronic goods in China daily, clocking over RMB 2bn of transactions every month

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Sorry, we couldn’t find any matches for“Chevron Technology Ventures’ Catalyst Program”.